Datacenters have long warranted close attention from electricity providers due to their prodigious appetite for energy. The breakout of computationally intensive artificial intelligence into the mainstream, however, has brought them front and center. Annual electricity demand from US datacenters is expected to reach over 280 TWh in 2024. By 2028, this is expected to nearly double to 530 TWh, or slightly more electricity than what the entire state of Texas produced in 2022.

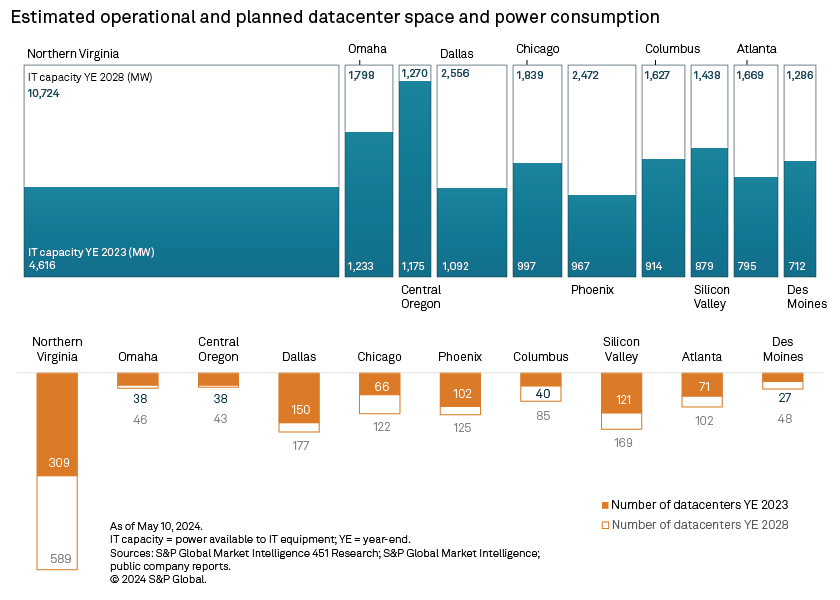

Prescient datacenter developers are expanding their geographic footprint to US regions of generation surpluses and minimal interconnection delays to expedite planning and construction phases, partially alleviating stress in highly concentrated markets. That said, a handful of locations including Northern Virginia, Phoenix and Dallas will remain focal points for datacenter growth for the foreseeable future, leading to increasingly constrained grids and tougher pathways to decarbonization.

Energy reliability concerns and local grid constraints are rising in highly concentrated datacenter markets in the US. These areas offer benefits in terms of broadband infrastructure access and proximity to population centers. But mounting hurdles are forcing companies to explore nontraditional markets and are making access to energy — particularly clean energy — the most important consideration for new datacenter construction.

While datacenters are expected to be sited where the power is, certain markets will remain hotspots for datacenter activity, such as Northern Virginia, where datacenter energy demand is expected to account for up to 40% of the regional load by 2040.

➤ Fueled by the increased computational demand created by generative AI, almost 50 GW of datacenter capacity are projected to be added to the grid by 2028, according to S&P Global Commodity Insights and S&P Global Market Intelligence forecasts based on conservative estimates.

➤ Northern Virginia is by far the largest datacenter market in the US and the second largest in the world, only behind the greater Beijing area, although current projections indicate that it could take the top spot by 2027.

➤ Hyperscalers — large-scale cloud service providers, including Amazon.com Inc., Microsoft Corp., Google LLC and Meta Platforms Inc. — are among the most aggressive companies in datacenter development and as a result are the leading procurers of clean energy, with a combined 33 GW of wind, solar and battery capacity currently contracted.

➤ Nearly 579 GW of wind, solar and battery storage are in the pipeline, according to Market Intelligence data, while capacities across US interconnection queues for these technologies stand at almost 2,100 GW.

➤ Datacenter developers may look to creative solutions to energy shortfalls and grid interconnection delays, such as repurposing retired coal power plants where on-site generation can leverage existing interconnection infrastructure while taking advantage of tax credit bonuses associated with energy communities, as defined by the Inflation Reduction Act of 2022. Our data indicates that 229 coal plants have been fully or partially retired since 2015, with another 62 planned to go offline over the next 15 years.

➤ Nuclear remains an intriguing option for powering datacenters as it is both reliable and carbon-free. While existing nuclear plants can still be an option for datacenters, as evidenced by the deal between Talen Energy Corp. and Amazon, next-generation small modular reactors boast a variety of attractive features for datacenters, even though cost and construction timelines remain an uncertainty.

Datacenter boom

Seemingly insatiable needs for data storage and AI-related computing power are driving the current datacenter expansion, somewhat taking the focus off low latency and high throughput for developers. For this particular segment of the datacenter market, proximity to population-dense areas is not an imperative and rurality no longer a hurdle, provided there is favorable terrain, access to water and adequate infrastructure, including sufficient energy supplies and high-speed broadband connectivity.

AI is the next frontier toward productivity gains. In a fragmenting global marketplace that is leading to a race for economic competitiveness, this arguably makes AI-supporting datacenters a matter of national security — a context in which high-profile datacenter owners such as Amazon, Google and Meta may have to reconsider decarbonization timelines. Fossil fuel generation could be retained longer than anticipated just a few months ago.

Of note, AI — and all that the technology entails — has yet to truly reverberate through the datacenter universe, according to 451 Research, a part of Market Intelligence. Most of the firm datacenter commitments in place are essentially to satisfy the still-rising demand for cloud computing services, and predate the current appetite for AI. This suggests current forecasts for datacenter energy needs — with the International Energy Agency projecting global power demand from datacenters to double from 2022 through 2026 — could prove conservative.

State of the energy transition

Now boosted by measures in the Inflation Reduction Act, the US renewables space is advancing at breakneck speed, setting a record for annual capacity additions in 2023. As of this report, the US had more than 270 GW of combined battery storage, solar and wind capacity in operation and an additional 579 GW in the pipeline. Furthermore, an analysis of interconnection queues as of May 2024 shows nearly 2.1 TW of proposed renewable energy capacity undergoing impact studies for connection to the grid.

Aside from the energy transition itself, the act includes special rules to revitalize (essentially rural) communities that have fallen on hard times. The rules are meant to encourage renewable energy development and "green energy" manufacturing in eligible geographies. They are but one sample of the many federal programs aiming to reinvigorate rural America — arguably all converging to create a propitious environment for datacenter development. This includes the tens of billions of dollars from the Infrastructure Investment and Jobs Act of 2021 earmarked to bring broadband to these areas.

Transmission is the one glaring obstacle. The aging US grid is in need of significant expansion and upgrades. Hundreds of billions are being spent to do just that, but chatter around the insufficiency of the current plans is growing louder. Failure to keep up with proposed renewable generation could jeopardize energy transition targets, among other things curtailing siting prospects for datacenter developers.

WEBINAR: Artificial intelligence, Datacenters and Energy: Looming crisis or latest craze?

Join S&P Global analysts for a panel discussion on the current and future state of AI, the datacenter industry and the US energy grid.

Register now.

Data visualization by Chrisallen Villanueva.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Regulatory Research Associates is a group within S&P Global Commodity Insights; 451 Research is part of S&P Global Market Intelligence. S&P Global Commodity Insights and S&P Global Market Intelligence are divisions of S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.