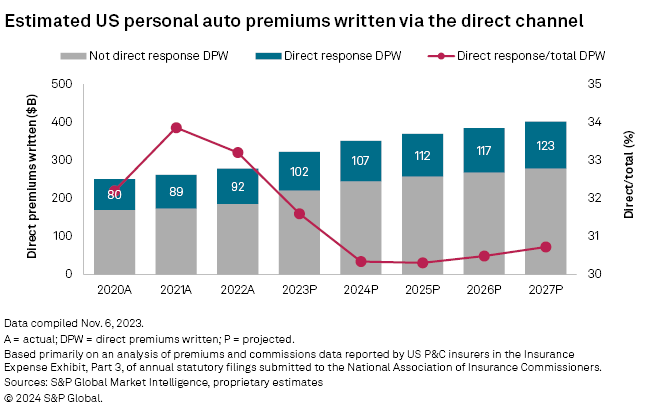

For many years, the growth of personal auto premiums written via the direct channel far outpaced that of the traditional market. But that dynamic changed in 2022 and 2023. While direct personal auto insurance writers are still growing, the rate of growth is lagging the rest of the market. In 2023, we estate direct channel premiums rose 10.3%, but the rest of the market grew 18.7%.

The "direct channel" commonly refers to customers who buy insurance via the internet or mobile devices, as well as those who purchase by phone. Companies in the channel advertise heavily to consumers since there is no agent involved that will market the policies.

In 2021, for instance, we estimated direct channel premiums were up 10%, versus 2% for the rest of the market. But in 2022 direct channel growth was 3 percentage points lower. This was largely due to more modest growth from industry giants GEICO Corp. and United Services Automobile Association. Along with The Progressive Corp., those three insurers dominate the direct channel, accounting for 79% of the total direct channel premiums written.

Normally, a slowdown from market leader GEICO would present an enormous opportunity for insurance technology startups to take market share. But some of the full-stack companies have reined in their growth as well, as they look to control costs and turn a profit. Root Inc., which primarily uses a direct-to-consumer model, increased direct premiums written by only about 0.2% year over year in the first nine months of 2023. Lemonade Inc., which also markets directly, decreased its personal auto premiums written by 9.8% for the same period.

Based on our estimates, the biggest beneficiaries of GEICO's pullback in the direct channel will be Progressive and USAA. We predict they will log direct premiums written growth rates of 23.4% and 20.4%, respectively, in 2023. Progressive's monthly disclosures reveal a similar trend: Net premiums written via the direct channel in its personal lines business were $26.3 billion for full-year 2023, up 25.6% versus 2022.

State Farm Mutual Automobile Insurance Co., the market leader in US personal auto, likely picked up some of GEICO's agency business. But State Farm largely avoids the direct channel; its HiRoad Assurance Co. subsidiary wrote only $21 million in direct premium in the first three quarters of 2023.

GEICO, which is owned by Berkshire Hathaway Inc., was a major drag on direct channel growth in 2023 as well. After annualizing data from the first nine months of 2023, we anticipate GEICO growing only 0.4% for the year. Rising claims severity seems to be a major catalyst, according to a Nov. 8 analysis from S&P Global Market Intelligence. Not only are the components more expensive in increasingly sophisticated vehicles, but the skill required to repair those vehicles, coupled with labor shortages, has led to wage increases and, as a result, higher costs. GEICO has also reduced its advertising expenditures, which is a key driver of direct channel sales growth.

Embedded insurance seems to still be a fairly hot topic in the insurtech world, though we think artificial intelligence has stolen much of the spotlight. Root remains a big proponent of embedding's potential, saying on a Nov. 2 call that it has an active embedded product in 33 states. Such products are a core part of the company's distribution strategy and a foundation for long-term growth, according to a transcript of the Root CEO's remarks.

In the past four quarters, though, Root has derived much more new business from direct writings. Embedded new writings as a percentage of total new writings was 10% in the third quarter of 2023, down from 17%, 33% and 41% in the three quarters prior to that, respectively, per a company shareholder letter. Root cited significant growth in direct new writings as cause for the relative decline.

One of the buzzworthy topics of 2023 in the distribution arena was Lemonade's "synthetic agents." Per the program, which began July 1, General Catalyst Group Management LLC finances up to 80% of Lemonade's customer acquisition costs in return for 16% of the stream of premiums it helped finance. Those streams end when General Catalyst has recouped its initial investment, which Lemonade expects will be two to three years.

In terms of accounting, Lemonade's sales and marketing expense line will not change, per the CFO's remarks during an August conference call. While this may seem counterintuitive, we think of the synthetic agent model as akin to a pass-through security. As such, we would expect additional cash in the cash flow statement, more debt on the balance sheet and additional interest expense. Lemonade's CFO confirmed that those are the areas where the impact will be visible, based on conference call transcripts.

Customer acquisition is a big drain on cash and using synthetic agents provides an alternative source of funding for its growth, Lemonade said. We could envision other VC firms offering a similar arrangement to their portfolio companies, particularly now that higher interest rates have raised the cost of capital.

In our view, the synthetic agent model seems more like a debt innovation than a distribution innovation. Indeed, Lemonade said part of the rationale for creating synthetic agents was to preserve its existing direct distribution, so it can own the client relationship, the client experience and the client data.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.