A blowout year for individual annuity production in 2024 will lead to the strongest growth for the US life insurance industry in more than two decades, but it will also create a high hurdle for future expansion in a lower interest rate environment.

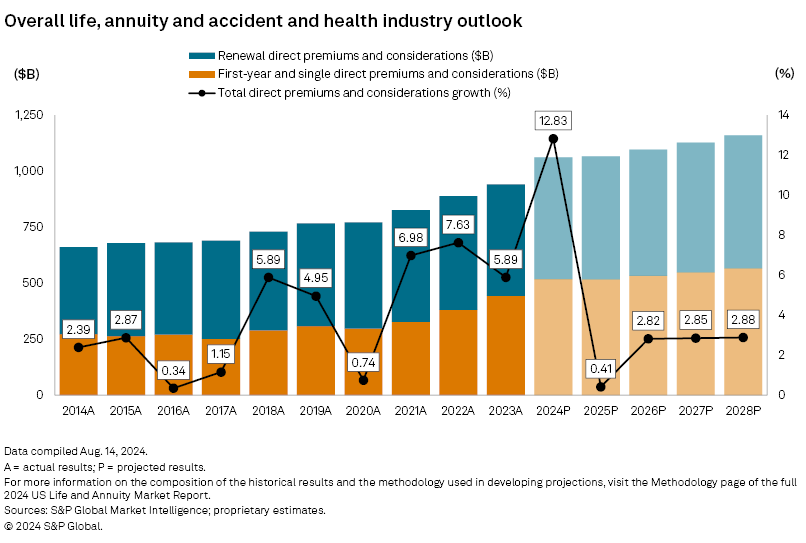

➤ We have opted to err on the side of conservatism in the S&P Global Market Intelligence 2024 US Life and Annuity Market Report, projecting that growth rates in direct premiums and considerations across the combination of the individual and group life, annuity, and accident and health business lines will slump from outsized expansion of 12.8% in 2024 to the low single digits from 2025 through 2028. Our outlook, which reconciles the current breakout of lines of business reported on Exhibit 1 of statutory statements from the previous format to create a more accurate baseline, assumes a macroeconomic outlook with sluggish economic growth and lower interest rates.

➤ While several underlying drivers of demand for key products such as multiyear guaranteed annuities, fixed indexed annuities, registered indexed-linked annuities and pension risk transfer group annuities remain in place, we anticipate that the industry is due to take a breather after a confluence of unique circumstances over the past three years has led to a sustained expansion with no recent precedent in a business that had been considered mature.

➤ Beyond macroeconomic considerations, numerous variables and uncertainties could impact our outlook on both the demand and supply sides. The unprecedented expansion of the individual annuity business in recent years, coupled with unusual volatility in the individual life, accident and health and group annuity lines, makes it particularly challenging to determine whether the industry has entered a new paradigm or has been a fleeting beneficiary of unique market conditions. In projecting that volumes in the individual annuity business will remain at or near historical highs throughout our five-year outlook, we acknowledge the possibility of a new paradigm even as our very modest growth outlook offers a concession that the beneficial market conditions may have been temporary.

The outsized expansion we expect for 2024 will make for four consecutive years of total life, annuity, and accident and health direct premiums and considerations growing more than 5%. The industry achieved growth of that magnitude four times in the preceding 15 years, underscoring that companies have been riding unique tailwinds.

The individual annuity business has been the most significant and consistent catalyst for the expansion. We project 22.2% growth in individual annuity direct premiums and considerations in 2024, capping off a remarkable four straight years of double-digit percentage growth and two years of expansion north of 20%. Individual annuity business volume is modeled to account for 40.1% of the life industry total in 2024, up from just 27.4% in 2020.

Factors such as higher interest rates, an aging American population needing attractive retirement savings solutions, banks' reluctance to offer competitive rates on longer-term certificates of deposit, and excess consumer liquidity after the pandemic have stimulated demand for various types of individual annuities. On the supply side, the reinvention of the US life insurer business model has given carriers the flexibility to pursue additional growth through the reinsurance of low-returning, capital-intensive, and/or interest-rate-sensitive blocks of in-force business as well as the entry of flow reinsurance agreements to help facilitate new business issuance. A model that has become known as asset-intensive reinsurance has fueled this shift.

With the Federal Reserve moving away from its aggressive inflation-fighting posture, the crediting rates on certain annuities are bound to fall. The question facing the market is, what will happen to sales volumes when they do?

"The short answer on sensitivity of retail sales to interest rates is we don't know — we haven't lived through this," said Athene Holding Ltd. President Grant Kvalheim during an August conference call. Kvalheim added that fixed indexed annuities have been growing regardless of the interest rate environment but that multiyear guaranteed annuities would be more sensitive to rate changes.

Even if sales slow, Kvalheim and others in the industry view it as likely that consumers holding maturing multiyear guaranteed annuities may roll their funds into a fixed indexed annuity or multiyear guaranteed annuity rather than a different savings vehicle entirely. This would seem to set a floor under individual annuity volumes at recent levels even if it does not necessarily imply a continuation of outsized growth.

Private equity will also remain a catalyst for additional industry expansion as well as scrutiny from regulators and legislators. Apollo Global Management Inc.'s success in its strategy with Athene has attracted more private equity firms and alternative asset managers to the life and annuity realm in recent years, and some have issued lofty targets for their future in the space. Brookfield Wealth Solutions Ltd., months after closing the acquisition of the parent of fixed indexed annuity writer American Equity Investment Life Insurance Co., said it was seeking to grow its insurance assets to about $300 billion in 2029 from more than $110 billion in 2024.

Athene has demonstrated the ability to pivot between businesses that are most attractive at a given moment with capabilities in pension risk transfer, block and flow reinsurance, funding agreements and acquisitions in addition to its market-leading retail annuity platform. Brookfield listed growth in several geographies on its 2029 roadmap, including the sale of retirement income products in the US, Japan, the UK and Europe.

On the strength of its retail production, Athene ranked second only to Aetna Life Insurance Co. parent CVS Health Corp. as the largest US life company by total direct premiums and considerations, just ahead of UnitedHealth Group Inc. The group led by Massachusetts Mutual Life Insurance Co., Prudential Financial Inc., the group led by New York Life Insurance Co., MetLife Inc., Lincoln National Corp., The Cigna Group and Corebridge Financial Inc. rounded out the top 10. The ranking incorporates accident and health business written by entities licensed as life insurers.

In 2024, we expect growth in group annuities to complement the historic strength in individual annuities. Pension risk transfer group annuity issuance remains ahead of the 2023 pace through the first half of the year on the strength of record activity in the first quarter. In 2023, not having the level of historically large pension risk transfer deals witnessed in the second half of 2022 contributed to a 14.6% year-over-year decline in group annuity direct premiums and considerations. Our outlook for 2024 anticipates growth of 12.6%, but the outcome depends heavily on the timing and size of pension risk transfer activity.

We expect individual life business growth to return to the historical trendline in the low single digits, with the industry appearing to have moved beyond pandemic-era volatility and other structural changes that led to unusually significant year-over-year changes in premium volume.

Methodology

The results and outlook presented in the report primarily focus on premiums, benefits, and commissions for the approximately 725 individual entities that currently file life and health statement blanks with the National Association of Insurance Commissioners. They reflect a sum-of-the-parts analysis of disclosures at the line of business level, aggregated to major product categories and the industry.

The results and projections in the US Life and Annuity Market Report do not consider data attributable to select entities primarily focused on markets outside the US that generated at least $100 million in direct premiums and considerations in the most recent calendar year, of which more than 90% were from Canada and/or "other alien" jurisdictions as defined by the NAIC. In 2023, American Bankers Life Assurance Co. of Florida, an Assurant Inc. subsidiary, and American Life Insurance Co. (DE), a unit of MetLife, were excluded based on those criteria.

Results for all business lines are generally derived from a proprietary aggregation of disclosures made by individual insurance companies on Exhibit 1 and the Analysis of Operations pages of annual statutory statements for calendar years 2004 through 2023 except where otherwise noted. Due to revisions to line-of-business designations and compositions implemented effective with 2023 annual statements, we have estimated historical results for 2004 through 2022 to conform with the current reporting format. The changes resulted in the consolidation of industrial life into individual life, portions of the credit life business into both individual and group life, and the consolidation of other, group and credit accident and health into a single business line.

Historical results through the second quarter of 2024, macroeconomic forecasts, sales surveys published by LIMRA, anecdotal commentary, conversations with market participants, and various other internal and external inputs contribute to the formation of our outlook.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.