Utility renewable capital expenditure plans are holding steady despite recent supply chain challenges and an ongoing U.S. Commerce Department investigation into whether certain solar manufacturers are circumventing American tariffs on Chinese imports.

On recent earnings conference calls, management teams have noted that while the investigation could affect the timing and ultimate cost of some planned solar projects, spending in the near term may be reallocated toward other investments — such as wind generation or transmission and distribution projects — with an eye focused on maintaining earnings and rate base growth targets.

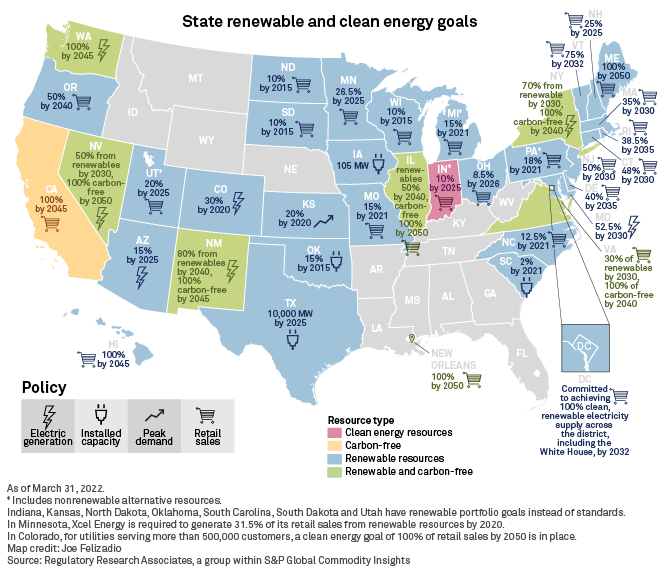

Broadly speaking, state-level clean energy mandates via renewable portfolio standards, the continued availability of federal production and investment tax credits, robust corporate demand, and booming interest in renewable energy development on federal lands and waters remain significant drivers of ongoing renewable energy development.

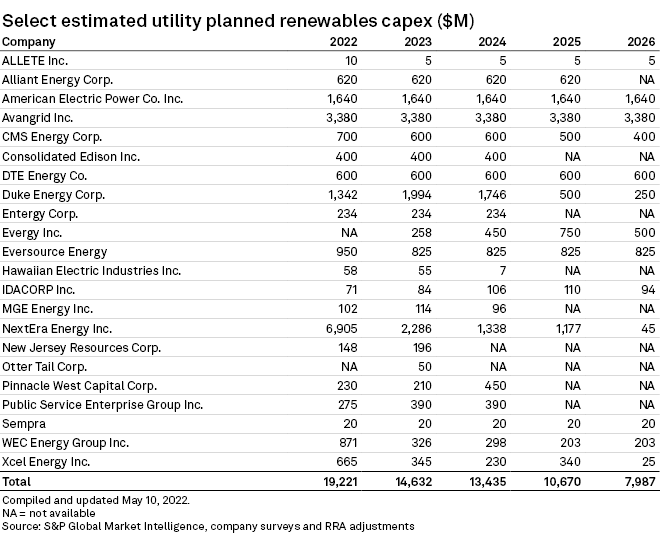

Based on conclusions from our most recent review of company spending plans made available through investor presentations, SEC filings and other sources, projected renewable energy investments for Regulatory Research Associates' sample of publicly-traded electric, gas and multi-utilities approximates $19.2 billion in 2022, declining to $14.7 billion in 2023 and to $13.4 billion in 2024. These conclusions flow from our most recent Utility Capital Expenditures Update report dated April 12.

Within RRA's Financial Focus coverage universe of electric, gas and multi-utilities, renewable energy capital expenditures are estimated to account for approximately 13% of 2022-2024 spending within these subsectors, therefore, comprising a significant component of utility EPS growth objectives.

The addition of renewable assets to a utility's generation mix, and rate base, represents an attractive, incremental earnings stream and, with no fuel costs, a hedge against potential commodity price volatility. Utilities with competitive generation segments continue to develop and acquire projects under long-term power purchase agreements to hedge against volatile commodities markets while delivering predictable earnings growth.

Company perspectives

Eversource Energy

Prior to announcing that it would undertake a strategic review of its offshore wind segment on surging investor interest in such assets, Eversource's planned capex in the segment was to total between $900 million and $1 billion in 2022, as well as an additional $3 billion to $3.6 billion from 2023 through 2026 to bring several new projects online. Instead, proceeds from a possible sale of all or part of the segment may be allocated to fund modernization and decarbonization investment at its regulated electric, water and gas utilities, where more than $18 billion of spending is planned over the next several years.

Eversource's strategic review includes its 50% stake in an offshore wind joint venture with Danish power company Ørsted A/S, which includes several contracted projects comprising 1,758 MW. Eversource management cited strong offshore wind auction results in announcing its decision in early May to pursue a potential monetization of its stake in the business.

New Jersey Resources Corp.

Management noted in its first-quarter earnings call that while the Commerce Department investigation has not yet affected its solar supply procurement — with panels secured for most projects planned through fiscal 2023 — uncertainty over New Jersey state incentives for solar projects and a growing backlog in PJM Interconnection's generation interconnection request queue will force New Jersey Resources to delay near-term solar capex.

Given an anticipated decline in its commercial project installations in 2022, New Jersey Resources reduced its 2022 solar capex outlook from a range of $235 million to $301 million to a range of $139 million to $157 million. At the end of fiscal second-quarter 2022, New Jersey Resources' solar pipeline included approximately 680 MW in various stages of development.

Despite the solar investment delay, management expects to achieve long-term annual net financial EPS growth of 7%-9%, driven primarily by earnings from its core gas utility business as well as its energy services and clean energy segments.

WEC Energy

WEC management indicated during its first-quarter earnings call that the potential impacts from the Commerce Department investigation are expected to be immaterial to the company's overall capex plan but may lead to "some price increases and potential delays" to planned solar and battery projects. The company may redirect renewables capex toward wind installations in the meantime.

New renewables comprise nearly 31% of WEC's $17.7 billion capex outlook for 2022-2026, which, together with electric and gas utility reliability and modernization investments, is expected to drive EPS and rate base growth upward of 7% annually.

Recent solar, wind installations slump amid supply chain, trade challenges

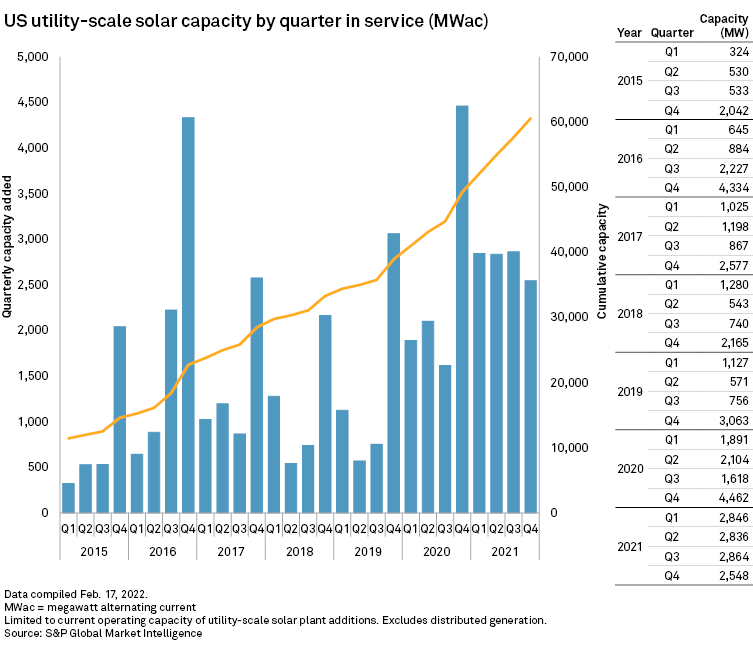

Fourth-quarter 2021 solar additions fell more than 40% year over year to 2,548 MW, with projects delayed due to supply chain, logistics and international trade complications. WEC Energy Group and MGE Energy Inc.'s 150-MW Badger Hollow Solar Farm in Iowa County, Wis., was the largest utility solar project brought online during the period.

Data collected by S&P Global Market Intelligence as of mid-February shows NextEra Energy Inc. with the largest pipeline of solar projects among investor-owned utilities, with more than 9.6 GW of projects in development. As one of the largest renewables developers globally, NextEra carries the largest renewables 2022-2026 capex budget in our April forecast at approximately $11.75 billion. The total U.S. solar development pipeline stood at nearly 124,000 MW in early 2022, with just under 15,000 MW under construction.

Wind capacity installations fell to about 3,800 MW in fourth-quarter 2021 from about 9,600 MW in the prior-year quarter.

Data presented in this article was collected from Kagan's Q3'21 U.S. Consumer Insights survey conducted in September 2021. The survey totaled 2,529 internet adults with a margin of error of +/- 1.9 percentage points at the 95% confidence level. Percentages are rounded up to the nearest whole number.

Consumer Insights is a regular feature from Kagan, a group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.