Several large electric and gas utilities are preparing to submit rate increase requests in February, suggesting that the latter part of 2024 could be pivotal for those entities.

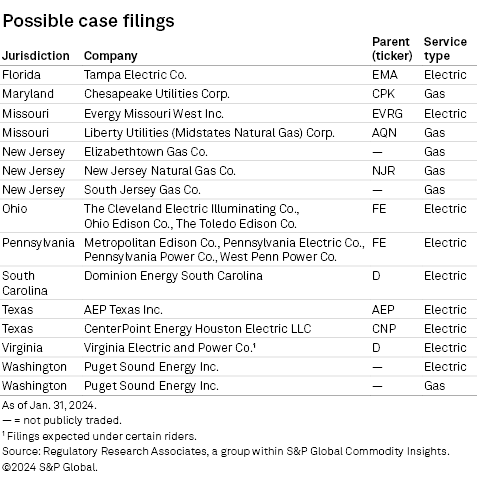

➤ At least 15 new rate cases could be filed in February. In addition, decisions could be issued in at least nine pending rate proceedings, and various intervenors and agencies will file testimony in at least seven pending proceedings. Administrative law judges are expected to weigh in on at least one pending rate request, and relevant information regarding settlements may be filed in at least four other cases.

➤ The busiest time for rate case filings is usually late spring or early summer, with the least activity in fall. By contrast, the fourth quarter is generally the busiest time of the year for rate case decisions, particularly in December.

➤ Actions concerning the composition of regulatory bodies and legislative developments that could impact utilities are expected in several jurisdictions.

A listing of expected events for February and beyond is available in the Regulatory Research Associates Events Calendar.

Expected decisions

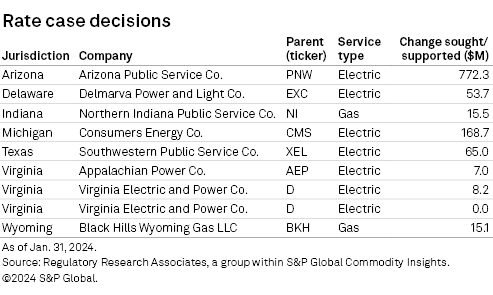

Arizona — Arizona Public Service Co. — A decision may be issued in Arizona Public Service's pending electric rate case. (Docket E-01345A-22-0144) The Pinnacle West Capital Corp. subsidiary filed for a $772.3 million base rate increase based on a 10.25% return on equity (51.93% of capital) and a 7.17% return on a $10.516 billion rate base.

Delaware — Delmarva Power & Light Co. — A decision could be rendered in Delmarva's pending electric distribution rate proceeding. (Docket 22-0897) Delmarva, a subsidiary of Exelon, recently signed on to a nonunanimous settlement that calls for a $42.3 million base rate increase premised upon a 9.60% return on equity (50.50% of capital) and a 6.97% overall return.

Indiana — Northern Indiana Public Service Co. LLC — A decision may be issued in NiSource Inc. subsidiary Northern Indiana Public Service's pending transmission, distribution and storage system improvement charge rider proceeding. (Cause 45330-TDSIC-7) The company seeks a $15.5 million gas rate increase that reflects certain investments made through Aug. 31, 2023.

Michigan — Consumers Energy Co. — A decision could be issued in Consumers Energy's pending electric rate proceeding. (Case U-21389) Consumers Energy, a subsidiary of CMS Energy Corp., supports a $168.7 million rate increase based on a 10.25% return on equity (42.58% of a regulatory capital structure) and a 6.11% return on a $13.758 billion rate base.

Texas — Southwestern Public Service Co. — The agreed-upon extended decision date in Southwestern Public Service's pending electric rate case (Docket 54634) is Feb. 12. The Xcel Energy Inc. subsidiary recently signed onto a settlement that calls for a $65.0 million rate increase. The settlement is silent with respect to the rate of return and rate base underlying the rate change, but it calls for the company to use a 9.55% return on equity (54.51% of capital) and a 7.11% overall return for calculating allowance for funds used during construction and for certain riders.

Virginia — Appalachian Power Co. — A decision is likely to be issued in February in Appalachian Power's pending BC-RAC rider proceeding. (Case PUR-2023-00102) Appalachian Power, a subsidiary of American Electric Power Co. Inc., supports a $7.0 million revenue requirement increase under the rider, premised upon a 9.50% return on equity (48.31% of capital) and a 7.05% return on a $52.8 million rate base. The BC-RAC rider reflects the investment and costs associated with projects to facilitate broadband access to rural areas by building out the "middle mile" portion of the network.

Virginia — Virginia Electric and Power Co. — A decision is expected to be issued in February in Virginia Electric and Power's pending GV rider proceeding. (Case PUR-2023-00094) The Dominion Energy Inc. subsidiary supports an $8.2 million revenue requirement increase under the rider, premised upon a 9.70% return on equity (50.33% of capital) and a 6.95% return on an $860.8 million rate base. Rider GV pertains to the gas-fired Greensville County project that achieved commercial operation in 2018.

Virginia — Virginia Electric and Power — A decision is expected to be issued in February in Virginia Electric and Power's earnings review proceeding. (Case PUR-2023-00101) A pending settlement calls for no change to the company's rates in the context of the case. The settlement calls for a revenue-neutral transfer of $67.8 million of revenue requirement to the company's distribution business from the generation business.

Wyoming — Black Hills Wyoming Gas LLC — A decision is expected in Black Hills Wyoming Gas' pending rate case. (Docket 30026-78-GR-23) Black Hills Wyoming Gas, a subsidiary of Black Hills Corp., recently signed an amended settlement that calls for a $15.1 million rate increase premised upon a 9.85% return on equity (51.00% of capital) and a 7.33% return on a $450.8 million rate base. Following the transfer of roughly $1.2 million that is being collected through a rider, the net impact would be a $13.9 million rate increase.

Administrative law judges' recommendations

Virginia — Virginia Electric and Power — A hearing examiner's report may be issued in February in Virginia Electric and Power's rider CE proceeding. (Case PUR-2023-00142) The company seeks a $47.5 million rate increase under the rider premised upon a 9.70% return on equity (52.10% of capital) and a 7.05% return on a $2.255 billion rate base. Rider CE pertains to the company's investment in renewables and storage projects to comply with the 2020 Virginia Clean Economy Act.

Testimony

California — Southern California Edison Co. — Intervenor testimony is due Feb. 29 in Southern California Edison's pending electric rate proceeding. (Application 23-05-010) The company, a subsidiary of Edison International, seeks a $3.270 billion multiyear base rate increase premised upon a 7.44% overall return and a $50.34 billion rate base.

Connecticut — Intervenor testimony is due Feb. 8 in a pending rate proceeding (Docket 23-11-02) for Connecticut Natural Gas Corp. and The Southern Connecticut Gas Co. Connecticut Natural Gas requests a $19.8 million rate increase premised upon a 10.20% return on equity (55.00% of capital) and a 7.82% return on a $594.7 million rate base. Southern Connecticut Gas seeks a $40.6 million rate hike premised upon a 10.20% return on equity (53.00% of capital) and a 7.56% return on an $875.9 million rate base. The companies are subsidiaries of Avangrid Inc.

New Hampshire — Liberty Utilities (EnergyNorth Natural Gas) Corp. — Intervenor testimony is due Feb. 21 in a pending rate proceeding (Docket DG-23-067) for Liberty Utilities (EnergyNorth Natural Gas). The company, a subsidiary of Algonquin Power & Utilities Corp., proposes a $51.1 million permanent base rate increase premised upon a 10.35% return on equity (55.00% of capital) and a 7.68% return on a $527.9 million rate base.

New Mexico — New Mexico Gas Co. Inc. — Intervenor testimony is due Feb. 21 in a pending rate proceeding (Case 23-00255-UT) for New Mexico Gas. New Mexico Gas, a subsidiary of Emera Inc., proposes a $49.0 million base rate increase premised upon a 10.50% return on equity (53.00% of capital) and a 7.38% return on a $972.6 million rate base.

Louisiana — Cleco Power LLC — Intervenor testimony is due Feb. 5 in Cleco Power's pending electric rate case. (Docket U-36923) Cleco Power, a subsidiary of Cleco Partners LP, proposes a $155.5 million base rate increase premised upon a 10.40% return on equity (52.00% of capital) and a 7.99% return on a $3.259 billion rate base. After consideration of various offsets, ratepayers would experience a net rate increase of $40.8 million.

Virginia — Washington Gas Light Co. — Staff and intervenor testimony is due between Feb. 15 and Feb. 22 in Washington Gas Light's pending rider RNG proceeding. (Case PUR-2023-00220) The company proposes an initial $1.4 million revenue requirement under the rider premised upon a 10.65% return on equity (52.53% of capital) and a 7.67% return on a $27.3 million rate base. The company will purchase, own, operate and maintain an eight-mile pipeline and associated interconnection facilities and other necessary equipment to transport renewable natural gas from a biogas production facility. Washington Gas Light is a subsidiary of AltaGas Ltd.

Settlements

New Jersey — Jersey Central Power & Light Co. — Settlement talks are ongoing in Jersey Central Power & Light's pending rate proceeding. (Docket ER23030144) The FirstEnergy Corp. subsidiary seeks a $192.2 million base rate increase premised upon a 10.40% return on equity (51.90% of capital) and a 7.60% return on a $3.050 billion rate base. The requested rate increase would be $197.2 million once the state's 6.625% sales and use tax is applied.

New York – The Brooklyn Union Gas Co./KeySpan Gas East Corp. — A settlement may be filed in February in National Grid PLC subsidiaries Brooklyn Union Gas' and KeySpan Gas East Corp.'s pending rate cases. (Case 23-G-0225 and Case 23-G-0226, respectively) Brooklyn Union Gas supports a $466.5 million rate increase premised upon a 9.80% return on equity (48.00% of capital) and a 7.09% return on a $7.353 billion rate base. KeySpan Gas East supports a $277.3 million rate increase based on a 9.80% return on equity (48.00% of capital) and a 7.05% return on a $4.711 billion rate base.

New Mexico — New Mexico Gas — The deadline to file a settlement in a pending rate proceeding (Case 23-00255-UT) for New Mexico Gas is Feb. 26. New Mexico Gas proposes a $49.0 million base rate increase premised upon a 10.50% return on equity (53.00% of capital) and a 7.38% return on a $972.6 million rate base.

Other

California — Pacific Gas and Electric Co. — A California Public Utility Commission decision on the company's petition to transfer non-nuclear generation assets is due after Feb. 5. Pacific Gas and Electric is a subsidiary of PG&E Corp.

Ohio — Ohio Power Co. — A decision could be issued in Ohio Power's electric security plan proceeding. (Case 23-0023-EL-SSO) Ohio Power is a subsidiary of American Electric Power.

Commissioners

Developments are expected in February that will impact the composition of several state commissions.

The terms of Diane Burman and John Howard of the New York Public Service Commission are due to expire in February.

The following commissioners are serving beyond the expiration of their terms, pending reappointment or replacement: Vice Chairman John Betkoski III (D) and Michael Caron (R) of the Connecticut Public Utilities Regulatory Authority; David Veleta of the Indiana Utility Regulatory Commission; Scott Rupp (R) and Maida Coleman (D) of the Missouri Public Service Commission; Abigail Anthony of the Rhode Island Public Utilities Commission; Justin Williams, Tom Ervin and Florence Belser of the Public Service Commission of South Carolina; and Lori Cobos of the Public Utility Commission of Texas.

Due to the postponement of the Nov. 8, 2022, Georgia Public Service Commission election following a US district court's ruling that found that the commission's electoral method violated the federal Voting Rights Act, Vice Chair Tim Echols and Commissioner Fitz Johnson have continued to serve on the commission since their terms expired in December 2022. A special election is expected in 2024, subject to an appellate court ruling.

In several instances, commissioners have been appointed/reappointed and are serving pending confirmation, including John Espindola of the Regulatory Commission of Alaska; Megan Gilman of the Colorado Public Utilities Commission; Chairman Doug Scott, Stacey Paradis and Conrad Reddick of the Illinois Commerce Commission; Chair Andrew French and Annie Kuether of the Kansas Corporation Commission; Mary Pat Regan of the Kentucky Public Service Commission; Kumar Barve and Bonnie Suchman of the Maryland Public Service Commission; Chairman Dan Scripps and Alessandra Carreon of the Michigan Public Service Commission; Hwikwon Ham of the Minnesota Public Utilities Commission; Kayla Hahn of the Missouri Public Service Commission; Chairman Herbert Hilliard of the Tennessee Public Utility Commission; Chairman Thomas Gleeson of the Public Utility Commission of Texas; Chairman Ed McNamara of the Vermont Public Utility Commission; and Renee Larrick and William Raney of the Public Service Commission of West Virginia.

Gov. Ned Lamont has not yet filled the two vacancies on the Connecticut Public Utilities Regulatory Authority stemming from 2019 legislation that expanded the authority from three to five members.

Oregon Gov. Tina Kotek, on Jan. 16, nominated Leslie Perkins to the Oregon Public Utility Commission to fill a vacancy created by the departure of Mark Thompson, who left the commission just after being reappointed to an additional term. Perkins will serve a term that extends to November 2027. The Senate Committee on Rules is scheduled to consider the nominations Feb. 6.

Following the Wisconsin Senate's rejection of Tyler Huebner's appointment to the Public Service Commission of Wisconsin, a vacancy remains on the commission for a term extending to March 2027. Additionally, Chairperson Rebecca Cameron Valcq announced her resignation effective Feb. 2; however, Gov. Tony Evers announced the appointment of Kristy Nieto to serve the remainder of Valcq's unexpired term, which extends to March 2025. Nieto will join the commission on Feb. 2, and her appointment will be subject to Senate confirmation.

There are also vacancies on the New Jersey Board of Public Utilities, the New York Public Service Commission and the Public Utility Commission of Texas.

FERC

On Feb. 8, the Federal Energy Regulatory Commission will convene a settlement conference in Docket ER23-2212 to consider a proposed formula rate filed by Consolidated Edison Inc. subsidiary Consolidated Edison Co. of New York Inc. (ConEd) to recover the company's investment in certain new transmission projects through rate schedules in the New York ISO transmission tariff. ConEd proposed a ceiling ROE of 10.87% for certain projects as a fixed value in the formula rate, subject to a lower ROE authorized by the New York Public Service Commission. ConEd proposed a separate base ROE of 10.60% for certain other projects.

On or before Feb. 14, the Joint Federal-State Task Force on Electric Transmission will release an agenda for its next public meeting on Feb. 28 after reviewing comments filed by interested persons, including all state commissions, on agenda topics. The meeting will be held at the Westin Washington in Washington, DC. Commissioners may attend and participate in this meeting.

On Feb. 15, FERC will hold its regular monthly agenda open meeting.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.