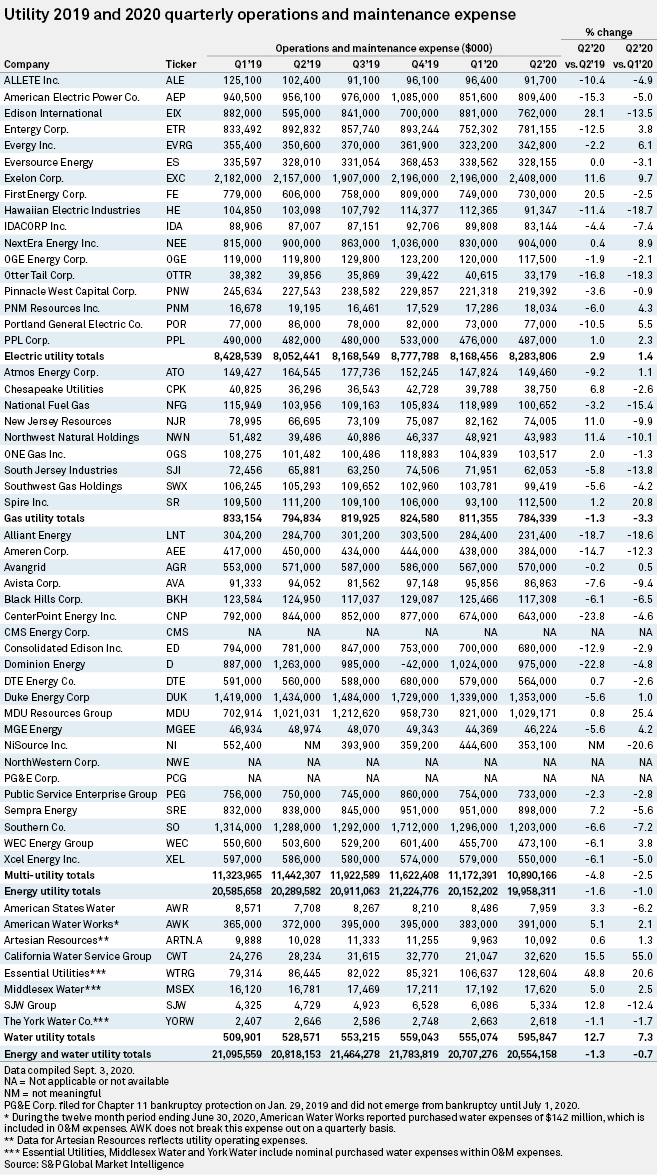

In response to the COVID-19 pandemic, utilities have implemented a heightened emphasis on cost control and the companies, as a group, reduced operations and maintenance, or O&M, expense in the second quarter of 2020 by 0.7% and 1.3% compared to the first quarter of 2020 and the second quarter of 2019, respectively. Given the considerable uncertainty surrounding the health and related economic impacts that COVID-19 will have in the upcoming fall and winter months, we anticipate that the heightened emphasis by utilities on cost control will continue for the foreseeable future. A data table providing quarterly data for the energy and water utilities in the Financial Focus coverage universe is provided at the conclusion of this report.

|

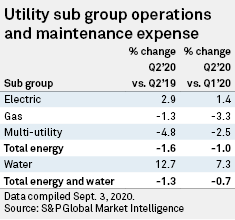

Notably, variation exists not only among the various companies but also among the four utility sub groups. Specifically, the gas and multi-utility sub groups saw the largest decline in O&M expenses in the second versus the first quarter of 2020, 3.3% and 2.5%, respectively. The electric group's O&M expenses, however, were 1.4% higher, while the overall energy group posted a 1.0% decline. The small water company sub group saw a 7.3% increase, driven largely by a full quarterly contribution from Peoples Gas included in Essential Utilities Inc.'s results.

Of the nine companies in the gas sub group, seven reported a decline in O&M expenses in the second quarter versus the first quarter of 2020, while for the multi-utility sub group 13 of the 18 companies for which full data is available showed a decline. We have excluded PG&E Corp. from the results because the company filed for Chapter 11 bankruptcy protection on Jan. 29, 2019, and did not emerge from bankruptcy until July 1, 2020.

For the companies in the electric sub group, 10 of the 17 companies reported a decline in O&M expense in the second quarter versus first quarter 2020, while three of the eight water companies exhibited a drop in O&M expenses in this period. Customer usage tends to be lowest in the first and fourth quarters for water utilities, so O&M expenses tend to move higher in the second quarter.

Arguably, the heightened expense control in the midst of the COVID-19 pandemic contributed to the overall solid second quarter EPS results for utilities. In a recently issued report, Financial Focus noted that although the broader economic effects of the coronavirus pandemic were in full force during the second quarter, most utilities' quarterly results, overall, did not reflect significant negative pandemic-related impacts. Adjusted earnings for the companies in the energy and water utility universe were up an average of 10.2% year over year, although individual company results varied widely. Despite many companies reporting that commercial and industrial sales fell in the second quarter, most management teams affirmed existing earnings guidance ranges.

For the utilities with adjusted S&P Capital IQ second quarter 2020 consensus earnings estimates available, 37 companies surpassed their estimates, 10 companies missed and four companies met the estimate. Among energy utilities, the multi-utility sector posted the highest average earnings expansion for the second quarter, at 14.9%, while the gas and electric sectors saw average earnings growth of 13.1% and 8.5%, respectively.

Revenues obviously have a notable impact on EPS, and Financial Focus plans to publish an analysis of second quarter 2020 utility revenues in the near future.

|

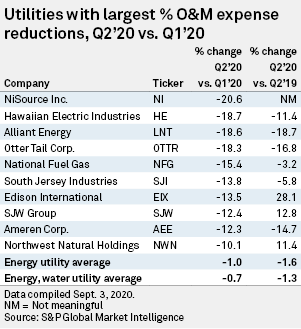

Regarding certain of the companies with the largest decline in second quarter 2020 O&M expense compared to first quarter 2020, Hawaiian Electric Industries, Inc. supplies electric service to Hawaii, a state heavily dependent on tourism that was especially negatively impacted by the pandemic. As a result, the company likely is particularly sensitive to controlling costs.

Otter Tail Corp. has significant non-utility manufacturing businesses that will likely fare worse in the recession than its upper Midwest traditional electric utility operations. Hence, aggressive cost cutting will likely be especially important and certain variable O&M expenses may decline along with non-utility manufacturing sales.

South Jersey Industries, Inc., in July 2018, completed the acquisition of New Jersey-based Elizabethtown Gas Co. and the extremely small Maryland utility Elkton Gas Co., and the company's O&M expense decline may well reflect improved efficiencies resulting from the merged operations.

National Fuel Gas Co. has four business segments: Exploration & Production, Pipeline & Storage, Gathering, and Utility. The upstream and midstream oil and gas industries have been especially hard hit by the pandemic and the company will likely be particularly aggressive in controlling costs. In addition, certain variable O&M expenses also may decline along with declining upstream and midstream sales.

At SJW Group, year-over-year operating expenses benefited from a $1.8 million decrease in merger-related costs from the acquisition of Connecticut Water completed in October 2019.

|

Regulatory Research Associates is a group within S&P Global Market Intelligence.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Global Market Intelligence Energy Research Library (subscription required).

Heike Doerr and Charlotte Cox contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.