Introduction

U.S. utilities cut CO2 emissions from generation by 33% between 2005 and 2021, with the bulk of the reduction logged in the back half of the interval, arguably putting the White House target of a drop of 50% to 52% from 2005 levels by 2030 within sight. Energy transition headwinds are rising, however, including the impact of geopolitical tectonic shifts in the energy space and the June 30 U.S. Supreme Court decision curbing the U.S. Environmental Protection Agency's powers to regulation emissions.

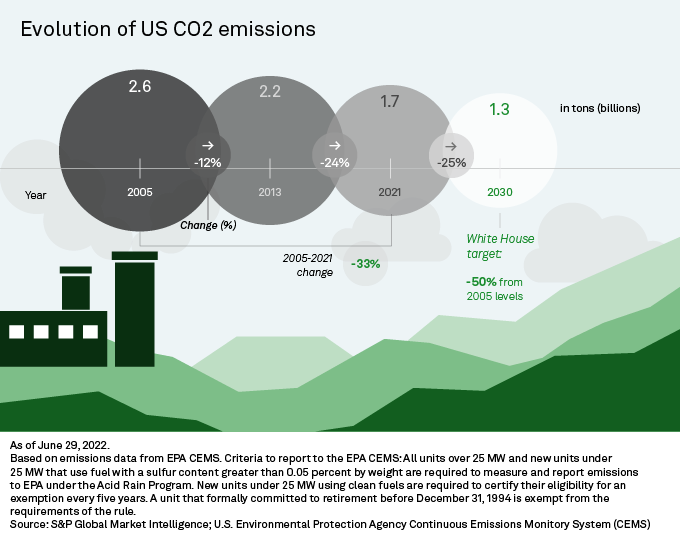

CO2 emissions by U.S. utilities are down significantly since 2005, arguably aligning with long-term reduction goals to address climate change.

With the conflict in Ukraine upending the decades-old global energy balance of power, however, the U.S. and its partners must now weigh energy security concerns against environmental issues, potentially redrawing net-zero roadmaps.

|

Tracked CO2 emissions from U.S. utilities came in at about 1.7 billion tons in 2021 based on an analysis of S&P Market Intelligence's data from the U.S. Environmental Protection Agency Continuous Emissions Monitoring System, or CEMS. This compares to almost 2.6 billion tons in 2005 and more than 2.2 billion tons in 2013, with renewables substituting fossil fuel capacity at a relatively fast clip in the 2005-2021 interval.

From 2005 through 2021, the U.S. retired a net 88.7 GW of coal capacity and a net 16.5 GW of oil capacity. On the green energy front, meanwhile, it added a net 127.3 GW of wind capacity and a net 62.4 GW of solar capacity, offsetting coal and oil net retirements to the tune of 180% — a necessary differential given generally lower solar and wind capacity factors. An S&P Commodity Insights study on energy production by fuel type published July 5, suggests renewables account for about 14% of the overall U.S. output and could reach 23% based on currently operating and planned capacity.

The evolution of U.S. utility-emitted CO2 from 2005 through 2021 implies the metric must fall an additional 25% to meet the White House's base carbon reduction target by 2030. For perspective, our analysis shows tracked CO2 emissions from U.S. utilities fell 12% from 2005 through 2013 and 24% from 2013 through 2021. In the wake of U.S. President Joe Biden's Jan. 20, 2021, decision to rejoin the Paris Agreement on climate change, originally inked Dec. 12, 2015, the White House set a goal for the U.S. to ultimately achieve net-zero emissions by 2050.

The world has changed dramatically in the last 18 months, however. Russia's invasion of Ukraine has roiled energy markets, and the jury is still out on the conflict's ultimate impact on the green energy space. Tensions in Eastern Europe add an energy security layer to the environmental argument for transitioning away from fossil fuels. On the other hand, the resulting global fuel supply and pricing crisis is reframing the challenge of bridging the legacy portfolio of U.S. utilities and the envisioned clean energy future.

On June 30, the U.S. Supreme Court ruled that absent specific instruction from the U.S. Congress, the previously proposed Clean Power Plan was an invalid way to regulate greenhouse gas emissions from fossil fuel power plants, curtailing the EPA's sway on the matter. The West Virginia vs. The Environmental Protection Agency decision essentially puts to rest the EPA's Clean Power Plan initiative and destabilizes the White House's clean energy goals. That said, virtually all top U.S. utilities have net-zero commitments, even though the Clean Power Plan never went into effect.

Across the Atlantic, the European Union says it remains committed to achieving net-zero emissions by 2050, but governments across the region are taking emergency steps away from green energy as the flow of natural gas from Russia slows. In June, Germany announced plans to restart mothballed coal power plants; Austria gave utility Verbund AG the green light to retrofit an existing gas-fired generation unit to use coal; and the Netherlands said it was lifting caps on coal energy production.

On July 6, European Union lawmakers backed a proposal to include some nuclear and natural gas projects in the economic bloc's list of sustainable energy activities. Natural gas is a fossil fuel, but it is seen as the lesser of two evils as the EU aims to wean itself off coal — a dirtier fuel. Nuclear energy is carbon-free, but it produces radioactive waste and is marred by history-altering incidents, generating widespread wariness. Per the EU proposal, nuclear projects could be classified as green, provided commitments to safe radioactive waste disposal.

In remarks at the Assemblée Nationale, France's lower house of Parliament, also on July 6, 2022, French Prime Minister Élisabeth Borne, invoking energy sovereignty and affordability, announced plans to renationalize Electricité de France SA, or EDF, a nuclear energy specialist. France's plan to assume full control of EDF coincides with a renewed nuclear-focused energy strategy championed by newly reelected President Emmanuel Macron, after years of retiring aging reactors.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.