Chinese manufacturing activity, as measured by the two leading purchasing managers' indexes, deteriorated in April, indicating that prices of hot-rolled coil — the major steel product used in manufacturing — will come under further pressure.

➤ Chinese manufacturing activity deteriorated in April.

➤ Manufacturers cut factory gate prices despite lower input costs.

➤ The second quarter may no longer be the steel-price high point in 2023.

China's official manufacturing purchasing managers' index (PMI), published by the National Bureau of Statistics, dropped below the neutral 50-point mark in April to 49.2, from 51.9 in March. The S&P Global PMI, branded Caixin, fell to 49.5 in April from 50.0 in March. Both PMIs showed weaker output and new orders in April, while costs of inputs, such as steel, fell for the first time in seven months. Worryingly for steel prices, manufacturers said they had to lower their factory gate prices to attract customers in an environment of weaker domestic demand.

Manufacturers said supply chains and logistics have improved, meaning they are able to maintain lower inventory levels during a period of uncertain demand. This also reduces the urgency to restock with steel.

A potential caveat regarding the weak manufacturing performance in April was that activity would have slowed ahead of China's early May national holiday. Steel and iron ore physical and futures prices trended down when China returned to work May 4. It usually takes several days for trading activity to ramp back up to normal levels.

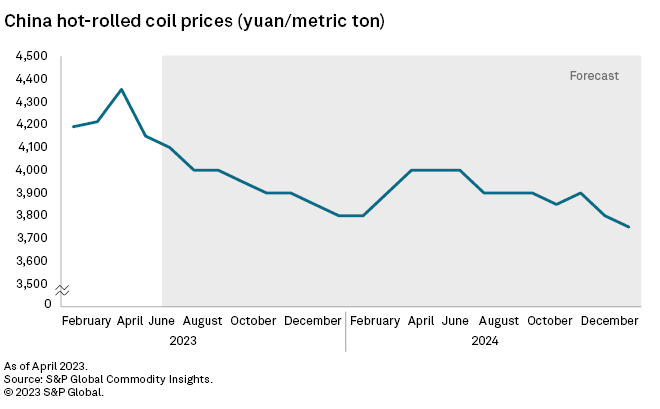

Chinese hot-rolled coil prices averaged 4,140 yuan per metric ton ($600 per metric ton) in April, close to our view of 4,150 yuan/t, down 5% from March. On May 5, they had dropped to 3,930 yuan/t. In the April issue of "Ferrous Markets Analytics," we forecast that hot-rolled coil prices will average 4,083 yuan/t in the second quarter, down from 4,253 yuan/t in the first quarter. This price forecast is likely to be lowered in our next report.

We no longer expect the second quarter to be the seasonal high point for steel production and prices in 2023. It now seems that production and prices overshot in the first quarter on expectations of an economic recovery in China and, in particular, a rebound in property construction.

We think that steel consumption in the auto and white goods and appliances sectors will be flat on 2022, though shipbuilding will increase as companies address the backlog of work created during China's COVID-19 restrictions.

S&P Global Commodity Insights analysts Paul Bartholomew, Sylvia Cao and Crystal Hao produce content for distribution on Platts Dimensions Pro. S&P Global Commodity Insights is owned by S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.