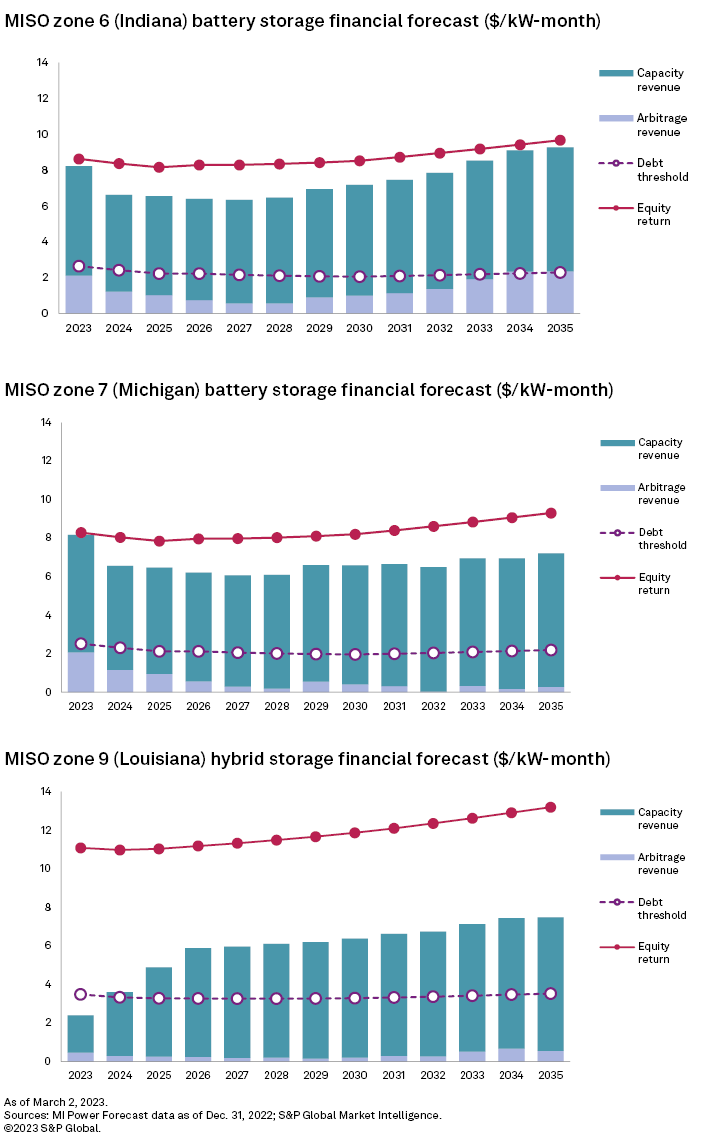

While the S&P Global Market Intelligence Power Forecast projects significant growth in renewable energy over the next 20 years, the need for new peaking resources is a bigger driver of battery storage value. In the Midcontinent ISO, supportive capacity revenue and, to a lesser extent, arbitrage revenue will make battery energy storage systems financially viable for contracted resources, but they will fall short of return on equity requirements.

With a large geographical footprint, ample wind resources and half a dozen states with renewable portfolio standards, MISO boasts a sizable renewable generation fleet, second only to the Electric Reliability Council of Texas Inc. Current battery storage capacity in MISO, however, is limited to a handful of battery energy storage systems scattered across states surrounding the Great Lakes, and the region ranks last in planned battery storage capacity with 1.6 GW in the pipeline.

Our forecast shows wind accounting for 60.7% of the MISO generation mix by 2035 with renewable penetration displacing fossil fuel-based generation during the summer peak demand season, lowering overnight zone prices and enticing overnight battery storage charging. Battery storage will be most prominent in zones 7 and 9, which should offer appealing arbitrage revenue, albeit not enough to support merchant battery storage resources. However, tight reserve margins in MISO do support strong capacity revenue, allowing battery energy storage systems to exceed debt threshold requirements and only fall short of return on equity, making them financially viable for contract resources.

The 2022/2023 Planning Resource Auction for MISO, concluded in April 2022, indicated a capacity shortfall for the North and Central regions (zones 4-7) heading into the 2023 peak summer season. This is a tightening of resources compared to the previous year's auction, which projected a small surplus for these zones that has since been eroded due to an increase in the forecast load growth, fewer resources entering the capacity auction due to retirements, and new resources entering the capacity auction with less accredited capacity.

These conditions are only complicated by slower transmission growth in MISO in 2022 and 4.5 GW of scheduled coal retirements by the end of 2024, including three J.H. Campbell units totaling 1.4 GW of capacity and four South Oak Creek units totaling 1.1 GW. With a large geographical footprint, MISO is moving power from its southern regions into the power-hungry North and Central regions, which have tighter reserves. Seeing the opportunity to satisfy a need in MISO, Otter Tail Power Co. and American Electric Power Co. Inc.'s Indiana Michigan Power Co. plan on adding 400 MW of renewables and 749 MW of solar, respectively.

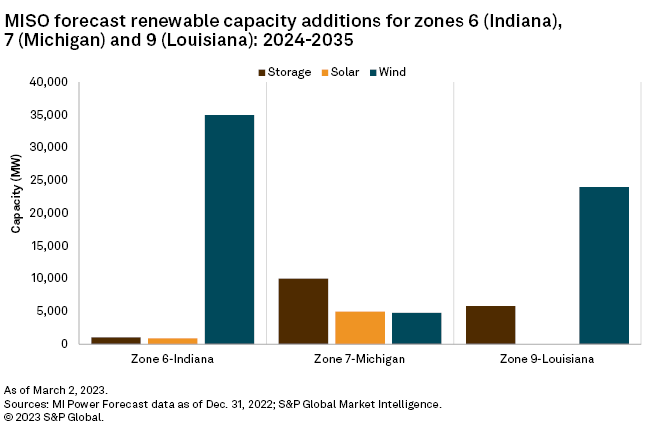

We forecast significant renewable capacity additions in zones 6, 7 and 9, corresponding to Indiana, Michigan and Louisiana, respectively. Indiana and Louisiana are projected to have strong load growth, which will drive forecast wind capacity additions 35.0 GW in Indiana and 24.0 GW in Louisiana. Of the three zones, Michigan is forecast to build the most solar and battery storage, reaching a total of 5.0 GW of solar and 10.0 GW of storage by 2035.

Low reserve margins are forecast to improve to 10.4% in 2024, the first full year of the 20-year Power Forecast, with an additional 16.4 GW of wind capacity, 5.5 GW of solar capacity, 5.8 GW from battery storage and 3.7 GW of gas resources bolstering MISO's 38.9 MW of operating wind capacity. Our forecast shows five times more wind than solar additions in MISO by the end of 2035 as the region capitalizes on 22-year-average wind speeds above 6 meters per second, driving reserve margins to 20.8%.

Wind will account for 60.7% of the generation mix and 47.3% of summer capacity in MISO by 2035. Renewable penetration by wind resources will displace gas, coal and combined cycle power plant generation during the summer peak-demand season, lower overnight zone prices and stimulate overnight battery storage charging, utilizing wind resources that may have otherwise been curtailed. This will be amplified in the winter when generation from wind resources increases.

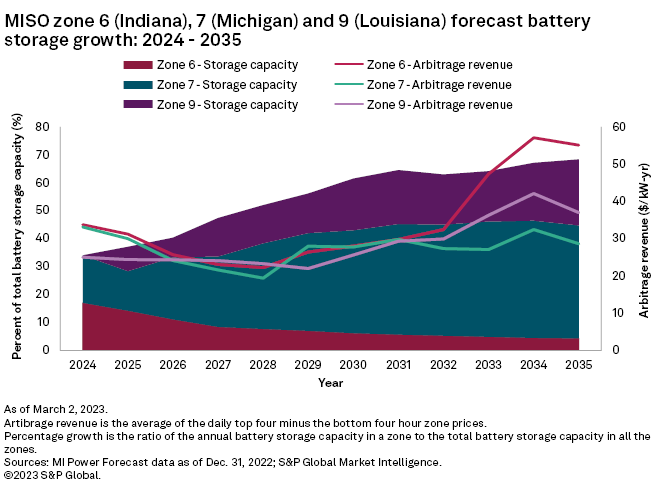

Indiana and Michigan will see similar, relatively high levels of revenue from arbitrage early in the forecast, motivating battery energy storage systems builds in 2024. Battery storage acts as a load on the grid, when paying to charge raises the overnight prices and reduces the potential arbitrage revenue. To counter this impact on the grid, additional renewable penetration would be required. As forecast battery storage is built in Michigan, arbitrage revenue levels out and, in response, so does the share of battery storage capacity. Battery storage builds shift to other areas, like Louisiana, where arbitrage revenue increases in the back half of the forecast.

In Indiana, forecast battery storage builds are limited despite the potential for significant arbitrage revenue. Peak demand growth is strong in Indiana relative to the other MISO regions, averaging about 115 MW of annual growth, contributing to negative reserve margins in the zone throughout the forecast. This limits the amount of excess generation available for charging since the incremental renewable capacity additions are needed to instead serve demand growth.

Forecast battery storage additions are most significant in zones 7 (Michigan) and 9 (Louisiana) with 10.0 GW and 5.8 GW, respectively, accounting for 40.5% and 23.6% of total battery storage additions in MISO. In Indiana, the forecast shows 1,000.0 MW of battery storage built in 2024, tapering to 61.6 MW in 2032.

MISO's low reserve margins result in a solid outlook for capacity prices in almost every zone. Capacity prices are higher in the northern zones where reserve margins are tighter, averaging $6.13 per kW-month from 2023 through 2035 across zones 6 and 7. As capacity is built in response, prices remain high since the additional capacity is directed toward incremental demand. In the southern zones, capacity prices are low early in the forecast due to healthy reserve margins. In Louisiana, capacity prices increase later in the forecast, catching up to northern zone prices as reserve margins improve in MISO but there is still a need for new capacity each year.

Arbitrage revenue varies by location, and only in Indiana in 2034 and 2035 does it meet the debt threshold, meaning none of MISO's market areas will be suitable for pure merchant stand-alone battery storage. Healthy capacity revenue combined with arbitrage revenue, however, should easily surpass the debt serve threshold from 2024 through 2035, making battery storage financially viable as contracted resources. Battery storage systems fall short of meeting full equity return in all MISO markets, with the biggest gap among solar-battery hybrid systems due to their higher operation and maintenance costs.

We anticipate coal- and gas-based resources will remain significant contributors to generation in the region, supplying half of daily generation through 2035, but the forecast rapid substitution of renewables in MISO's power mix points to a growing need for battery energy storage. Prospects for battery storage are location dependent in MISO, with zones 7 and 9 projected to contain 64.1% of the battery storage share by 2035, growing 47.1 percentage points over the 12 years. While the prospects for contracted battery storage resources will be financially viable across all of MISO, merchant stand-alone battery storage will not take hold beyond zones 7 and 9 unless renewable penetration reaches a point where arbitrage revenue meets financial minimums.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

Qaiser Ali and Chris Allen Villanueva contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.