Clearing prices for capacity in the Midcontinent ISO, released in mid-April, indicate that capacity surpluses have been exhausted, and new peaking generation will be needed over the next one to two summers to ensure reserve margin targets are met and bring the cost of capacity down. In the meantime, higher cleared prices this year and the next are forecast to deliver strong returns to merchant gas generation in Illinois and Michigan, making them one of the better-performing markets from a financial perspective.

The Market Intelligence Power Forecast has flagged the potential for generation shortfalls, relative to targets beginning in mid-2020 when it was forecast that utilities planned to retire 12 GW of coal-fired generation over the following five years, with only 3 GW in reserve contributions from new gas, wind and solar generation planned over the same period. The gap has only since expanded, with Power Forecast estimating in its release as of March 31, that planned coal retirements had swelled to nearly 18 GW over the next five years, again with relatively few capacity additions planned to offset the loss of reserves.

Institutional factors partly account for the emergence of an acute need for new capacity as indicated by the clearing price. Although MISO manages centralized dispatch across a large region of the Midwest, it is institutionally decentralized regarding resource adequacy. The capacity auction it manages has thin participation, and reserve margin results represent a consensus outcome of the actions of individual member utilities and participating merchant generation. This model contrasts with capacity auctions in PJM and ISO New England, where the balancing authority's auctions play a more prominent role in procuring sufficient capacity to meet reserve requirements.

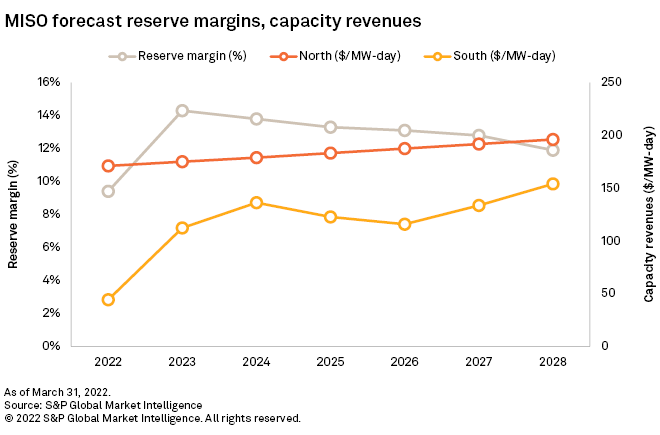

The Power Forecast estimates future capacity payments in MISO as a fraction of new combustion turbine annualized costs in years where new capacity is needed, an equivalent of $170/MW-day. Our forecast assumes an immediate need for new capacity in MISO North Zones 1-7, providing support for capacity prices in MISO South Zones 8-10. By 2029, MISO South is projected to need new generation as well, and the MISO South and MISO North capacity price forecasts converge. However, MISO's April Planning Reserve Auction, or PRA, cleared in Zones 1-7 at $236.66/MW-day for the reliability year 2022-2023, while Zones 8-10 cleared at a much lower $5.00/MW-day.

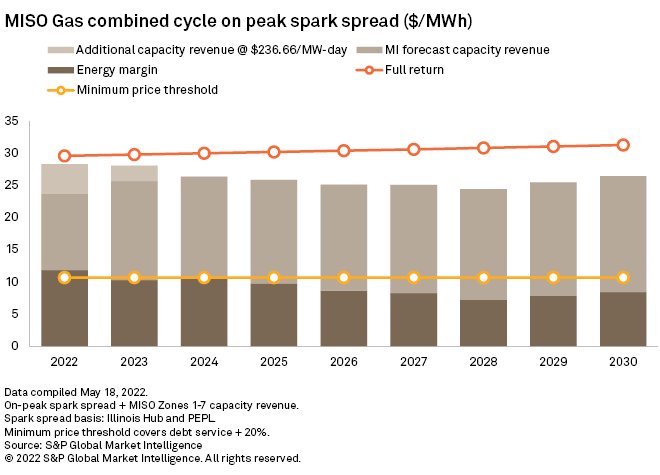

Market Intelligence expects that the high cleared capacity price for next year, combined with spark spreads, will deliver nearly full returns to open merchant gas generation in MISO North. As illustrated in the generic spark spread chart, the additional revenues from the April, clearing capacity price for this year and next, significantly improve returns. This contrasts with other ISO markets in the Continental U.S., where fairly low capacity prices and compressed spark spreads threaten to reduce returns.

The Market Intelligence Power Forecast assumes the estimated incremental cost of peaking could become a floor price moving for capacity moving forward, in which case, MISO would remain among the best markets for conventional generation. Whether MISO capacity markets remain supportive is highly uncertain, however. Previous auction results indicate that even small capacity surpluses could return MISO's capacity prices to its historically lower clearing levels.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.