How do US utilities set service rates? What do rate base calculations mean for US utility ratemaking? What lies ahead for FERC’s regulation of the US energy sector? How are US water utilities evolving? Get answers to these questions and learn more about the evolution of the US utility sector in our industry primer below.

Request a demo of S&P Capital IQ Pro to access more analysis and coverage of US utility sector regulation, financials, and forecasts. Learn more about our full suite of energy solutions >

In market-based economies, the utility sector is unlike any other. In competitive industries, customers have numerous purchasing options. In the automotive or consumer products industry, customers can select from the product offerings of many different providers, and product quality and price influence consumer purchasing decisions.

If a seller’s prices are too high or the quality of the product does not meet the customer’s standards, the customer can select the wares offered by another seller. Prices in competitive industries are set by supply and demand in the marketplace.

Utilities, however, cannot simply set up shop wherever they choose. Utilities are natural monopolies because their capital costs are enormous.

Therefore, monopolies, by definition, also have high barriers to entry. However, a company with monopoly power cannot be allowed to operate without oversight. Otherwise, the price of the company’s product could be exorbitant.

For this reason, the US states created utility commissions to regulate the rates charged by utilities. These regulatory commissions, together with the utilities themselves, investors, and customers, comprise what is known as the “regulatory compact.”

The US rate-setting process is grounded in the fact that utilities operate as monopolies where there is no market for competitive pricing of the utility’s product in the absence of regulation. This has different consequences, however, in jurisdictions considered either “restructured” or “non-restructured.”

In non-restructured jurisdictions, vertically integrated electric utilities own generation, transmission, and distribution infrastructure, which is rate regulated.

In restructured jurisdictions, formerly vertically integrated utilities have either divested their generation plants to a merchant generation company or transferred them to an affiliate. In such jurisdictions, regulators deem the power commodity competitively priced and not subject to rate regulation.

In the absence of a market-based approach to setting utility rates, except for the limited circumstances above, US rate cases rely on a cost-of-service methodology. The commission examines the utility’s costs and investments, determines whether they were prudently incurred, and then adds a risk-adjusted return for the utility’s shareholders.

This figure, known in industry terms as the “revenue requirement,” then translates, in most instances, into a combination of a fixed monthly charge and an added usage-based fee. Which then forms the basis for calculating each customer’s total monthly bill.

In the US, when a utility seeks to raise its prices, the company must come before its state commission and file a rate case unless it is already required to initiate rate proceedings at regular intervals. The reasons for a rate case filing are numerous. Still, they generally relate to investments by the utility, to changes in expenses and cost of capital, and the impact of broader economic forces such as inflation or a sluggish economy.

The rate-case process begins with the utility’s filing, which includes the testimony of several witnesses. The company quantifies the additional revenue it seeks to recover its operating costs, depreciation expense, and taxes, allowing its shareholders to earn a reasonable return. Each witness supports a specific aspect of the filing, e.g., depreciation, rate of return, or pension costs.

To learn more, read this report, available to CapitalIQ Pro subscribers. Request a demo.

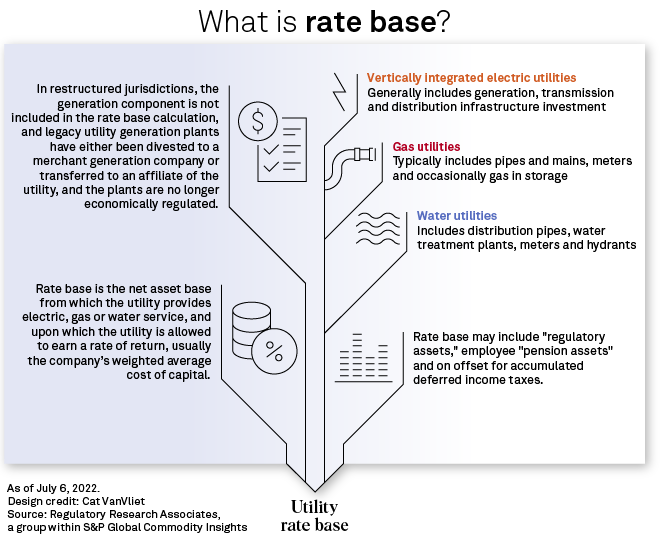

One of the most misunderstood concepts in the US utility industry is rate base, a term unique to the utility realm. A utility’s rate base is essentially the company’s "prudent" capital investment as determined by the applicable regulatory authorities, net of accrued depreciation and other adjustments.

Rate base is the net asset base of an electric, gas, or water utility upon which an allowed rate of return is usually the company's weighted-average cost of capital. Rate base value is a key variable that regulatory bodies use in a rate case to determine a utility's revenue requirement.

Rate base typically includes generation, transmission, and distribution infrastructure investment for vertically integrated electric utilities. In restructured jurisdictions, where utilities have either divested generation plants to a merchant generation company or transferred them to an affiliate, rate base calculation does not include the generation component, as the utility procures that service competitively.

For a gas utility, rate base typically includes pipes and mains, meters, and occasionally gas in storage. Rate base includes distribution pipes, water treatment plants, meters, and hydrants for water utilities. However, the calculation can consist of many other items regarding valuing rate base.

A utility's "current" rate base refers to the value the state commission that oversees it has most recently adopted for its rate base for ratemaking calculations. Industry stakeholders and regulators find determining and agreeing on that value challenging. While it might seem reasonable to use RRA's rate case history database to arrive at an approximate rate base value, calculating a current rate base, at best, is an arduous task and, at worst, may be fraught with mistakes.

Although there are guidelines on what is often included in rate base, reasonable parties can and often do greatly disagree on the items reflected in rates at a given time and how their value should be calculated for ratemaking purposes. This phenomenon is readily evident in the differences between rate base values requested by a company, recommended by the intervenors, and ultimately authorized by the commission in a given case.

There is no way to know what a commission may or may not approve. In addition, rate case settlements may be silent regarding rate base, making tracking the parameter even more difficult.

To learn more, read this report, available to CapitalIQ Pro subscribers. Request a demo.

The US Federal Energy Regulatory Commission, or FERC, is an independent federal agency with jurisdiction over transmission in interstate commerce and wholesale electricity generation and sales. This includes competitive energy and ancillary services markets operated by regional transmission organizations and independent system operators, or RTOs/ISOs. FERC also oversees the reliability of the interstate transmission system through mandatory standards administered by the North American Electric Reliability Corp.

In the natural gas industry, FERC regulates natural gas pipeline rates and the siting of interstate gas pipelines and storage facilities. FERC also oversees environmental matters related to natural gas and conducts environmental reviews of proposed new gas projects.

Federal and state regulators play an increasingly critical and often overlooked role in the energy transition. FERC will continue to address many critical issues and policies impacting the electric power and natural gas industries in the coming months, including the following:

Clean energy and the environment: Climate change and the clean energy transition present regulated electric and gas companies with unprecedented challenges and growing regulatory uncertainty. Evolving state and federal policies and transformational changes in the US generation portfolio mix are introducing new regulatory complexities and testing current regulatory frameworks. Including the challenge of integrating increasingly modern resources into the electric distribution and transmission system while maintaining reliability and grid security.

More frequent extreme weather events in the electric power sector increase stress on the aging electric transmission grid and threaten system resilience and reliability. New renewable energy resources, particularly those located in remote locations, highlight the urgent need for new transmission infrastructure to interconnect these resources to the grid.

Advances in battery storage and other technologies, as well as states’ authority over generation resource planning, are increasing tensions between state and federal regulation, with significant implications for the design of wholesale electricity markets.

In the natural gas sector, there's growing opposition from environmental and landowner groups. Meanwhile, state and federal permitting disputes are increasing the risks and challenges for infrastructure developers, often adding considerable costs and causing delays for new pipeline and liquefied natural gas projects. All of these factors contribute to regulatory uncertainty and risk for companies in the electric and gas sectors.

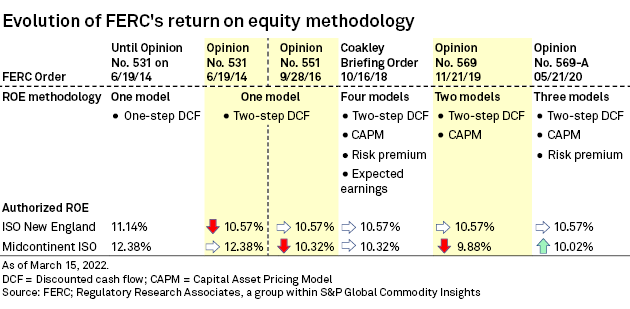

Return on equity: The commission's controversial policy for establishing base ROEs for electric utilities has been modified multiple times in the last eight years and has since been applied in other cases at FERC.

The methodology was first modified to apply a two-step discounted cash flow, or DCF, analysis to establish a utility's ROE instead of the one-step DCF analysis the commission had used historically. The commission subsequently proposed to modify and expand the methodology to apply four financial models, then adopted a two-model approach, and finally adopted the current three-model approach.

The changes in the commission’s methodology came in two long-running cases addressing the appropriate ROE for transmission owners in ISO New England and the Midcontinent ISO, resulting in multiple adjustments to the authorized ROE in the two regions since 2014.

FERC’s ROE policy is back before the commission after a federal appeals court vacated and remanded orders adopting the current three-model financial methodology in August.

Gas pipeline certificate policy: On February 17, 2022, FERC issued two proposed policy statements that would update the commission's 1999 permitting processes for natural gas infrastructure projects and outline policies for considering new projects' potential climate change impacts. On March 24, the commission designated both policy statements as drafts and sought further public comment.

Transmission planning and cost allocation: On April 21, 2022, FERC issued proposed rules requiring transmission owners to conduct long-term scenario planning and consider transmission needs driven by changes in the generation resource mix of the US. The proposed regulations would also require transmission providers to consult more closely with state regulators in allocating costs of specific new transmission facilities.

Generator interconnection: On June 16, 2022, FERC issued proposed rules that would reform interconnection procedures to relieve backlogs that plague interconnection queues and provide greater certainty for new generation resources.

Transmission incentives: FERC proposed in 2020 to expand ROE incentives for certain electric transmission investments, including projects demonstrating reliability benefits or using transmission technologies that enhance reliability. Alterations to the proposal in 2021 would eventually eliminate the current 50-basis-point ROE incentive for companies that are either members of or join an RTO/ISO.

FERC also has ongoing proceedings to examine electrification and the grid of the future, cybersecurity incentives, hybrid, clean energy resources, offshore wind integration, and the threat of extreme weather events on grid reliability.

To learn more, read this report, available to CapitalIQ Pro subscribers. Request a demo.

The water sector requires a lot of capital investment, given its extensive pipe and primary infrastructure system and its complex treatment process, storage facilities, dams, wells, and pumping stations. Many US systems operate on a 200-to-300-year replacement cycle. Defective pipes can lead to main breaks, which can cause larger system disruptions and/or water stream contamination.

The American Society of Civil Engineers’ 2020 economic study, “The Economic Benefits of Investing in Water Infrastructure: How a Failure to Act Would Affect the US Economic Recovery,” found that the annual drinking water and wastewater investment gap will grow to $434 billion by 2029. Additionally, the cost to comply with the US Environmental Protection Agency’s 2019 Lead and Copper Rule is estimated at between $130 million and $286 million.

Over 50,000 water utility systems exist nationwide, approximately 85% of which are municipally owned. Municipal entities have been investing in their infrastructure at suboptimal rates for decades, and elected officials are turning to the private sector for solutions.

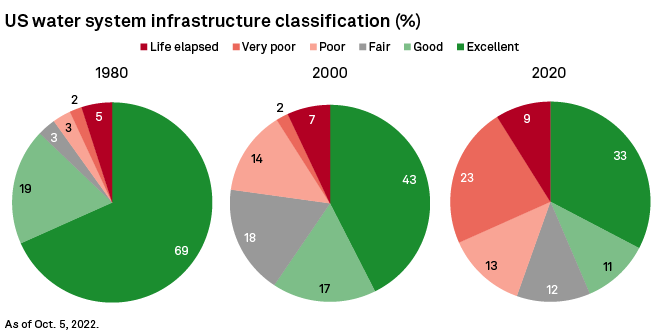

At the current pace of investment, 44% of the pipe infrastructure will be in "poor" or worse condition by 2020 versus 23% in 2000 and 10% in 1980. Defective pipes can lead to main breaks, which can cause larger system disruptions or contaminants entering the water stream.

While municipal entities have been investing at suboptimal rates, the investor-owned water utility industry has been increasing capital investment across the board. There are only nine publicly traded US water utilities, down from 25 stocks traded 30 years ago. A handful of medium-sized water utilities are owned by larger US electric and gas utilities, private equity investors, and international owners. These utilities are well-capitalized and well-run within the regulated utility structure.

Due to a lack of investment, US water and wastewater systems have been ripe for consolidation for decades. The increasing prevalence of legislation enabling acquirers to utilize market value for municipal system transactions has finally served as the necessary catalyst to consolidate this fragmented sector and inject needed investment into the country’s worsening water infrastructure.

Water utilities should continue expanding their regulated operations through a growth-via-consolidation strategy strategically. This approach has not been noticeably impacted by the current economic slowdown or the COVID-19 pandemic. RRA expects investor-owned water utilities to concentrate their corporate development resources on identifying and acquiring systems in states that utilize legislation that encourages consolidation and have other regulatory policies favorable to acquisitions.

Increased regulation by the EPA could drive further expansion of water utility capital spending programs, and continued development of water utilities’ operational footprints and CapEx programs are likely to support further earnings growth.

To learn more, read this report, available to CapitalIQ Pro subscribers. Request a demo.

Copyright © 2022 S&P Global Market Intelligence, a division of S&P Global Inc. All rights reserved.