Comprehensive Coverage

Granular, robust, reliable. Data you can trust.

Climate Credit Analytics translates climate scenarios into drivers of financial performance tailored to each industry, such as production volumes, fuel costs, and capex spending. These climate analytics drivers are then used to forecast complete company financial statements under various climate scenarios, including those published by the Network for Greening the Financial System (NGFS), key regulatory scenarios, and short-term carbon-tax adjusted scenarios.

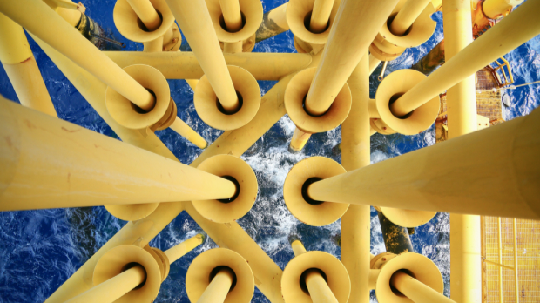

This enables users to have comprehensive and consistent modelling covering 140+ industries under the GICS (Global Industry Classification Standard) code via a product-specific approach for high-carbon emitting sectors, such as the oil and gas, power generation, metals and mining, and airline sectors, plus an emissions-based approach for construction, steel, agriculture, and other remaining non-financial sectors. Additionally, a top-down approach is available for name-based extrapolation for full portfolio coverage, where needed.

The robust suite of tools leverages S&P Global Market Intelligence’s proprietary datasets and capabilities, including financial and industry-specific data from across divisions of S&P Global, sophisticated quantitative credit scoring methodologies, and emissions and physical asset risk data from S&P Global Sustainable1, all of which enrichen the climate risk analysis and provide granularity to the approach. The offering enables automated bottom-up analysis for 2.2 million companies. Where users have the requisite information on their portfolio companies, a capability for proprietary analysis is available.