The essential corporate yield curve solution.

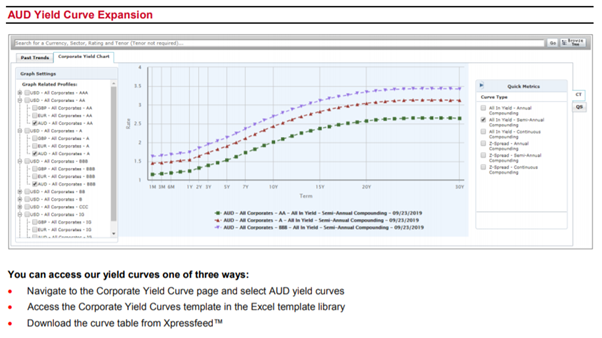

In order to reliably value and monitor debt, perform discounted cash flow valuations, and execute transfer pricing and accounting analysis, you need more data points than your competitors. Our Corporate Yield Curves offer broad and consistent coverage of credit term structures (1 month – 30 years), across four currencies ($, €, £, A$), every GICS sector (non-financial corporates, investment grade and high yield), and seven ratings (AAA – CCC).

Any time, anywhere delivery.

With data sourced directly from major buy-side firms, credit trading desks, and trade reporting venues, our yield curves provide robust and transparent data to let users drill down and view the underlying bond constituents and prices used in the construction of each curve.

Built with your workflow in mind.

Corporate Yield Curves are available on our S&P Capital IQ platform and Excel Plug-in.