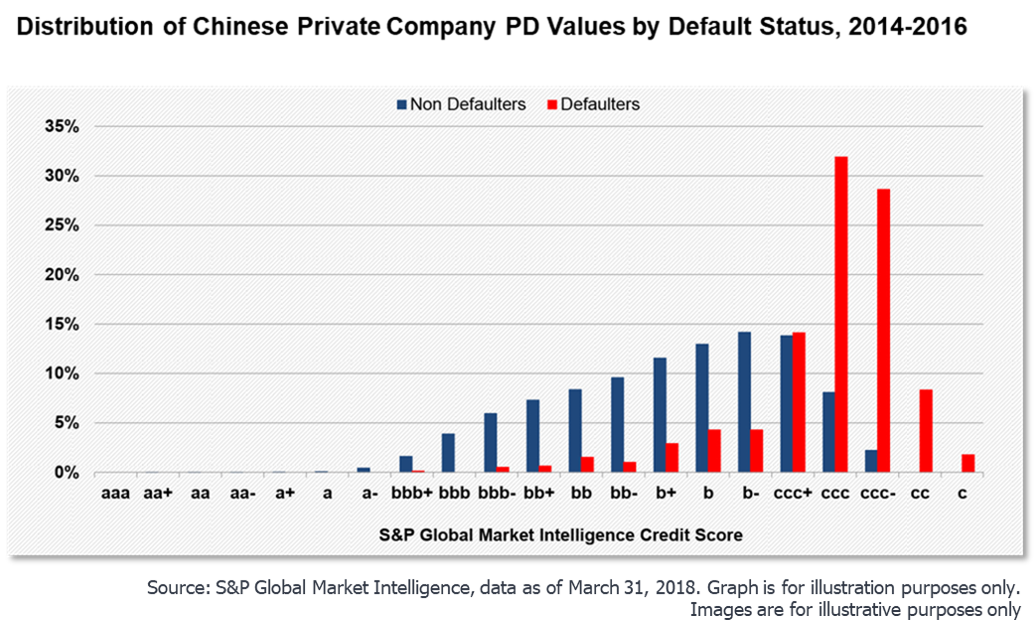

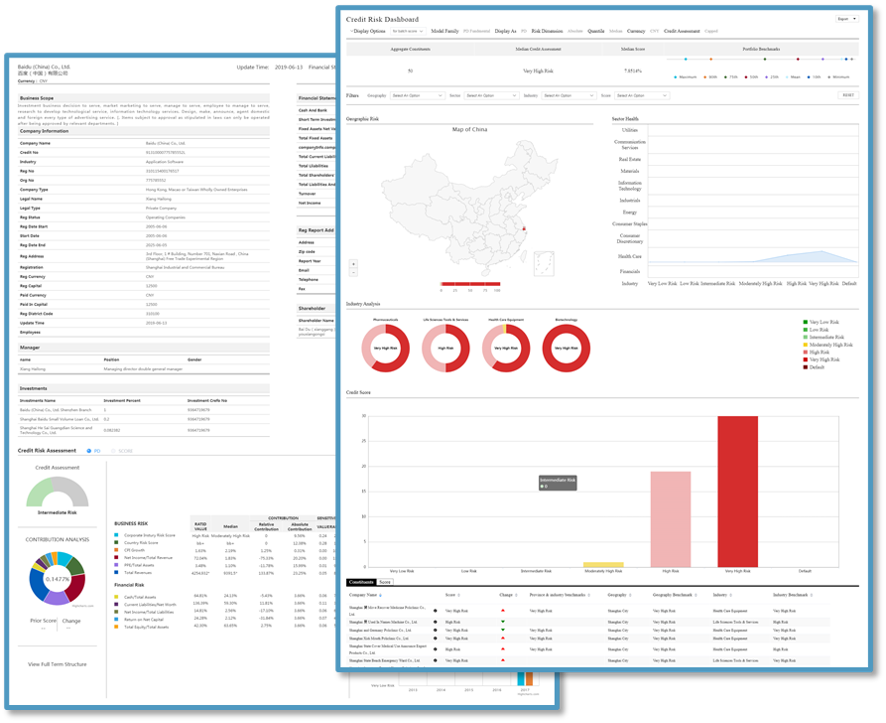

Leverage differentiated content, localized analytics, qualitative credit scores produced by ratings’ analysts, and quantitative model-generated credit scores that broadly align with S&P Global (China) Ratings’ credit ratings.[1]

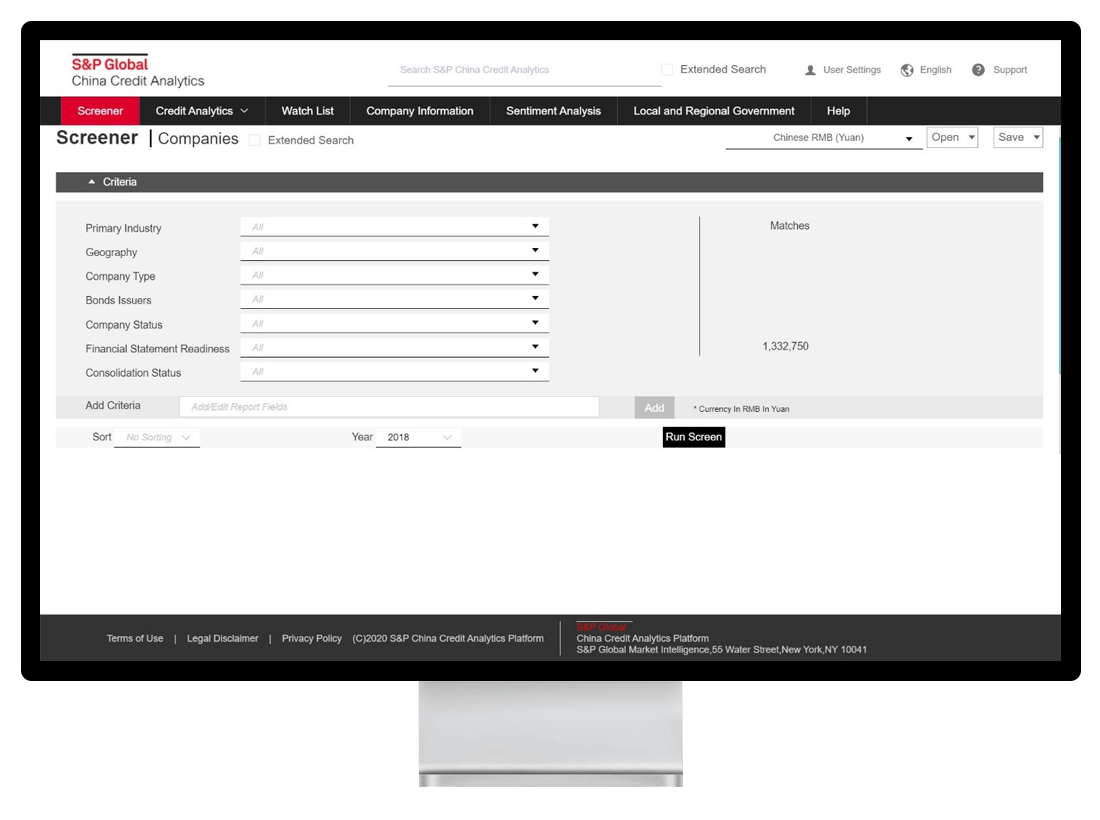

Utilize a dual language platform in Chinese and English. In addition, view financial information in USD currency as well as CNY to reconcile information back to global portfolios and easily make comparisons.

Easily search, evaluate, and monitor essential information to guide:

- Investment strategies

- Loan origination activities

- Financing deals

- Counterparty risk analysis

- New business development efforts

- Benchmarking initiatives

- …and more.

1 S&P Global (China) Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global (China) Ratings.