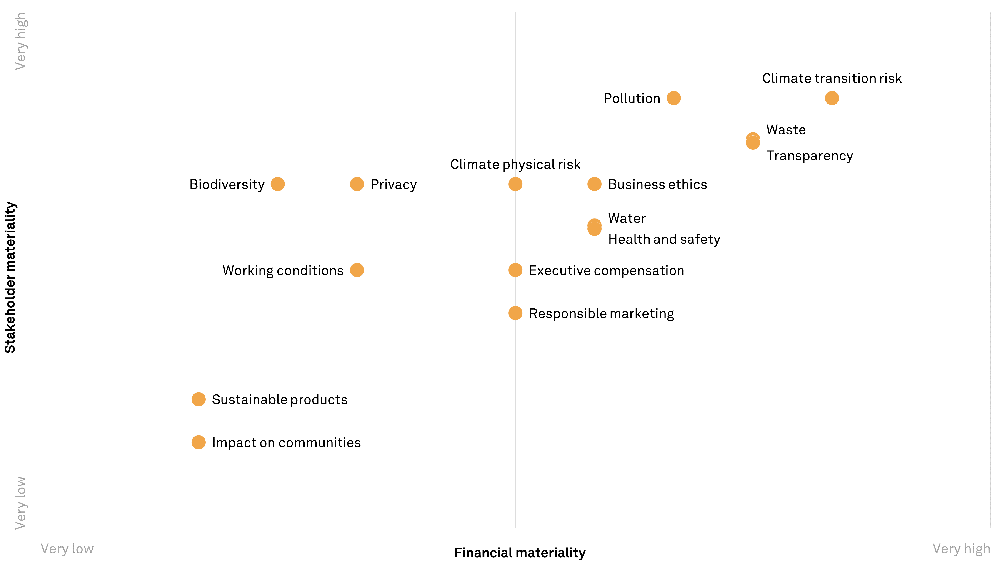

Assess Materiality

Understand material sustainability topics

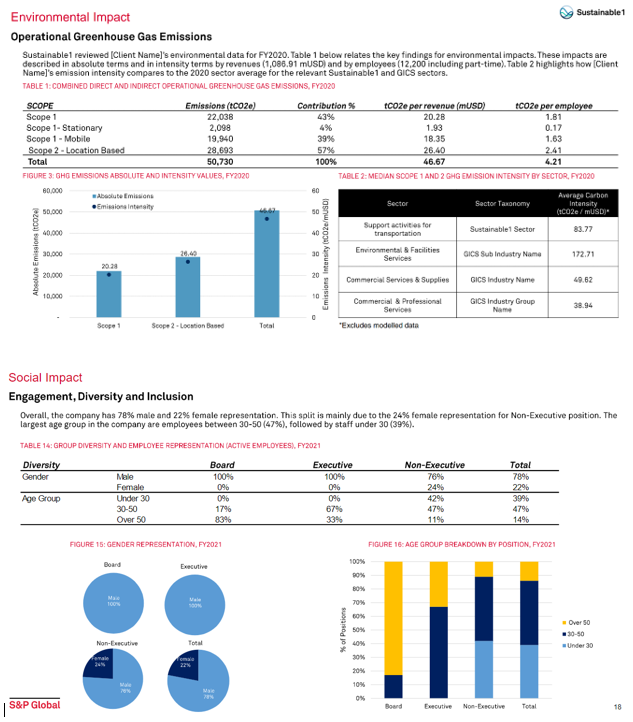

Disclose financially material sustainability topics to your business and identify broader sustainability impacts with our materiality assessment, which uses sector-level materiality to identify environmental, social and governance issues relative to companies operating in your sector.