A business strategy that considers economic, social, and governance (ESG) criteria is no longer just a “nice to have” as more and more asset managers combine ESG and traditional financial analysis to drive their investment choices. In 2020, assets under management (AUM) tied to ESG ETFs alone nearly tripled to more than $170 billion U.S., with flows of $81 billion. [1] Mid-cap and small-cap ESG ETFs grew even faster, with AUM increasing by more than 260%.

“Sustainability has become a top focus of not only investors, but corporations as well. Our launch of mid-cap and small-cap ESG indices reflects that it's no longer just the largest companies recognizing the need to better position themselves globally through sustainable business practices.”

Reid Steadman, Managing Director and Global Head of ESG Indices at S&P DJI

Participating companies in the S&P Global Corporate Sustainability Assessment (CSA) have long been able to demonstrate their dedication to the highest standards of ESG action planning by reporting key sustainability metrics and benchmarking their relative performance on a wide range of industry-specific issues. This ESG analytics and disclosure continues to grow in importance.

The Market Demands More Transparency

In response to growing market demand, S&P Global recently took steps to facilitate the sharing of additional CSA information by releasing question-level scores on the S&P Global Market Intelligence platform for use by the company’s broad base of capital market clients. This included 400 data points (i.e., answers to sub-questions that are aggregated to create question-level scores) for questions that use public information. These deeper levels of granularity have been especially important for investors who are increasingly seeking to integrate sustainability performance into their decision making, as well as for companies looking to meet the fast evolving regulatory and reporting mandates for ESG disclosures.

“The sophistication of investors is increasing and many require data-point level insight into KPIs related to our ESG performance. Instead of answering many questionnaires, we see a lot of value in being able to answer one survey that then provides the relevant data points to capital market participants.”

Olivier Elamine, CEO of Alstria Office REIT-AG

The Use of ESG Data Has Spread Rapidly

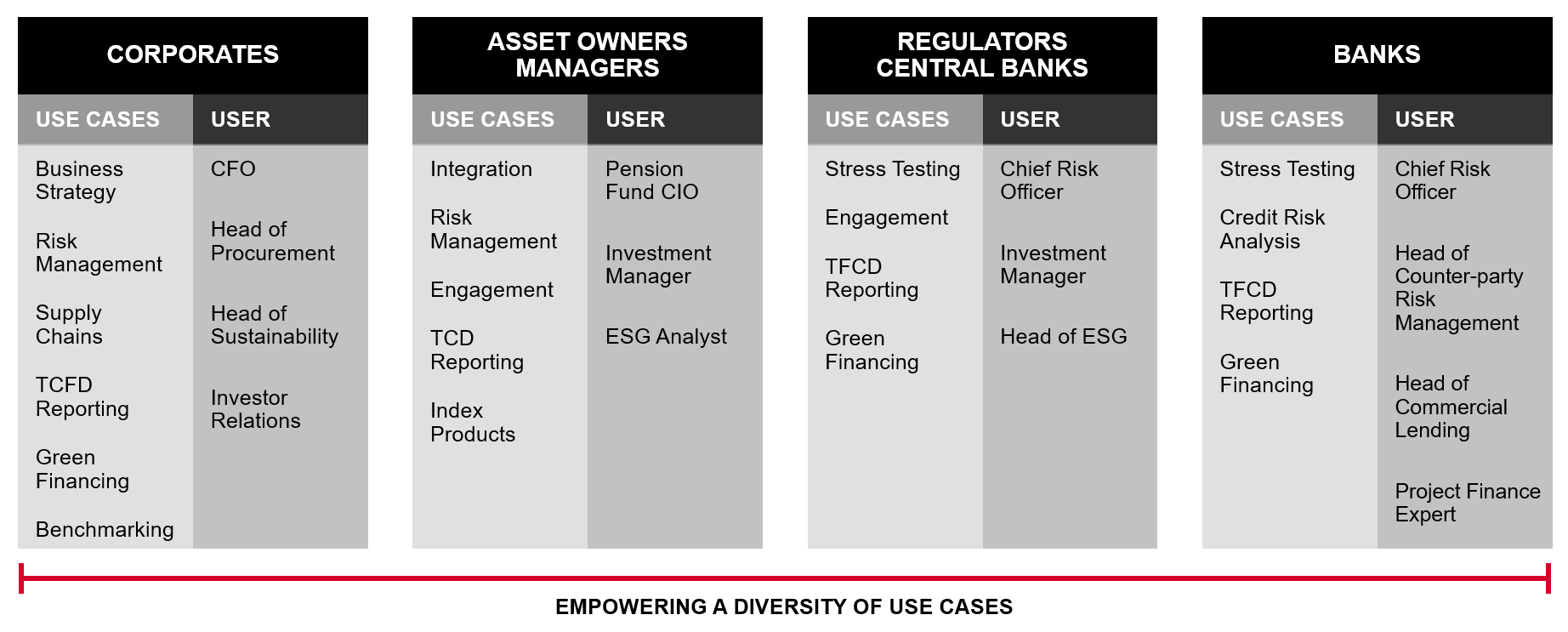

Companies are completing the CSA at record rates, as investors and other stakeholders drive the demand for material ESG information. Use cases for sustainability scores and underlying details have spread across firm types and functional areas, as shown in Figure 1.

Figure 1: Who is Using ESG Data?

Source: S&P Global Market Intelligence, March 2021. For illustrative purposes only.

Disclosure Enhances Decision Making

Deeper transparency is not just about making more data elements available, but about understanding how scores are formulated. Knowing what data points are gathered to create a question-level score can be informative, educating the market regarding reporting methodologies. Given this, S&P Global plans to facilitate the sharing of even more data points when the next round of the CSA, which will launch in April, is completed. Where agreed by companies, these data points will include additional granularity on ESG topics, supplementing public disclosures and providing a new level of insight into the depth and rigour of the CSA process.

We believe that companies that share additional data points will be better positioned to guide corporate strategies, while benefitting from the breadth and depth of S&P Global's reach in capital and commodity markets. It will also help keep companies on the radar screens of asset managers looking to allocate capital to companies with superior ESG performance. Companies with little information available about their ESG performance will be at a disadvantage.

“If companies want investors to consider them, they need to give this information out. If they don’t disclose it, they will be off the radar screen of many investment teams. Regulators are moving quickly, and firms like ours need to disclose this information by company. If it’s not available, companies will be out of sight and face higher costs as they look to attract investors.”

Robert De Guigné, Head of ESG Solutions at Lombard Odier Investment Managers

[1] “S&P Dow Jones Indices Expands Global ESG Suite with Launch of S&P MidCap 400 ESG and S&P SmallCap 600 ESG Indices”, S&P Dow Jones Indices