International Sustainability Board

New global sustainability board aims to cut through disclosure confusion

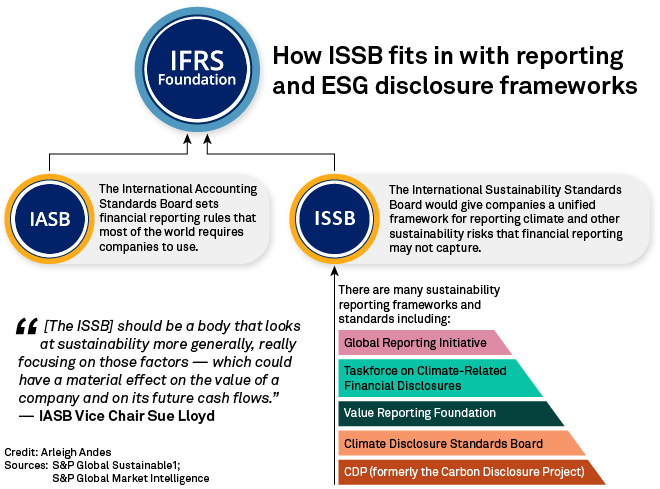

The confusing world of competing sustainability reporting frameworks and standards guiding companies and investors on ESG disclosure could soon get a little simpler.

The 26th U.N. Climate Change Conference, known as COP26, is scheduled to take place in Glasgow in November. And by the time it begins, the IFRS Foundation responsible for setting global accounting standards plans to create a new International Sustainability Standards Board. The new ISSB will guide companies on what sustainability disclosures ought to be made to investors to supplement financial statements.

ESG Insider Podcast: Standard setters work to close climate accounting gaps

Investors are increasingly calling on companies to reflect climate-related risks in their financial results. In September 2020, global investor groups representing more than $103 trillion wrote an open letter asking companies and their auditors to include climate-related risks in financial reporting.

We interview International Accounting Standards Board (IASB) Vice Chair Sue Lloyd about plans for a new international sustainability standards board.

News and insights into environmental, social and governance developments driving change in business and investment decisions.

SUBSCRIBE TO THE NEWSLETTERESG Disclosure

New EU ESG Disclosure Rules to Recast Sustainable Investment Landscape

SFDR, CSRD, green taxonomy — there's a veritable alphabet soup of regulation coming out of the EU this year, with the potential to dramatically change the landscape of sustainable investing in Europe.

The EU's sustainable finance action plan in 2018 put the bloc at the forefront of creating global sustainability policies. A cornerstone of that strategy was to make environmental, social and governance investing more transparent and improve disclosure. That led to the Sustainable Finance Disclosure Regulation, or SFDR.

ESG Insider Podcast: EU Revolutionizes Sustainability Regulation with SFDR

The new Sustainable Finance Disclosure Regulation, or SFDR, is expected to drastically change the scope of sustainable investing by providing greater clarity and transparency and increasing disclosure.

Fund managers will now have to disclose environmental, social and governance risks in their portfolios, marking the first step in a vast EU plan to drive capital to meet sustainable goals.

In the episode we talk to Nathan Fabian, Chairperson of the European Platform on Sustainable Finance and Chief Responsible Investment Officer at the Principles for Responsible Investment, or PRI, a United Nations-backed network of investors.

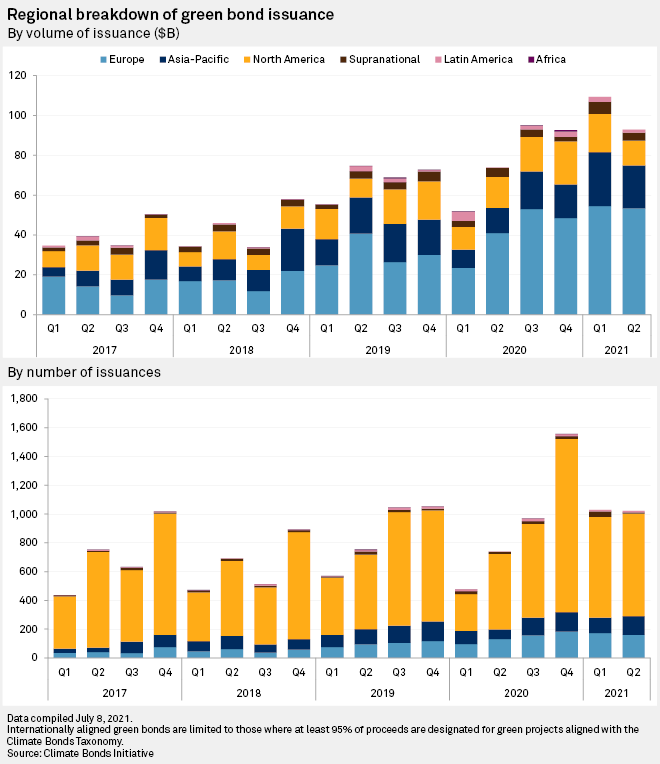

S&P Global Ratings anticipates global sustainable debt issuance will surpass $700 billion in 2021. This comes after green bonds grew from virtually nothing in 2012 to $282.05 billion in 2020 and social bond issuance surged during the COVID-19 crisis.

ACCESS THE TOPIC PAGETCFD

Companies, Investors Face New Pressure from Compulsory Disclosure of Climate Risk

A growing number of countries are pushing companies and financial institutions to report their climate-related risk on a mandatory rather than voluntary basis. The new rules, based on the TCFD framework, represent a complex accounting-style challenge, and companies need to prepare.

While many businesses say they support the TCFD, only a small number actually report their climate-related exposure, though that is expected to change.

TCFD Gains Momentum as Climate Reporting Shifts from Voluntary to Mandatory

A big reason why many companies struggle with TCFD implementation is because it's hard to collect, collate and analyze detailed emissions-related data in all areas of their operations. Companies also need to train their employees on technical aspects of reporting under the framework. Above all, TCFD implementation must be roundly embraced and instilled — all the way from the C-suite to product and client-teams — and that takes time.

In this episode, we speak to Thora Frost, senior manager of green finance at the Carbon Trust, a London-based consulting firm that works on climate change and sustainability issues. And we interview Matthew Townsend, partner at U.K. law firm Allen & Overy.

Investors are demanding transparency. Policymakers and regulators are imposing disclosure requirements. Companies are backing the Task Force on Climate-related Financial Disclosures. But a patchwork of reporting frameworks keeps ESG data uneven.

Read more on this topicSFDR

More Than $3T of Companies Outside the EU Could Be on the Hook for SFDR

Lately, we’ve been hearing from firms outside the EU asking whether the Sustainable Finance Disclosure Regulation (SFDR) applies to them. Until recently, European legislation may not have been at the top of the agenda for financial services firms in the U.S., or anywhere outside the European Union.

But two factors might have you suddenly realizing that it’s worth paying attention to EU sustainable investment regulation, regardless of where you’re based. This is, especially true since some of this regulation is already in effect.

First, in order to market investment funds in the EU, firms often set up a local legal entity that could potentially expose the parent company to EU regulation. Second, the EU put new regulation in place mandating sustainability disclosure from certain types of financial firms.

Will parent companies outside the EU be impacted by SFDR? Which non-EU country’s financial firms have the greatest exposure? Does it matter if the subsidiary FMP or parent is a private company? We looked at these questions leveraging S&P Global Market Intelligence data.

ESG Insider Podcast: New EU Sustainable Finance Rules a ‘Game-Changer' for Private Equity

The European Union’s new SFDR is expected to drastically change the scope of sustainable investing by providing greater transparency and increasing disclosure. And this is a particularly big deal for the private equity world, which has historically relied on self-regulation.

Broadly speaking, private equity refers to investments in or ownership of private companies, and in this episode, we ask how SFDR is impacting the private equity industry. We hear from Sophie Flak, managing partner in charge of ESG at French investment firm Eurazeo. Sophie was a member of an EU expert group that put in place some recommendations on SFDR.

We also talk to Andy Pitts-Tucker, who works closely with private equity firms in his role as managing director of APEX ESG Ratings. He expects that SFDR will require “a significant leap” for a majority of the industry.

ESG Insider is a podcast from S&P Global that takes you inside the environmental, social & governance issues shaping the business world today. Each episode, co-hosts Lindsey Hall and Esther Whieldon interview ESG experts, leveraging S&P Global data to shine a light on the sustainability opportunities and risks that business leaders and investors need to know about.

ESG podcastsGreen Bond Market

Proposed EU Standard Seeks To Bring Clarity To Ballooning Green Bond Market

A proposed EU Green Bond Standard seeks to cement Europe's leadership in the green debt market by creating a go-to European standard, but it may find limited appeal among international issuers unable to comply with the bloc's strict new rules defining what is "green."

The proposal, born out of 2019 recommendations by an EU advisory group, aims to create what the EU terms "a gold standard" for the market. The proposed EU Green Bond standard would be voluntary but its requirements will be stricter than existing market guidelines. Notably, under the proposal issuers opting in to the standard would have to demonstrate that their green bonds are financing projects in line with the EU's "green taxonomy," which is, simply put, a dictionary of sustainable activities.

What EU's Proposed Green Bond Standards Could Mean for Market

The EU has proposed a European Green Bond Standard as part of its strategy to drive investment into sustainable finance and achieve net zero carbon emissions by 2050. The new rules will also aim to protect investors from greenwashing, which is when an investment is made to sound greener than it is.

Although they represent a tiny fraction of the overall debt market, green bonds — debt that finances environmentally friendly projects such as wind farms or solar power — have grown rapidly over the last eight years, from virtually nothing in 2012 to nearly $300 billion in 2020. The EU is counting on further growth in the market to meet the targets in its European Green Deal, designed to mobilize at least €1 trillion of sustainable investment over the next 10 years. The rules will be tougher than other existing green bond guidelines because issuers will have to prove their green bonds are financing projects in line with the EU's "green taxonomy," a dictionary of sustainable activities.

In this episode, we speak to Climate Bonds Initiative CEO Sean Kidney, who was part of an advisory group that helped shape the new rules.

With global sustainability policies evolving rapidly, we at S&P Global Sustainable1 are here to help you navigate an increasingly complex web of market regulations and frameworks. We track the trends, the costs, and the outlook to provide the clarity you need to get ahead in the transition to a low carbon, sustainable and equitable future.

Speak to a specialistEU Taxonomy

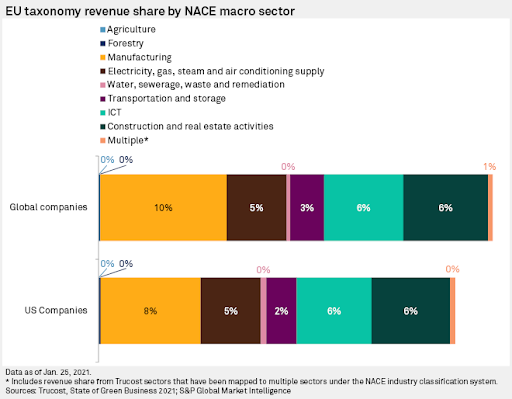

Investors Grapple with Lack of Taxonomy Alignment as Final Rules Still to Come

Investors subject to the EU's new green finance classification system are facing major challenges: the revenues of the vast majority of the world’s largest companies are not aligned to the instrument, and the jury is still out on whether controversial sectors such as gas or nuclear will be included in the tool.

S&P Global data shows that the revenues of most large U.S. and global companies are not in line with the taxonomy, presenting a major challenge for fund managers in compiling investment portfolios that are aligned to the EU green taxonomy. By Jan. 1, 2022, investors managing environmental, social and governance-related funds will have to start explaining how they use the tool to determine the sustainability of their investments.

A Short Guide to the EU’s Taxonomy Regulation

The EU’s new Taxonomy Regulation is designed to support the transformation of the EU economy to meet its European Green Deal objectives, including the 2050 climate-neutrality target. As a classification tool, it seeks to provide clarity for companies, capital markets, and policy makers on which economic activities are sustainable. As a screening tool, it seeks to support investment flows into those activities.

What is the EU Taxonomy?

At over 550 pages (with more to come), the EU Taxonomy can be daunting – even to the initiated. Let’s start with the basics. The Taxonomy is primarily a classification system for economic activities. Like any classification system, it has definitions and rules. The EU Taxonomy’s definitions and rules determine which economic activities are environmentally sustainable.

S&P Global's SFDR Data Solution enables FMPs to start the process of disclosure at the entity-level and eventually at the product-level across a broad range of mandatory and opt-in principal adverse impact indicators (PAIs) outlined by the SFDR.

Speak to a specialistU.S. ESG Policy

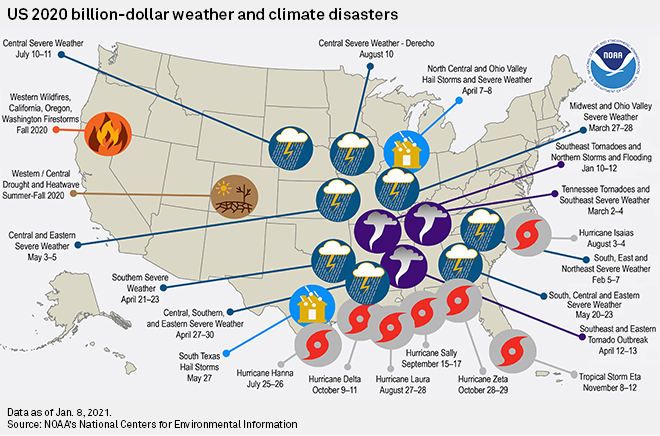

Why we need Biden’s executive order on climate-related financial risk

U.S. President Joe Biden issued an executive order that sets the stage for sweeping climate-related disclosure requirements and standards. At S&P Global Sustainable1, we view this as a necessary step to ensure the U.S. government is a taking an active role in helping the financial sector as well as companies, local governments and at-risk communities understand and address these growing risks.

Climate change comes with steep economic costs. Almost 60% of the companies in the S&P 500 have at least one asset at high risk of physical climate change impacts, according to S&P Global Trucost data.

Top US financial regulator faces big questions in move to mandate ESG disclosures

The U.S. Securities and Exchange Commission is poised to roll out ESG disclosure regulations on climate risk and human capital management. New rules could plug gaps and inconsistencies in data that many investors have identified as a challenge.

But in crafting these regulations, Wall Street’s top regulator will need to tackle several thorny questions: How should the agency address corporate liability concerns? What specific metrics are needed? And to what extent should the SEC harmonize its disclosure rules with existing voluntary and mandatory standards in other parts of the world?

READ THE FULL ARTICLE >We’re here to help you accelerate your sustainability journey. Get connected with an ESG specialist who can advise you on your next steps.

Speak to a specialistClimate Risks for Insurers

Why the Industry Needs to Act Now to Address Climate Risk on Both Sides of the Balance Sheet

The insurance industry is exposed to climate-related liabilities on two fronts: In both its investments, and on the liability side through property and casualty underwriting. As of year-end 2019, the U.S. insurance industry had $582 billion invested in some combination of oil, gas, coal, utilities and other fossil fuel-related activities, a slight increase from $519 billion in 2018, according to research from S&P Global Sustainable1. The insurance industry must act quickly to adapt to the growing threat of climate change.

ESG Insider Podcast: Here’s How You Stress Test for Climate Risk, According to France’s Central Bank

In a world first, the French central bank conducted a climate stress test on its financial sector. Listen to this episode of ESG Insider, a podcast hosted by S&P Global Sustainable1, to hear an interview with Laurent Clerc, director for research and risk analysis at the supervisory arm of the French central bank, which conducted the world’s first climate stress tests.

Webinar Replay: How Can ESG Policy and Regulation Unlock Opportunities for Insurers?

Watch this webinar replay as our panel of experts discuss the regulator’s role in driving ESG integration and disclosure that could lead to long-term financial value in insurance portfolios.

Watch the Replay

Climate Change Stress Testing

Helping Banks Get Underway with the Bank of England's Climate Biennial Exploratory Scenario

The Bank of England’s

Climate Biennial

Exploratory Scenario

(CBES) assesses the

resilience of banks

and insurers to

climate‑related risks

associated with the

move to a net zero

economy under three

scenarios: early action

by governments to

cut carbon emissions,

late action and no

additional action.

Webinar Replay: Getting Practical at Banks & Insurers

Climate change has become an important strategic issue for global financial institutions as concern grows about lending to, investing in, or insuring companies that are failing to take steps to transition to a low-carbon economy. Stress testing aims to address several key areas for banks and insurers, including asset level counterparty modelling and the financial impact on loan and investment portfolios.

Watch the ReplayFurther Reading

More of our coverage

– Biden's 1st 100 days: Businesses like econ moves but are eying taxes, regulation – How Biden's 1st 100 days changed the course of US ESG and sustainability policy – 1st 100 Days: New FERC chair eyes power market reforms, environmental justice – Biden's next 1,361 days – onshoring, not big deals; CMA CGM's high risk charge – Meet the regulator helping shape the next era of US corporate disclosures – Politics & Policy: Pathways to Sustainable Recovery – All ESG Insights