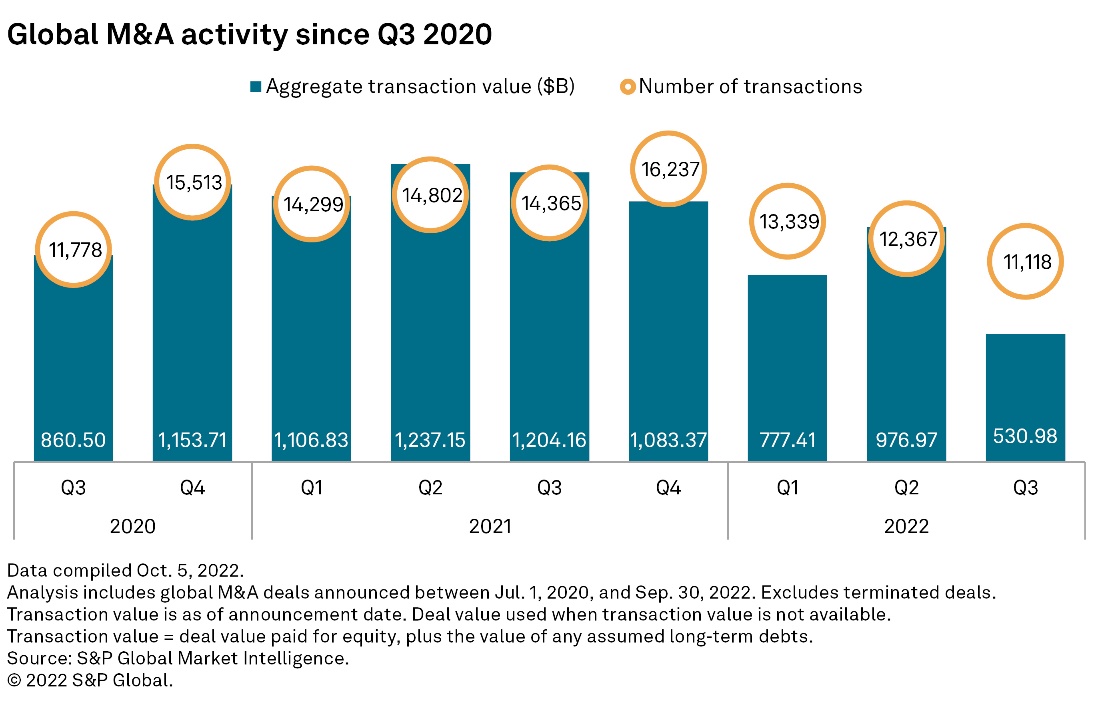

New York – November 2, 2022 – Overall M&A activity has slowed considerably in 2022 and the challenges to dealmaking aren't going away, according to a new S&P Global Market Intelligence report released today. For the first nine months of 2022, the total value of global M&A is down more than 35% year over year. The newly published 2023 M&A Industry Outlook is part of S&P Global Market Intelligence’s Big Picture 2023 Outlook Report Series.

The new report highlights key strategic trends expected to impact the overall global M&A environment within selected sectors. Depreciating stock prices, rising interest prices, and growing economic uncertainty have all made M&A more difficult. Among corporate buyers, large transformational transactions have become less common. Many private equity firms have moved to the dealmaking sidelines as they grapple with the higher cost of acquisition financing.

“M&A activity will continue to face near-term headwinds. However, given the steep decline in activity it's hard to see dealmaking going any lower in 2023,” said Joe Mantone, News Desk Manager at S&P Global Market Intelligence. “It may take some time before we see M&A volumes reach 2021 levels but surpassing the 2022 totals shouldn't be a difficult task.”

Key highlights from the report include:

- Overall M&A activity plummeted in 2022, and a sharp turnaround is not on the near-term horizon.

Central banks have been raising interest rates to combat inflation. The moves hurt M&A as they led to equity market volatility and increased cost of acquisition financing. - For the Technology, Media and Telecommunications (TMT) sector, a drop in deals is starkest at the high end of the market, as buyers decide now is not the time to put big money on the line. Unsolicited takeovers dominate as public sector discounts make underperforming companies vulnerable to aggressive investors. In the middle and early-stage markets, “soft landings” are peaking as many venture-backed companies find themselves out of other options.

- Utilities companies have been eschewing large deals and looking to shore up balance sheets. Multiple companies have conducted internal strategic reviews and begun the process of divesting assets, or selling minority interests in projects, to raise cash and to facilitate capital reallocation.

- Metals & Mining is one area that has been active when it comes to M&A as companies capitalized on high commodities prices. With inflation creeping up, however, and metals markets facing macroeconomic headwinds, prices have corrected from their recent highs and are expected to fall further into 2023.

- For financial institutions, the drivers of bank M&A activity have not changed as deals offer the opportunity to gain scale and cut costs, but many buyers simply see transactions as less doable. Fintech M&A activity followed a similar trend, with depressed valuations in the sector leading to lackluster activity.

- The insurance sector’s hangover from a two-decade-high amount of dealmaking in 2021 proved particularly acute as the volume of traditional M&A all but evaporated. Private equity-backed insurers continue to make their mark on the industry largely through transactions involving the reinsurance of blocks of life and annuity business.

To request a copy of the 2023 M&A Industry Outlook, please contact pressinquiries.mi@spglobal.com.

S&P Global Market Intelligence’s opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

# # #

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact:

Amanda Oey, S&P Global Market Intelligence

P. +1 212-438-1904

E. mailto:amanda.oey@spglobal.com