C-Suite and Managing Partners

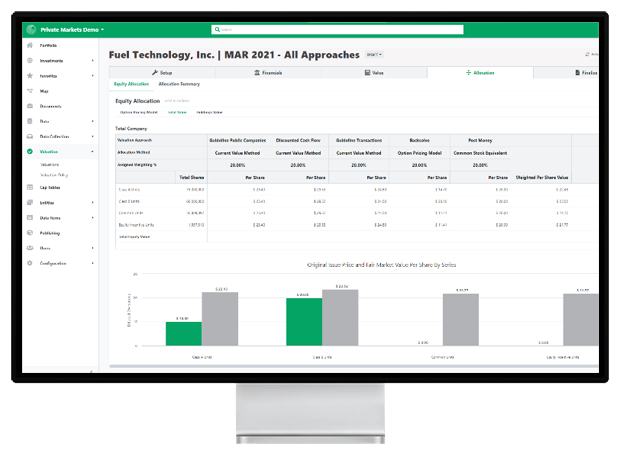

Get the data & tools you need to scale your portfolio

Get solutions that sharpen your insights and streamline your workflows across the full fund lifecycle:

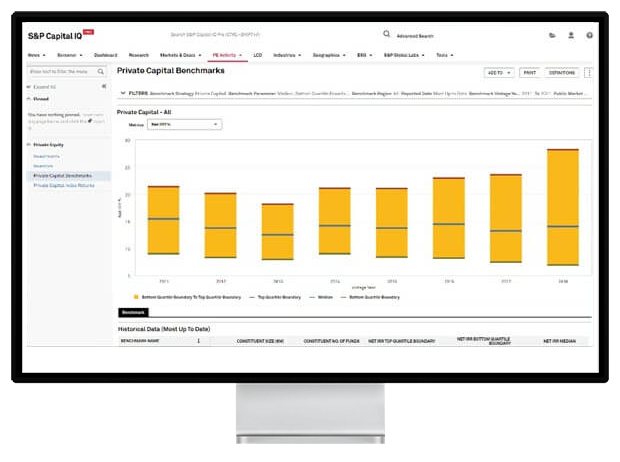

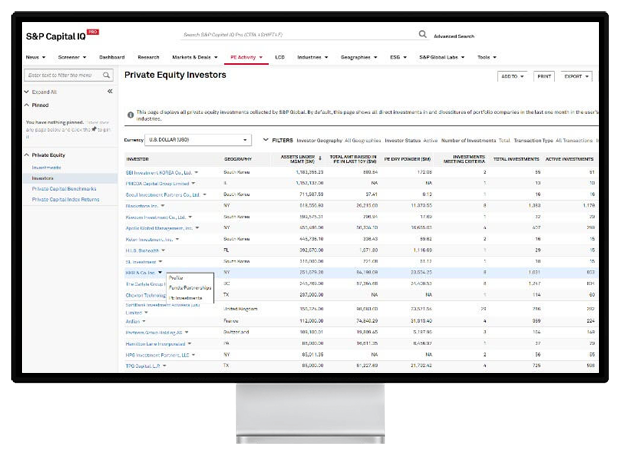

- Make decisions with speed and confidence using comprehensive datasets that reveal a complete yet consolidated view of competitors, sectors, and market trends.

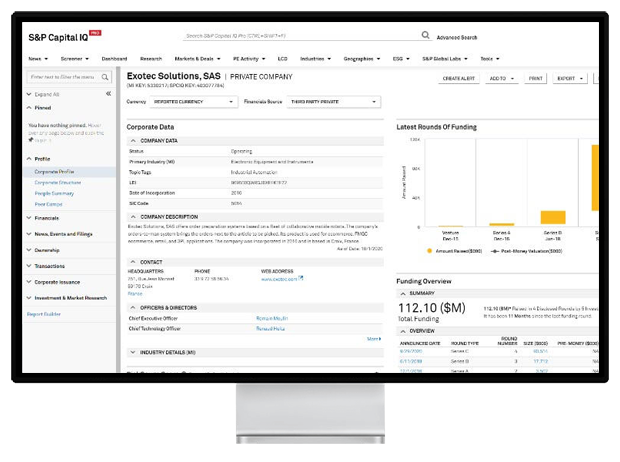

- View consolidated, reliable information on your private assets portfolio.

- Create and manage a holistic sustainability program with data collection tools, a dedicated sustainability reporting solution, and benchmarking tools based on broad public market data.