Deal sourcing is hard. Finding a target for acquisition has been likened to finding ‘a needle in a haystack’. Firm financials are a valuable starting point for systematic identification of acquisition targets. This publication provides actionable insights and a detailed blueprint on how practitioners can leverage computational finance for deal sourcing. Specifically, five firm-level financial dimensions are identified that differentiate targets from their comparable non-targets based on global data from the most recent 10 years.

View our source code > (Sign Into the S&P Global Marketplace)

Source: S&P Global Market Intelligence Quantamental Research. Data as of Jan 14, 2024.

Key takeaways:

- Acquisition targets exhibited faster growth, higher leverage, lower liquidity, greater profitability, and larger revenue size, relative to comparable non-targets.

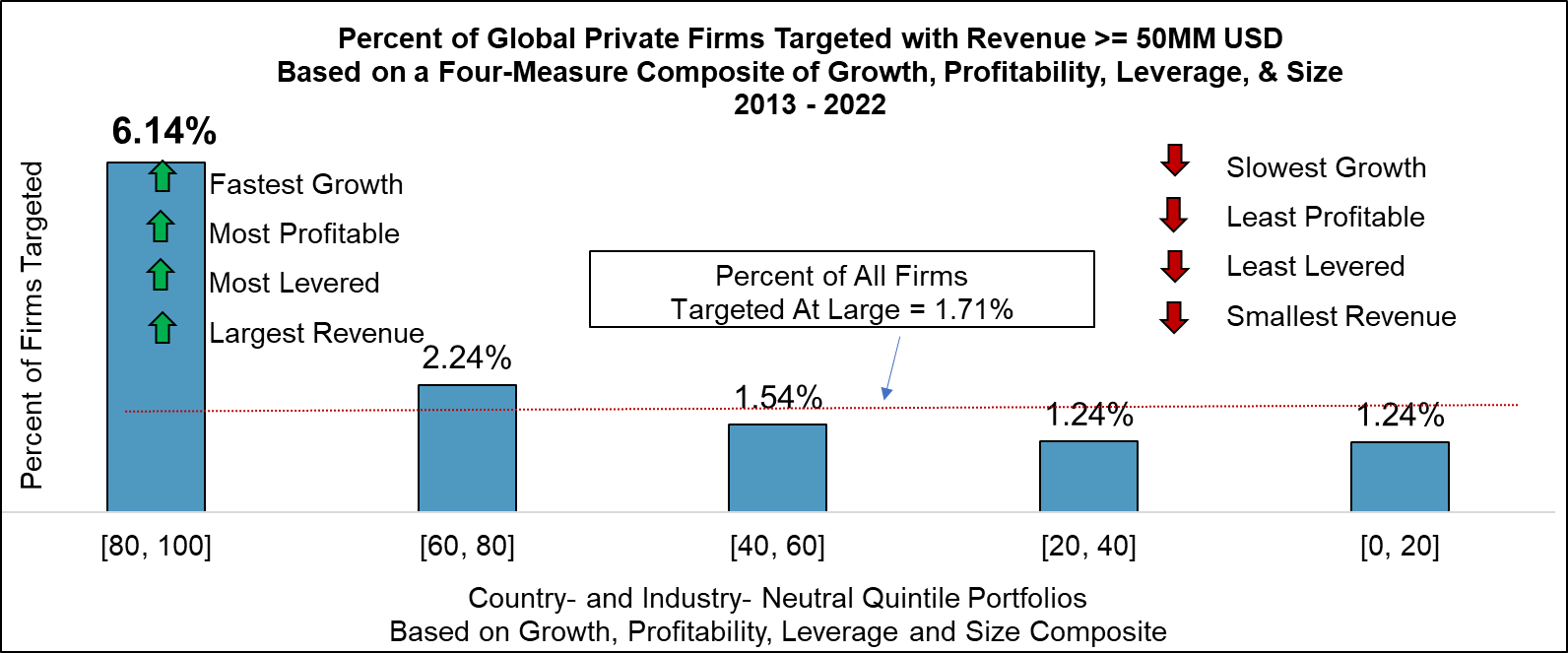

- Firms in the top quintile based on a composite of four financial measures that equally weights growth, leverage, profitability, and revenue size were 5x more likely to be targets for acquisition than firms in the bottom quintile.

- Growth and profitability were universally important. Regionally, European targets were further differentiated on leverage whereas APAC targets were additionally differentiated on revenue size.

- A portfolio of European firms (APAC firms) that scored in the top quintile on a region-specific composite of growth, leverage, and profitability (growth, profitability, and revenue size) had a 4.1% (4.6%) probability of being targeted, 2.4x (2.7x) more likely than all European (APAC) private firms at large.

Explore the datasets used to conduct this research

The Private Company Financials dataset provides 200+ standardized financial statement items for over 12 million private companies globally. This dataset includes i) fully standardized data integrated within the S&P Capital IQ Fundamentals offering ii) global coverage with history dating back to 2004 for North America and Europe and iii) APAC coverage dating back to 2012.

The Transactions dataset provides the entire lifecycle of primary and secondary market business transactions, across public offerings, private placements, mergers & acquisitions, buybacks/repurchases, corporate restructuring, bankruptcies, spin-offs, and split-offs. The transactions database covers more than two million transactions across the globe.

View our source code

Click HereDeal Sourcing: A Data Science Approach - Impact of Financial Characteristics on Acquisition Likelihood

CLICK HERE