For the first time, natural language processing algorithms get to tell the earnings call story. This recurring series reviews an earnings season exclusively using texts from call transcripts.

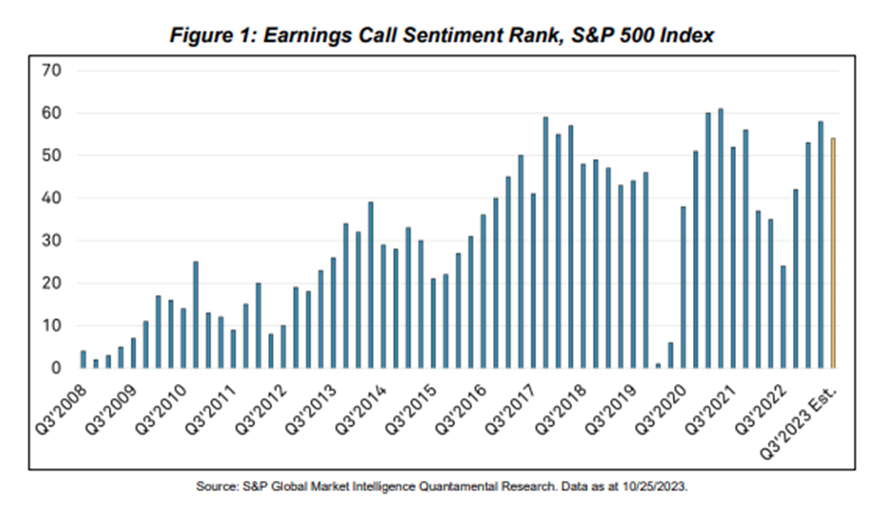

- Watch for Q3’23 sentiment to be near 5-year highs, despite a quarter-on-quarter decline. Sentiment for Q3’23 is estimated to decline by 5% compared to last quarter; but remains on track to be the 7th most positive of the last 60 quarters.

- Watch for Q3’23 focus on ‘supply chain’ to hit a 3-year low. Q3’23 is estimated to be the first quarter in 3-years that focus on supply chain returns to pre-pandemic levels.

- Watch for renewed interest in ‘interest rates’ in Q3’23, for the first time in the last 4 quarters. Talk of interest rates and monetary policy is expected to rise in Q3, quarter-onquarter, for the first time in the last 4 quarters. If estimates prove correct, mentions will be at their highest for the 2023 fiscal year to-date.

- Watch for ‘inflation’ worries to hit the lowest level in the last 10 quarters in Q3’23. Mentions of ‘inflation’ are on a steady decline since peaking in Q1’22 and are set to hit the lowest level in Q3’23 in the trailing 10 quarters.

- The term ‘banking crisis’, a hot topic in Q1’23, all but vanished in the second quarter and is not estimated to be a focus in Q3’23.

- Another hot topic, ‘artificial intelligence’ is expected to continue to appear in earnings calls at fever pitch.

Explore the datasets used to conduct this research

TDA was launched in October 2019 and is productized from Quantamental Research’s previous publications with an advanced suite of analytics and metrics added in May 2022. It is an off-the-shelf NLP solution that tailors to our Machine-Readable Transcripts and outputs 800+ predictive and descriptive analytics for equity investing and various data science workflows. The analytics could be accessed via SQL, Snowflake or (DataBricks) Workbench.

Transcripts is a global data set that was added to the S&P Global Market Intelligence’s Xpressfeed product in September 2017. Among its key features, the data set captures the different segmentations of earnings calls in the follow ways:

- Sections (e.g., prepared remarks, sell-side analyst questions, responses to questions)

- Speaker types (e.g., executives, sell-side analysts, shareholders etc.)

- Professionals (e.g., Tim Cook) where the individual professional identifiers serve as a unique key that connects the transcripts data set with the S&P Global Market Intelligence’s Professionals and Sell-side Estimates data sets.

Reading Between the Lines in Earnings Calls: 6 Things to Watch as the Q3’23 Earnings Season Unfolds

CLICK HERE