Basel is a set of reforms intended to improve regulation, supervision and risk management in the international banking sector. Basel III requires that banks calculate their risk-based capital requirements, which are the minimum capital requirements set by regulators in different jurisdictions. Banks can choose between two Approaches: (1) the Standardized Approach, and (2) the Internal Ratings-based (IRB) Approach. The first assigns standardized risk weights to exposures, while the second allows banks to model their own inputs for calculating risk-weights for various types of credit exposures, such as retail, corporate, financial institution, and sovereign borrowers, subject to supervisory approval.

The Standardized Approach includes two methods. The External Credit Risk Assessment (ECRA) is used for entities that are rated. The Standardized Credit Risk Assessment (SCRA) is used for entities that are not rated and for banks operating in jurisdictions where regulators do not allow the use of external ratings.

The credit risk team at this large European bank was responsible for complying with Basel III and was looking for answers to three questions:

- Did the list of unrated counterparties meet or exceed the minimum capital requirements?

- Was the bank well capitalized against these requirements?

- Did the bank have a sound capital position and could be resilient over the long term?

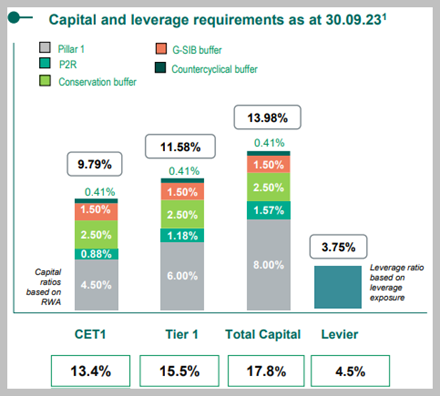

To calculate risk weights for unrated exposures using SCRA would require the team to classify unrated exposures into one of three risk-weighted buckets: Grade A, Grade B and Grade C. To do this, they would need access to minimum capital requirement data and combined buffer data, such as countercyclical buffers, capital conservation buffers and systemic risk buffers.

Pain Points

The Standardized Credit Risk Assessment (SCRA) is used for entities that are not rated and for banks operating in jurisdictions where regulators do not allow the use of external ratings. The SCRA requires banks to classify bank exposures into one of three risk-weight buckets:

| Grade A | Where the counterparty bank has adequate capacity to meet its financial obligations on time. A counterparty bank classified into Grade A must meet or exceed the published minimum regulatory requirements and buffers established by its national supervisor. |

| Grade B | Where the counterparty bank is subject to substantial credit risk, such as repayment capacities that are dependent on stable or favorable economic or business conditions. A counterparty bank classified into Grade B must meet or exceed the published minimum regulatory requirements (excluding buffers) established by its national supervisor. |

| Grade C | Where the counterparty bank has material default risks and limited margins of safety. For these counterparties, adverse business, financial or economic conditions are highly likely to, or have been shown to, lead to an inability to meet their financial obligations. A bank would apply a Grade C risk weight where the external auditor has issued an adverse audit opinion or has expressed substantial doubt about the counterparty bank's ability to continue as a going concern in its financial statements or audited reports within the previous 12 months. |

The team reached out to S&P Global Market Intelligence ("Market Intelligence") to see if data was available to classify counterparties into one of the three Grades.

The Solution

Banking specialists from Market Intelligence described the challenges with SCRA and the need to look at a bank's annual report and website, plus the specific regulations in the jurisdrictions where it operates, to gather the necessary details for the minimium capital requirements and combined buffers data. They described how they have been tracking changes in the Basel regulations since its inception and staying up to date on differences across various countries. They then described how they work closely with clients to review their list of counterparties and undertake the following four tasks to enable banks to outsource data collection:

| Review counterparty information | Below is an example of how a bank is reporting this data. |

|||||||||||||||||||||||||||||||

| Create the necessary fields | The following fields are in the product and are regularly monitored and updated:

|

|||||||||||||||||||||||||||||||

| Efficiently deliver data | Data can be delivered via a desktop solution, an Excel-plugin, Xpressfeed'sTM data management solution, Snowflake's cloud-based offering and APIs. | |||||||||||||||||||||||||||||||

| Provide ongoing support | This is a collaborative process, and bank specialists work closely with clients to prepare, deliver and explain the data. |

Key Benefits

Members of the credit risk management team now have the data needed to efficiently implement the new SCRA method to determine the appropriate risk weights for the bank's unrated exposures. They are benefiting from having:

- Saved hours looking at the annual reports and websites of banks to gather and standardize information, plus monitor regulations in numerous jurisdictions around the world.

- The backing of experienced specialists who create these datasets for many different banks.

- The ability to differentiate risk weights for banks based on a sound assessment of capital adequacy and financial resilience.

- A sound approach for vetting the needed information to help ensure that appropriate capital charges are established.