Fintech providers are looking to increase the breadth of data available via their solutions. These providers offer dynamic platforms with export and API options for integration into their clients' front-, middle- and back-office workflows. Feed solutions from S&P Global Ratings offer reliable and flexible delivery for one of the industry's largest databases of current and historical credit ratings across corporate, sovereign, U.S. public finance and structured asset classes.

This fintech's intent was to display credit ratings from S&P Global Ratings on its platform for enhanced risk analytics and portfolio analysis, along with powerful search capabilities to easily identify a specific issuer or fixed income security. The firm felt it was critical to establish relationships with premium data providers to be compatible with their asset management clients' existing vendors and remain competitive in the fintech start-up marketplace.

Credit ratings from S&P Global Ratings were integrated and displayed on the platform for use by the fintech's end clients. They were also made available in manipulable formats, including Excel, comma-separated values (CSV) and API delivery, for select end clients who were directly licensed with S&P Global Market Intelligence ("Market Intelligence") to receive credit ratings.

Fintech providers are looking for innovative ways to enhance their platforms, delivery channels and the data made available to their end clients. It is important for these start-ups to offer seamless integration with existing data providers utilized by the banks and asset managers they serve.

Pain Points

Fintech providers need to deliver common datasets used by their end clients. The power of the innovative technology used in their platforms and API delivery requires highly regarded third-party partnerships with information providers to be relevant and in demand.

This fintech provider was approached by a number of its asset manager clients to incorporate Market Intelligence's fixed income data for portfolio management to enable the fintech firm to:

- Include credit ratings from a highly respected provider on its platform.

- Have direct feed integration to end clients' front, middle and back offices via both feed and platform delivery.

- Share the data with all end clients in a display-only version, while also enabling API and manipulable delivery for clients that also had relationships with Market Intelligence.

The team reached out to Market Intelligence to see what was possible.

The Solution

Specialists from Market Intelligence discussed RatingsXpress delivered via XpressfeedTM, a powerful data feed management solution. This would provide the fintech firm with:

|

|

Access to trusted credit ratings | RatingsXpress offers one of the industry's largest databases of current and historical credit ratings from S&P Global Ratings with entity- and security-level data in one schema. The credit ratings cover nearly one million securities: - 9,000 global issuers, including corporates, financial institutions, utility and insurance companies/80,000 securities. - 550 sovereign, international public finance and government entities/13,000 securities. - 700 U.S. public finance entities/690,000 securities. - 10,000 structured finance transactions, including asset-backed, commercial mortgage-backed and residential mortgage-backed securities and collateralized debt obligations/45,000 securities. |

|

|

A reliable and flexible delivery mechanism | Xpressfeed offers streamlined delivery of credit ratings from S&P Global Ratings. The solution enables users to ensure accurate, timely delivery of critical information while helping to automate client statement reporting processes. |

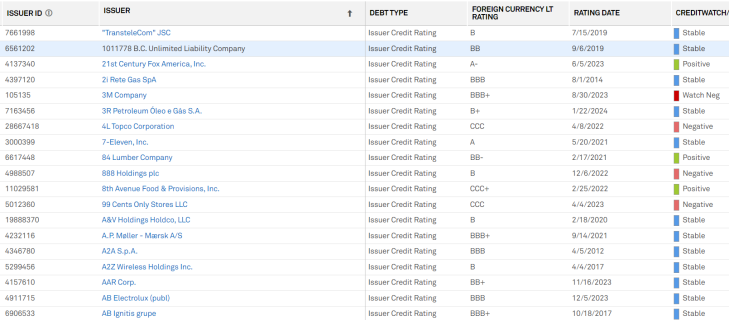

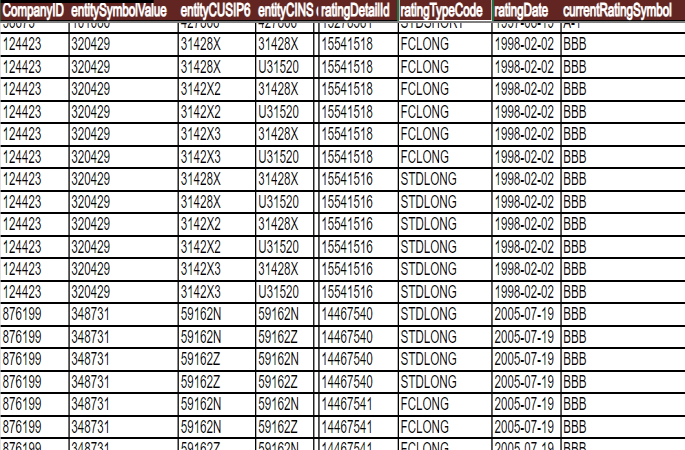

Figure 1: Sample Platform and API Integration

Source: Market Intelligence. For illustrative purposes only.

Key Benefits

The fintech firm is now able to license one of the industry's largest databases of current and historical credit ratings in a way that:

- Satisfies client demand for third-party data integration for transparency into investment risk.

- Seamlessly shares information in a flexible delivery format, including platform, manipulable export and API through multiple redistribution licensing options.

- Helps the firm both acquire and retain important clients by responding to their needs for deeper investment insights.

Click here for more information on the solution mentioned in this Case Study.