Asset servicers have begun offering enhanced regulatory reporting to their end customers. Among these customers, insurance and banking firms are under increased regulatory scrutiny to disclose their investments and debt structures to determine risk thresholds and capital adequacy, as they serve public markets. Basel II and solvency regimes are two examples where credit quality assessments must be reported consistently and accurately. Feed solutions from S&P Global Market Intelligence ("Market Intelligence") can help automate this reporting by offering reliable and flexible delivery of one of the industry’s largest databases of current and historical credit ratings. This coverage from S&P Global Ratings includes corporate, sovereign, U.S. public finance and structured asset classes globally.

This asset servicer requested the use of credit ratings from S&P Global Ratings to automate its regulatory reporting to reduce the time it takes to manually create credit quality reports on behalf of its customers. RatingsXpress feed delivery enables the seamless linking of regulatory models to underlying credit ratings across thousands of entities. The automation has helped this asset servicer create a sustainable business model that can scale to accommodate more clients and changing regulatory requirements.

Pain Points

Service providers need to accommodate diverse client reporting needs to help their clients meet regulatory requirements. This firm wanted to automate its reporting processes to:

- Leverage credit ratings from an industry-leading provider in the creation of credit templates required by regulators.

- Have direct-feed integration to maintain changes to entity level ratings in real time.

- Speed up the delivery of reports and reduce internal processes.

The team reached out to "Market Intelligence" to see what was possible.

The Solution

Specialists from Market Intelligence discussed RatingsXpress delivered via XpressfeedTM, a powerful data feed management solution. This would provide the company with:

|

|

Access to trusted credit ratings |

RatingsXpress offers one of the industry’s largest databases of current and historical credit ratings from S&P Global Ratings with entity- and security-level data in one schema. The credit ratings cover nearly one million securities:

|

|

|

A reliable and flexible delivery mechanism |

Xpressfeed offers streamlined delivery of credit ratings from S&P Global Ratings. The solution enables wealth managers to ensure accurate, timely delivery of critical information while helping to automate client statement reporting processes.

|

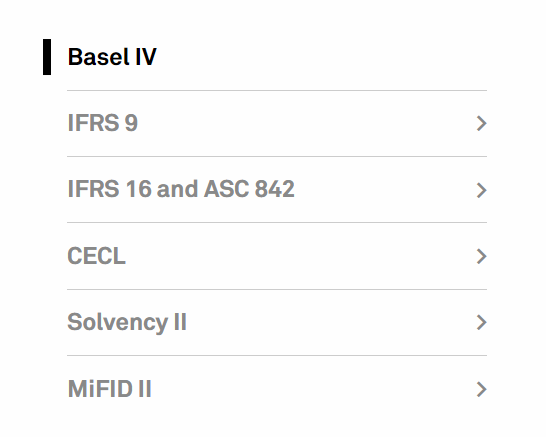

Figure 1: Sample Regulatory Reporting Regimes

Source: S&P Global. For illustrative purposes only

Key Benefits

This firm is now able to ingest one of the industry’s largest databases of current and historical credit ratings in a way that:

- Satisfies demand for accurate and reliable automation of regulatory models.

- Creates reporting for end clients who are subject to global regulations.

- Helps the firm scale its reporting business while streamlining internal processes.

Click here for more information on the solution mentioned in this Case Study.