Incremental deterioration in select measures of commercial real estate (CRE) credit quality during the third quarter of 2023 helped fan the flames that have been smoldering around the asset class since the U.S. economy began its emergence from the COVID-19 pandemic. Signs of strain continued to arise for banks and select life insurance companies with significant exposure to mortgages in CRE.

Tightening standards have indicated banks' concerns over CRE. In a mid-year 2023 Federal Reserve survey of loan officers, 87.9% said standards were tighter than long-term averages and 51.7% said they expected to tighten further over the second half of 2023.1

Members of the equity analyst team at this large investment bank cover the banking sector in their research and wanted to better understand bank exposure to CRE and where borrowers may be unable to extend a mortgage due to vacancy and higher interest rates. Many five-year loans coming due in 2024 and 2025 were initiated during the COVID period when rates were much lower. Team members wanted to find an efficient way to identify banks that lent during that period and dig into their loans by property type.

Today’s high interest rates are putting pressure on CRE, leaving some borrowers unable to extend their mortgage.

Pain Points

The equity analyst team was constantly evaluating banks of different sizes to understand their exposure to CRE and when loans might be maturing. While it is possible to access certain mortgage data through a registry of deeds, this is a very manual and laborious process. Team members wanted to find an efficient way to prospect that would help them easily:

― Identify banks in different U.S. geographies that had loans maturing in the near future.

― Understand the types of properties in a portfolio, especially riskier segments like office buildings.

― See if a property was originally a vacant land construction loan that may have been unable to get permanent financing.

― Determine the original sale price of a property relative to the size of the mortgage, which could indicate speculative activity.

― Gain insights for further tenant due diligence.

The team was familiar with S&P Global Market Intelligence ("Market Intelligence") and reached out to learn more about available information to undertand recorded commercial mortgages.

The Solution

Specialists from Market Intelligence described the powerful Commercial Property Screener that would enable the team to:

|

|

Identify banks across the country with CRE loans |

The Commercial Property Screener covers 25+ million commercial properties and commercial mortgages. This includes 70% of counties in the U.S., equating to 93% of the total U.S. population. |

|

|

Look at deals by date of origination | Searches on origination dates and maturity date can identify deals done in the COVID era when rates were very low compared to today. Many of these were five-year loans that will be maturing in 2025, with borrowers already beginning to look at other alternatives. |

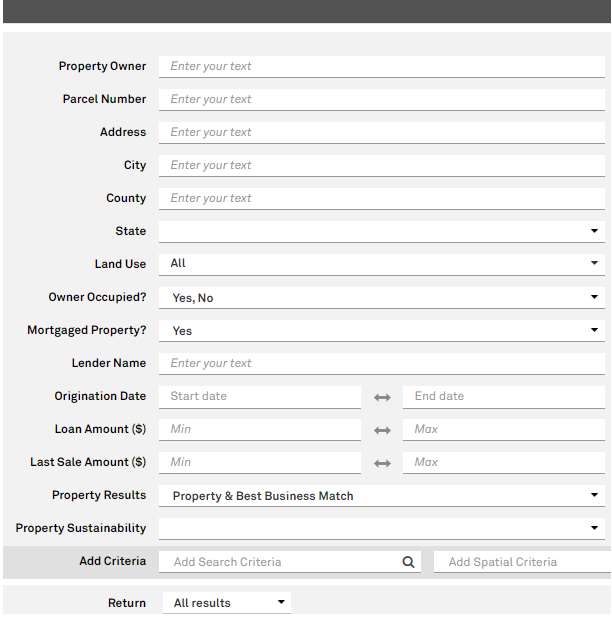

| Understand property types and sale prices | Users can search commercial properties by city, county and state, while focusing on specific lenders. They can also zero in on other details, as shown in Figure 1 below | |

Figure 1: An array of search criteria2 2.Visuals from S&P Global Market Intelligence. For illustrative purposes only. |

||

|

|

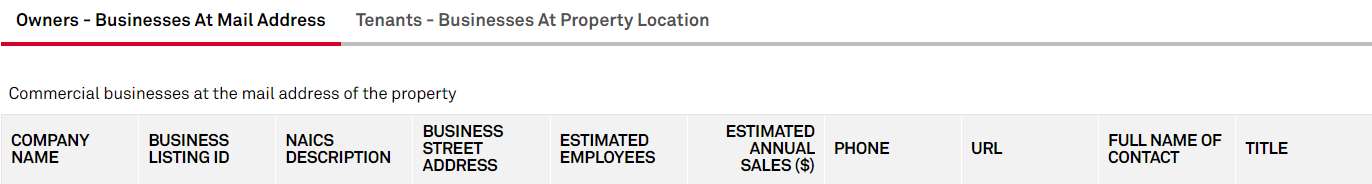

Gain information on tenants | Market Intelligence's Business Listing data is cross-referenced with third-party information to provide details on tenants that can be used for further due diligence. |

|

|

Have easy access to data |

A mapping tool lets users visualize the size of outstanding loans by location, plus there are different ways to access the data for further analysis with internal tools. Other searches are shown below. |

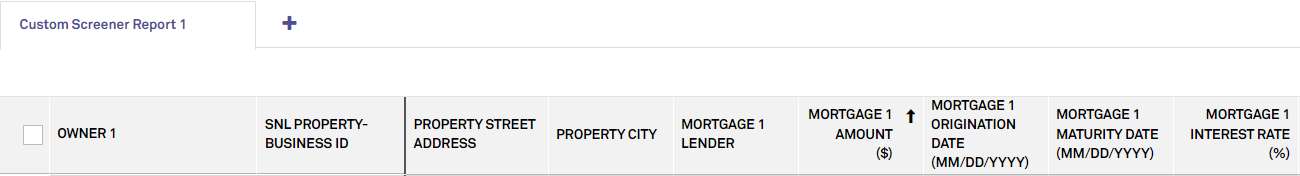

Figure 2: Sample fields for a search

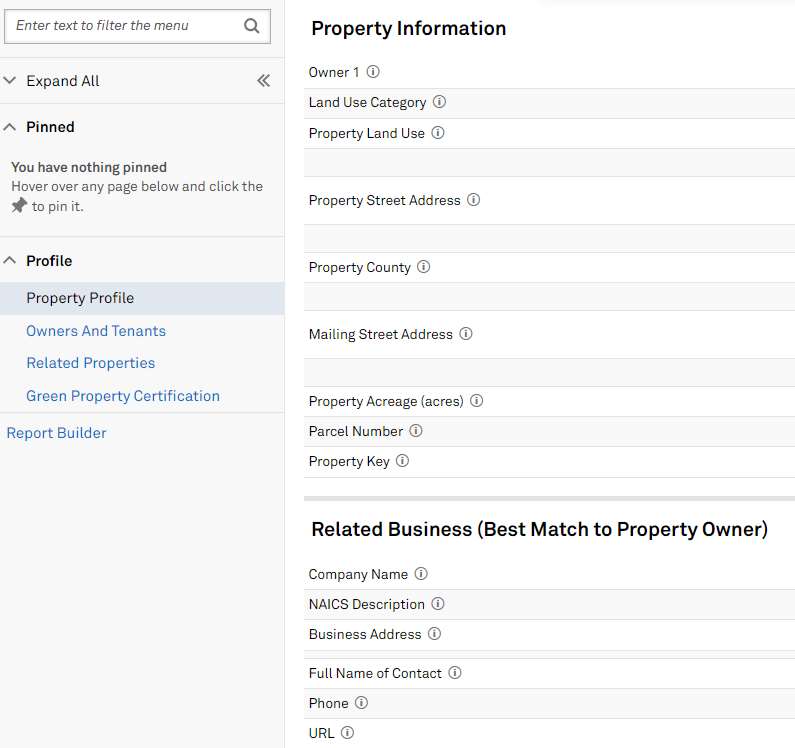

Figure 3: Property profile

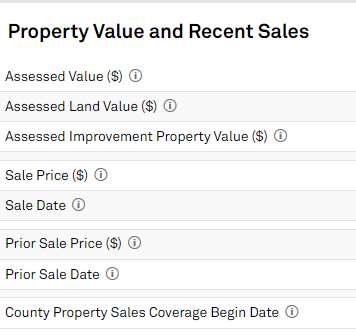

Figure 4: Details on owners and tenants

Figure 5: Details on related properties

Key Benefits

With the Commercial Property Screener, members of the equity analyst team now have easy access to the data they need for efficient research on the banks they cover and can:

― Save hours of time understanding bank commercial mortgages.

― Search by geography and origination/maturity date to see where/when mortgages are coming due.

― Dig deep at a property level to understand land use.

― Have insight into acquisition prices and the size of mortgages.

― Evaluate current tenants.

1 "Banks appear confident as commercial real estate delinquencies rise", S&P Global Market Intelligence, August 23, 2023, https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/banks-appear-confident-as-commercial-real-estate-delinquenciesrise-77130754.