Need to assess the impact of climate risks on your financials?

For decades, the car has been an essential part of daily life across the world, but as we know vehicles are a major cause of global warming. According to a report by the United Nations, the worldwide fleet of private cars is projected to triple by 2050, resulting in an increase in carbon pollution that could severely restrict the world’s ability to limit the global average temperature rise to less than 2°C. [1] There are many solutions available — from fuel-efficient vehicles, and cleaner fuels, to electric cars and trucks with many groups pushing for fast adoption. In 2020, UK businesses belonging to the UK Electric Fleets Coalition called on the government to target 100% electric car and van sales by 2030 as the next step in the UK's green recovery, and recommended stimulating electric vehicle (EV) manufacturing and strengthen the charging network. [2]

Change may not come fast enough, however, causing some governments to turn to a carbon tax to accelerate the process. How companies respond to the tax, whether it be —promptly adopting new technology and reducing CO2 emissions, or carrying on their business as usual, can have significant financial implications, affecting their credit risk profiles and, potentially, impairing their ability to operate.

Linking Climate Change and Credit Risk

Investors, lenders, regulators, and other stakeholders are calling for greater assessment and disclosure of climate change impacts and the appropriate financial risks. To support these efforts, S&P Global Market Intelligence and Oliver Wyman designed Climate Credit Analytics.[3] This powerful solution translates climate scenarios into drivers of financial performance tailored to each industry, such as production volumes, fuel costs, and capital expenditures. These drivers are then used to forecast complete company financial statements under various climate scenarios and assess potential changes in counterparty credit scores and probabilities of default. [4]

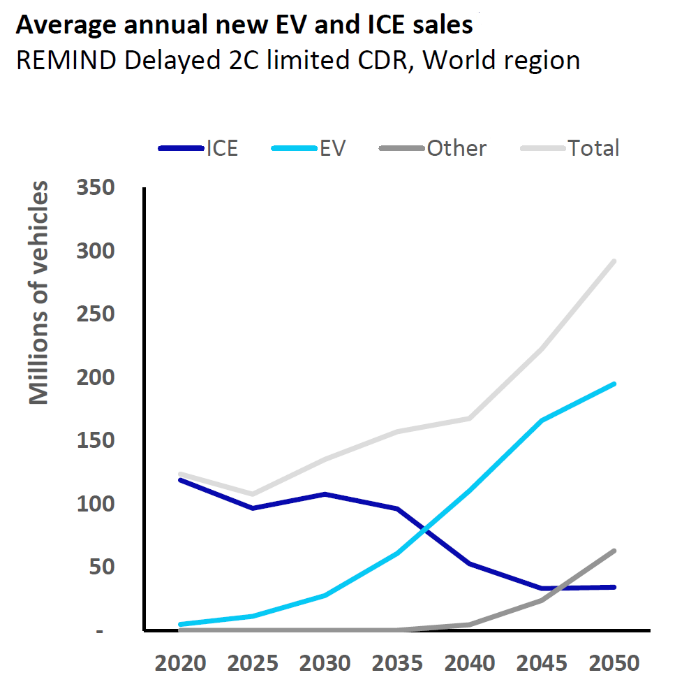

In the following case study, we look at how different responses to climate change can affect the creditworthiness of car manufacturers. Under a transition to a low-carbon economy, we expect to see a shift away from internal combustion vehicles (ICVs) towards electric vehicles (EVs). Using the REMIND Delayed 20 C scenario, Figure 1 shows an example of what this could look like. [5] This scenario assumes country pledges, in the form of nationally determined contributions, are the guiding principle until 2030. However, after 2030 a comprehensive emission pricing through a carbon tax is introduced to keep warming below 2°C, with limited availability of Carbon Dioxide Removal (CDR) technologies. For the automotive industry, that translates into a gradually increasing share of EVs in the short term until 2030, followed by a drastic fall in the global market for ICVs and a quickly increasing share of EVs and other types of engines, such as hydrogen.

Figure 1: Automotive Industry at the Crossroads

Source: S&P Global Market Intelligence, Oliver Wyman. As of March 23, 2021. For illustrative purposes only.

The climate transition will require significant investments in improving the fuel efficiency of ICVs and the development of EVs for broader consumption. Automotive producers may be static in their behaviour and only grow EV production to offset declining ICVs sales or, alternatively, they may become adaptive and rapidly increase EV production to maintain total vehicles market share.

With the REMIND Delayed 20 C scenario as the baseline, we look at two responses — one static and one adaptive.

- Static case: Companies grow EV volumes at their historical growth rate. This case models a ‘static’ or status quo approach to the scenario, where the company does not diverge from its baseline EV investment/growth strategy to accelerate EV transition.

- Adaptive case: Companies grow EV volumes as required to maintain total vehicles market share. For companies with low existing EV volumes relative to ICVs, that will require a more significant EV ramp-up, which impacts R&D costs.

Capturing Climate Transition Opportunities

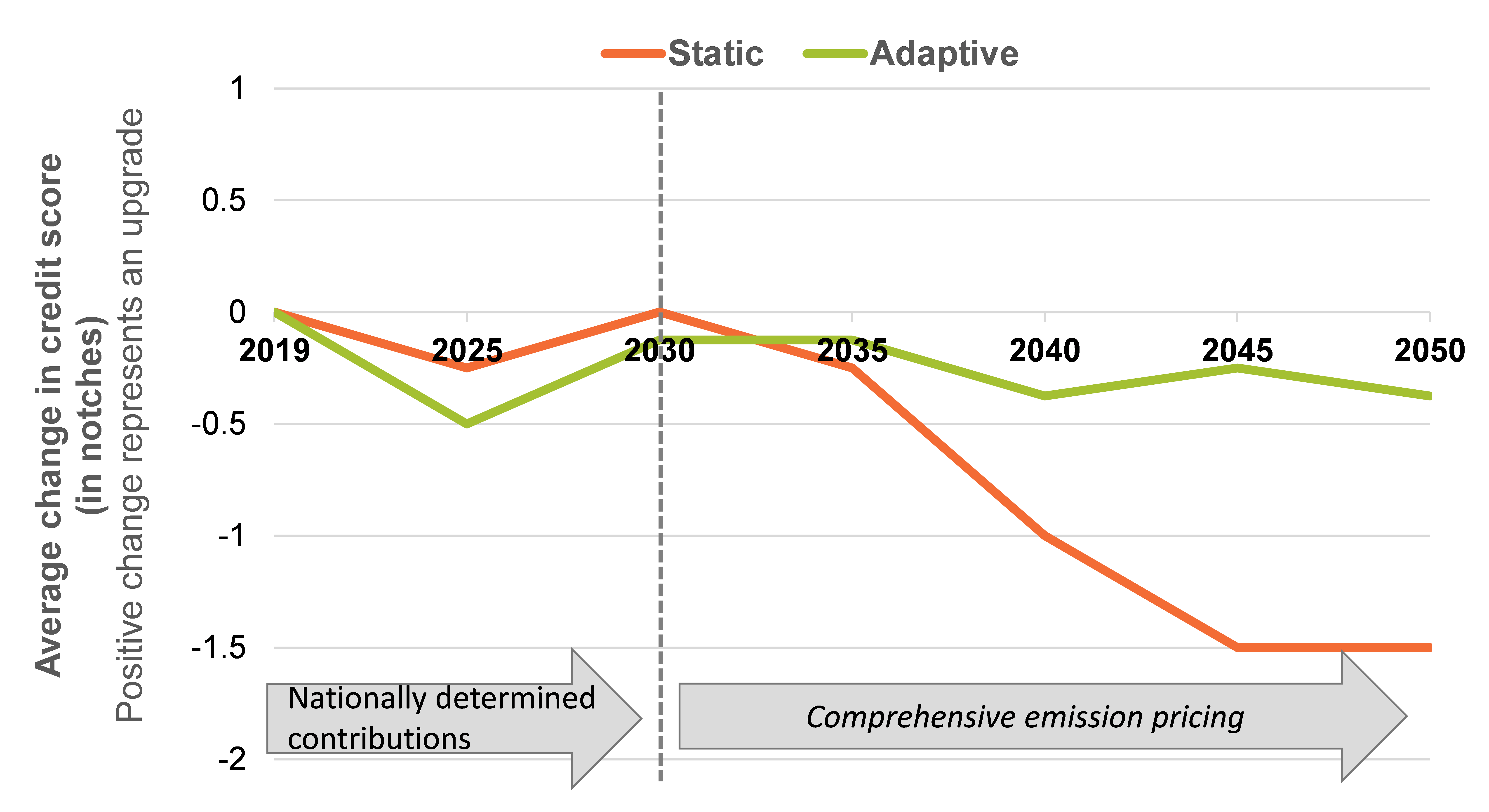

Figure 2 shows the average impact of the climate-related scenarios for the automotive industry.[6] The results are presented as a change in credit risk score in notches, where negative change represents a deterioration of credit quality.

In the static scenario, companies maintain the historical rate of increase for EVs. Therefore, despite a gradual decline in ICVs, their baseline sales volumes remain steady until 2030. After 2030, however, the production of ICVs is not fully replaced by EVs, leading to a drop in revenue. Despite the increase of cost-efficient EVs and declining ICV sales, the gross margin fall due to the increasing carbon tax. This leads to a deterioration in the credit risk scores in the long term.

In the adaptive scenario, companies increase EV production which requires significant R&D expenses in the short term, resulting in lower profits and an increase in debt. This is reflected in weaker short-term credit risk scores compared to the static scenario. However, the growth in EV sales is coupled with lower exposure to the carbon tax after 2030. In the long term, the ability to adapt will convert into an increase in total revenues and profitability. As a result, the credit risk scores remain steady and are considerably higher, on average, by 2050 compared to the static scenario.

Figure 2: Opportunities in the Transition

Source: S&P Global Market Intelligence, Oliver Wyman. As of June 02, 2021. For illustrative purposes only.

The transition effects depend on the company’s current investments in EVs and their overall financial health. Some companies are already well-positioned to capture the climate transition opportunities via increased EV sales to offset the decline in ICV sales. On the other hand, companies behind the curve on EVs, or with weaker financials to fund EV sales growth, could see larger negative credit risk impacts due to lack of adaptation. Most of the automotive producers, however, are in the middle of the road, where ICVs still represent much of their revenues and will need to invest in growing the EVs side of their business. Any adaptation will take time and investment of resources, but the long-term benefits stand to far outweigh the static approach to climate transition.

Navigating Climate Transition Risk

As shown in this Case Study, Climate Credit Analytics helps risk managers, investment professionals, sustainability teams, and others assess credit risks related to climate change and the transition to a low-carbon economy. The solution combines S&P Global Market Intelligence’s data resources and credit analytics capabilities with Oliver Wyman’s climate scenario and stress-testing expertise, enabling counterparty- and portfolio-level analysis of public and private companies across multiple sectors globally.

Click here for more information about Climate Credit Analytics

[3] Oliver Wyman is a global management consulting firm and is not an affiliate of S&P Global, or any of its divisions.

[4] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global Ratings.

[5] REMIND (regionalized model of investment and development) is a global multi-regional model incorporating the economy, the climate system, and a detailed representation of the energy sector. It enables analysing technology options and policy proposals for climate mitigation, and models regional energy investments and interregional trade in goods, energy carriers and emissions allowances. Source: Description of the REMIND model (Version 1.6), G. Luderer, et al., Potsdam, November 1, 2015.

[6] Includes aggregated results for Bayerische Motoren Werke Aktiengesellschaft (“BMW”), Daimler AG (“Daimler”), Geely Automobile Holdings Limited (“Geely”), Hyundai Motor Company (“Hyundai”), Nissan Motor Co., Ltd. (“Nissan”), Renault SA (“Renault”), Tesla, Inc. (“Tesla”), Toyota Motor Corporation (“Toyota”).