This article is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

In our recent blog Credit Score Implications of Russia-Ukraine War, we showed the American and Russian industries most impacted by the war from a forward-looking perspective using our Macro-Scenario Model (MSM). In this blog, we extend the scenario analysis to European industries.

Similar to the previous analysis, our dataset contains public companies and large private companies (turnover>$50 million). We use the RiskGauge™ scores as of January 31, 2022 as the pre-war probability of default (PD) and apply the MSM to obtain the scenario-stressed PDs of 2022. In this analysis, we focus on the Baseline scenario produced by S&P Global Market Intelligence’s proprietary Global Link Model to quantitatively determine the most impacted European industries in the post-war era. The Baseline scenario is the forecast of the possible economic conditions given the present state of the war. It assumes that the COVID-19 pandemic will recede significantly on a global level, the Russia-Ukraine war will continue for several months and the exports of Russia and the Ukraine will be durably reduced. In addition, it assumes that the average price of Brent crude oil in 2022 will be around $127 per barrel.

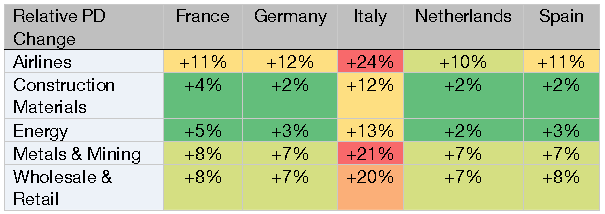

Figure 1 shows the industries most impacted in five European Union (EU) countries, displayed in descending order from left to right. The relative PD changes of these industries are also reported in Table 1. The same set of industries appear in the top five list for each country, albeit in a slightly different order. The Airlines industry makes it to the top of the list in all EU countries, as was the case for the U.S. in the previous blog.

Figure 1: RiskGauge PD of the most impacted industries

Source: S&P Global Market Intelligence. As of June 15, 2022. For illustrative purposes only.

Table 1: Industries with the highest increase in PD in the Baseline scenario

Source: S&P Global Market Intelligence. As of June 15, 2022. For illustrative purposes only.

Most Impacted Industries in the EU:

Airlines: Jet fuel cost that is closely linked to oil price inflation is a key expense for airlines. Fuel hedging by airlines should partly mitigate the impact from the cost inflation, but it will not be fully offset. The closing of Russian airspace and overflight bans lead to flight rerouting/cancellations and additional fuel/crew costs. Price-sensitive leisure consumers may cut back on their travel if inflationary pressures endure and, hence, affect the airlines' ability to recover the additional cost through higher ticket prices.

Energy: The Russia-Ukraine war remains the biggest risk to oil and gas prices. Besides the price volatility, European energy companies need to look for alternative oil and gas suppliers to bridge the gap from Russian imports, resulting in higher transportation costs.

Wholesale & Retail: Energy costs are not a major concern in the sector, but do add to the already high operating costs. The rising cost of living will push up wage rates and weaken operating margins of retailers. In addition, the war presents new challenges for European grocers around the food supply chain.

Construction Materials: Although European construction material companies have a low direct exposure, on average, to the Ukraine and Russia, they are indirectly affected by the high energy costs, supply chain disruptions and inflationary pressures. Companies where the energy bill represents a large proportion of their total costs, such as cement producers, will be affected the most. The slowdown of residential construction, as some households postpone their spending ahead of the increased cost of living, affects the demand for construction materials.

Metals & Mining: Metals & mining companies have huge energy needs and, hence, the spike in oil prices represents significant cost inflation. Despite the reduced metal exports from Russia, they are able to pass on the increased costs to consumers in the form of higher prices. The volatile metal prices and the concerns over energy supplies remain a risk to the sector.

If you would like to learn more about the solutions we used to conduct this analysis, please click here >