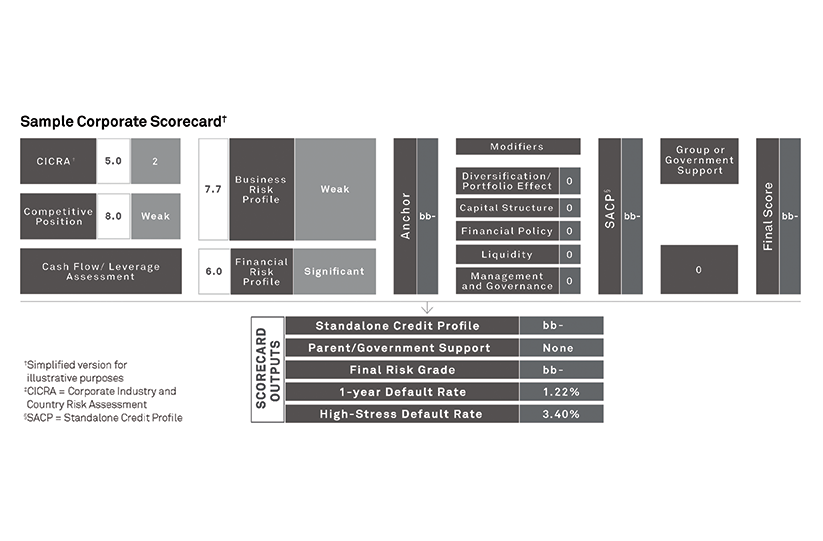

Proactive monitoring of quantitative and qualitative risk factors can help to understand and assess the rising credit risks associated with the new realities of market volatility. The Corporate Credit Assessment Scorecard provides an effective framework to navigate today’s climate, especially for low default portfolios that, by definition, lack the extensive internal default data necessary for the construction of statistical models that can be robustly calibrated and validated.

But how will the creditworthiness of the unrated universe be impacted by such volatility?

There are four primary areas where our Corporate Scorecard can reflect the spillover effects of market volatility on credit risk.

- Country Risk Scores (CRS) – Our CRS are structural long-term risk indicators, addressing the economic risk, institutional and governance effectiveness risk, financial system risk, and payment culture or rule of law risk in the countries in which a company operates.

- Industry Risk Scores (IRS) – IRS provides credit risk analysts a starting point in assessing credit risks in a specific industry/sub-sector. IRS are derived from industrial cyclicality and competitive risk and growth which is a theoretical median level of risk inherent to a given industry, considering its entry barriers, level and trend of industry profit margins, risk in growth potential, risk of secular change, and substitute product.

- Business and Financial Risk –The degree of disruption caused by declines in demand and cash generation can be captured by quantitative factors via our Corporate Scorecard. Credit risk analysts can use forecasts to manage the uncertainty and shock caused by market volatility on Revenue, EBITDA, FFO, and other financial ratios, based on a sound financial forecasting model.

- Liquidity Modifier – Credit analysts can update their calculation of longer-term liquidity resources and uses, integrating the latest cash figures and updating their assumptions for revenues and capital expenditures (capex), among others, by using our Corporate Scorecard.

In response to the COVID-19 pandemic, central banks and governments have deployed unprecedentedly large fiscal and monetary policy packages to help workers and companies bridge the gap to recovery. Today, the expectation of specific, extraordinary support provided by governments to certain government-related entities (GREs) is considered with the use of the GRE overlay provided along with the Corporate Scorecard.

With credit markets constantly evolving, how do you effectively manage risk?