The global aviation industry produces around 2% of all human-induced carbon dioxide (Co2) emissions, according to the Air Transport Action Group.[1] The Group's central traffic growth projection shows that by 2050, approximately 10 billion passengers will account for a distance of 20 trillion revenue passenger kilometres each year. Without any intervention in the fleet and operational efficiency, this activity would generate about 1.8 billion mt of CO2 and require over 570 million mt of fuel. However, the Group feels that the industry can slash its emissions in half by 2050 and reach net-zero about a decade later.[2] The plan will rely on a significant shift away from fossil fuels, the introduction of radical new technology, and continued improvements in operations by the sector.

Need to assess the impact of climate risks on your financials?

Since change may not come fast enough across many industries, however, some governments are turning to a carbon tax to accelerate the process. How companies respond to the tax — promptly adopting new technology and reducing CO2 emissions, lagging behind, or carrying on their business as usual — can have significant financial implications, affecting their credit risk profiles and, potentially, impairing their ability to operate.

Linking Climate Change and Credit Risk

Investors, lenders, regulators, and other stakeholders are calling for greater assessment and disclosure of climate change impacts and financial risks. To support these efforts, S&P Global Market Intelligence and Oliver Wyman designed Climate Credit Analytics.[3] This powerful solution translates climate scenarios into drivers of financial performance tailored to each industry, such as production volumes, fuel costs, and capital expenditures. These drivers are then used to forecast complete company financial statements under various climate scenarios and assess potential changes in counterparty credit scores and probabilities of default. [4]

In the following case study, we look at how different responses to climate change can affect the creditworthiness of airlines. The airline sector is particularly difficult to decarbonize, given the limited substitutes available for jet fuel. However, it is also a sector that made significant commitments to reduce or offset its emissions.[5] At the same time, the industry has tight margins and sometimes volatile demand – as seen most dramatically through the coronavirus pandemic – creating conditions that heighten the potential risk from any disorderly climate transitions.

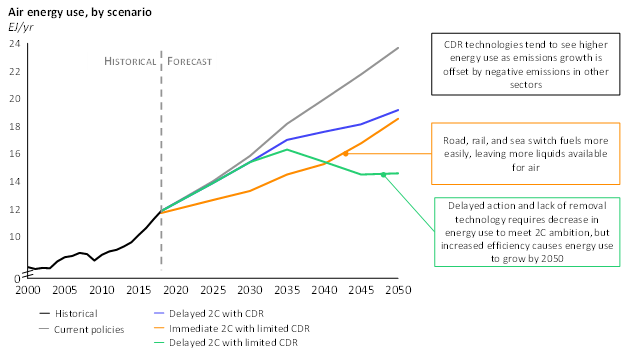

Figure 1 shows a few possible climate transition scenarios, which are closely aligned with those provided by the Network for Greening the Financial System (NGFS) scenarios. The NGFS scenarios enable an analysis of financial impacts through 2050 across various hot house, disruptive, and orderly transition scenarios. The reduction of emissions can be achieved through operations, fleet upgrades, alternative fuel use, and Carbon Dioxide Removal (CDR) technologies. However, currently it is not yet clear which approach will prevail.

Climate transition scenario summary:

- Current policies (Hot house world) - No further climate policies are enacted.

- Delayed 2°C with CDR (Disorderly) - Current country pledges are the guiding principle until 2030, thereafter comprehensive emission pricing is introduced to keep warming below 2°C with full availability of CDR technologies.

- Immediate 2°C with limited CDR (Orderly) – Warming is kept below 2°C with only limited availability of CDR technologies and immediate introduction of comprehensive emission pricing.

- Delayed 2°C with limited CDR (Disorderly) - Current country pledges are the guiding principle until 2030, thereafter comprehensive emission pricing is introduced to keep warming below 2°C, with only limited availability of CDR technologies.

Figure 1: Airlines Industry Glide Paths

Source: Oliver Wyman, S&P Global Market Intelligence. As of January 19, 2021. For illustrative purposes only.

Climate Transition Impacts

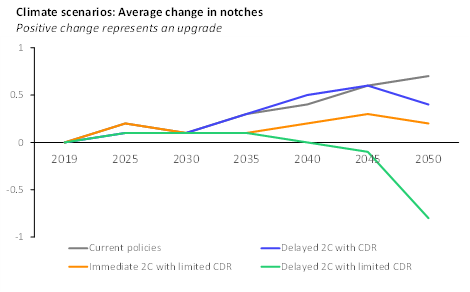

Figure 2 shows the average impact of the climate-related scenarios for the airline industry.[6] The results are presented as a change in credit risk score in notches, where negative change represents a deterioration of credit quality.

For the airline industry to reach its climate commitments, the industry will need to deviate from current emissions policies. The ‘immediate action’ scenario would require airlines to adapt more rapidly but would also put them on a smoother growth path up to 2050. By adapting earlier, airlines will need to lower their carbon tax costs from the onset and limit the longer-term negative financial impacts, even without the reliance on CDR technologies. As a result, the creditworthiness of airlines improves and remains steady in the long term.

When emission reduction and carbon taxation are delayed, the impact on long-term creditworthiness depends on the presence of CDR technologies and late-stage adaptation costs. The delayed action results in a more disorderly transition, as there is a sudden need to significantly lower energy consumption growth after 2030. And, whilst the potential availability of CDR technologies would be beneficial, the disorderly transition will negatively impact the creditworthiness of airlines.

Figure 2: Climate Transition Impacts

Source: Oliver Wyman, S&P Global Market Intelligence. As of January 19, 2021. For illustrative purposes only.

Company-level transition effects will be heterogenous, though. For example, airlines tend to have higher emissions if they fly shorter routes and older and more spacious planes. The carbon tax impacts will thus depend on an airline’s fleet composition and route structure, as well as its ability to pass on some costs to consumers. The changes in demand, as consumers might switch to alternative modes of transport over shorter distances, will also play a role. Over the longer term, however, fleet upgrade costs, availability of alternative fuels, and CDR technologies will drive the climate transition impacts in this industry.

Navigating Climate Transition Risk

As shown in this case study, Climate Credit Analytics helps risk managers, investment professionals, sustainability teams, and others assess credit risks related to climate change and the transition to a low-carbon economy. The solution combines S&P Global Market Intelligence’s data resources and credit analytics capabilities with Oliver Wyman’s climate scenario and stress-testing expertise, enabling counterparty- and portfolio-level analysis of public and private companies across multiple sectors globally.

Click here for more information about Climate Credit Analytics

[1] “Facts & Figures”, Website for the Air Transport Action Group, as of July 8, 2021, www.atag.org/facts-figures.html.

[2] “Aviation group sets out pathways to halve carbon emissions by 2050”, S&P Global Platts, September 2020, www.spglobal.com/platts/en/market-insights/latest-news/coal/093020-aviation-group-sets-out-pathways-to-halve-carbon-emissions-by-2050.

[3] Oliver Wyman is a global management consulting firm and is not an affiliate of S&P Global, or any of its divisions.

[4] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global Ratings.

[5] The International Civil Aviation Organization (ICAO) adopted the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) to address CO2 emissions from international aviation by committing to carbon neutral growth after 2021 and setting an industry-wide goal to reduce aviation emissions by 50% from 2005 levels by 2050. Source: ICAO Resolution A40-19, International Civil Aviation Organization, October 2019.

[6] Includes aggregated results for American Airlines Group Inc., Ryanair Holdings plc, Southwest Airlines Co., Singapore Airlines Limited, Air France KLM SA, Air China Limited, The Emirates Group, ANA Holdings Inc., Kenya Airways Plc, and United Airlines Holdings, Inc.