Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

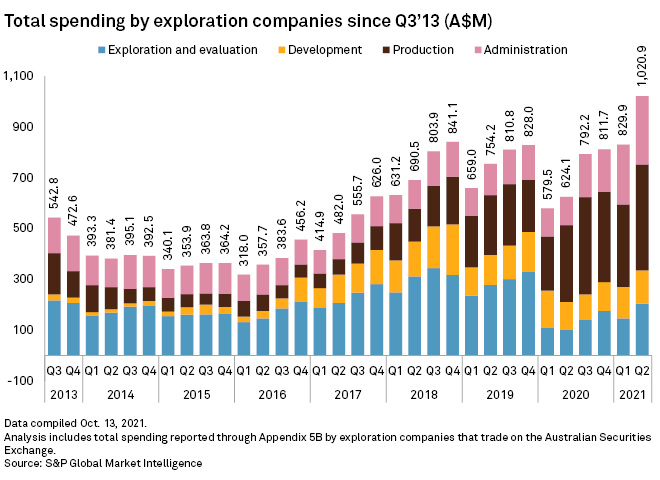

In this edition, we take a close look at the midstream sector's forthcoming third-quarter earnings, which are expected to see strong gains assisted by rising commodity prices. According to analyst consensus, year-over-year growth in adjusted EBITDA and revenues should prevail for most of the 11 major North American midstream companies analyzed by S&P Global Market Intelligence. The commodities price surge is also easing fundraising for Australia-listed exploration companies, helping the sector boost spending to record levels.

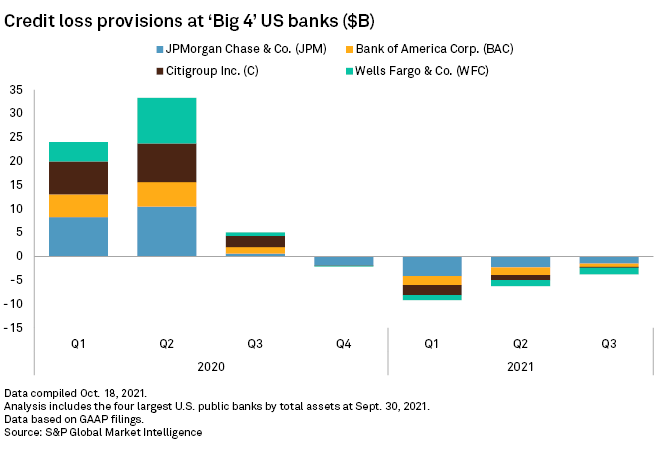

Third-quarter earnings at the largest U.S. banks were buoyed by continued strength in credit performance and robust capital markets revenues, but many analysts were focused on loan growth, and JPMorgan Chase & Co. and Bank of America Corp. both gave upbeat outlooks.

The number of M&A deals in the insurance industry amounted to 317 during the third quarter, up from 255 a year earlier, with asset managers and private equity firms getting involved in some of the largest deals.

Livestream: A tale of two mobile payment markets — the U.S. and India

Join our fintech experts for a Market Intelligence Live conversation on Oct. 28. Watch live on LinkedIn

Midstream Sector in Focus

Commodities price rise sets stage for midstream sector gains

Industry experts said 2022 capital decisions and environmental, social and governance opportunities could also come under the spotlight during the midstream sector's third-quarter earnings.

Read the full article from S&P Global Market Intelligence

Commodity boom helps Australian explorers boost cash amid record expenditure

ASX-listed explorers' spending levels and cash piles are at their highest point since 2013, according to S&P Global Market Intelligence data.

Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

Delayed First Citizens-CIT deal faced antitrust claims in unsigned letter to Fed

An unsigned letter sent to the Federal Reserve earlier this year alleges that First Citizens has asserted control over CIT's day-to-day operations, violating an antitrust law.

Read the full article from S&P Global Market Intelligence

De novo banks growing, some even turning profits during pandemic

The entire de novo class of 2018 posted a profit over the last 12 months ended June 30.

Read the full article from S&P Global Market Intelligence

US banks close 180 branches, open 69 in September

JPMorgan Chase bucked the trend, netting four new branches for the month.

Read the full article from S&P Global Market Intelligence

Big US bank earnings show momentum in loan growth

BofA and JPMorgan Chase gave upbeat outlooks on revenue growth, although bank earnings are still being fueled by credit reserve releases that are diminishing over time.

Read the full article from S&P Global Market Intelligence

Insurance

Cat losses, inflation among focal points during P&C insurers' Q3 earnings season

All but one of the 20 largest property and casualty and multiline insurers, for which estimates are available, are expected to log lower EPS sequentially for the third quarter, though a strong majority are projected to post EPS growth on an annual basis.

Read the full article from S&P Global Market Intelligence

Insurance M&A activity rises in Q3 as asset managers make major deals

There were 317 insurance deals announced during the period, compared to 255 in the third quarter of 2020, according to an S&P Global Market Intelligence analysis.

Read the full article from S&P Global Market Intelligence

Credit and Markets

Retail market: Supply issues may haunt holidays after sales rise in September

The monthly increase in sales surprised economists, who expected a slight decline in September as rising inflation and short supply of goods weigh on consumer spending.

Read the full article from S&P Global Market Intelligence

Weak earnings season may force Fed into dovish turn

Worse-than-expected results may cause the central bank to soften its tone surrounding plans to taper its pandemic-era monthly bond purchases.

Read the full article from S&P Global Market Intelligence

Energy and Utilities

NextEra, Xcel report largest CEO to median employee pay ratios in 2020

NextEra recorded a 176-to-1 ratio as CEO James Robo retained the top spot among the highest-paid U.S. utility executives.

Read the full article from S&P Global Market Intelligence

Clean energy groups tell FERC to nix long-standing transmission funding model

The Federal Energy Regulatory Commission heard opposing arguments from clean energy groups and regional grid operators as to whether the agency should jettison a long-standing transmission funding approach as part of sweeping rulemaking.

Read the full article from S&P Global Market Intelligence

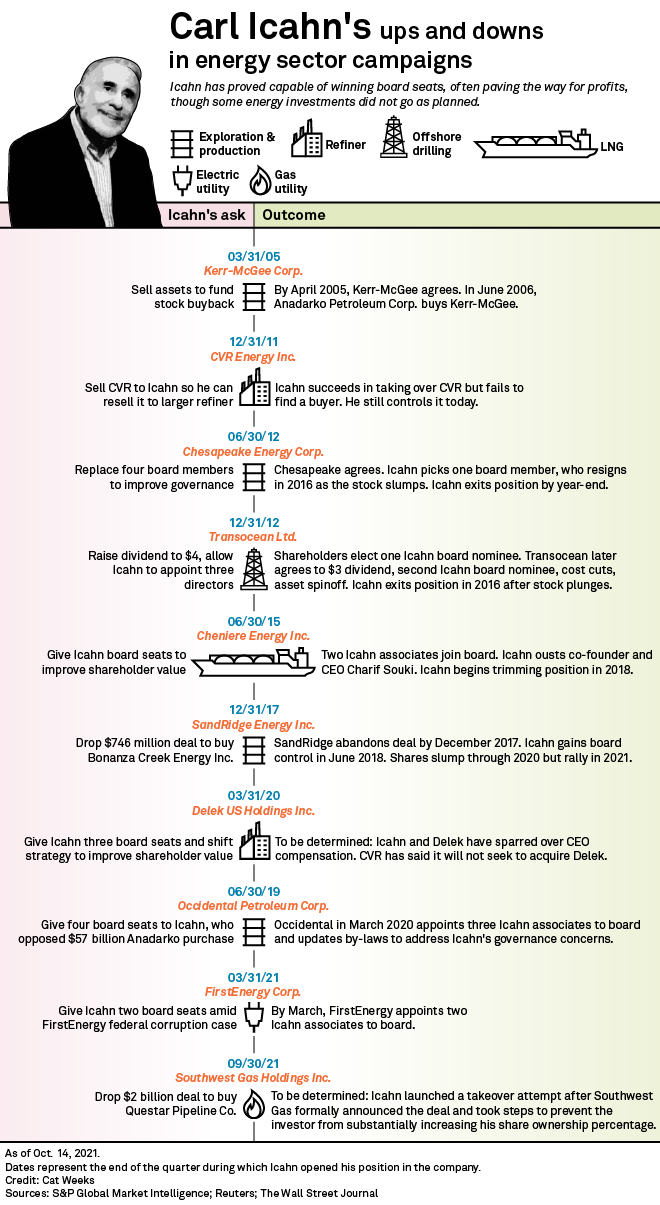

Carl Icahn puts his activist record to the test in Southwest Gas battle

Carl Icahn has a record of getting what he wants in energy sector campaigns. However, in his Southwest Gas takeover bid, he opposes a midstream deal that has already garnered some support, and he must now convince investors to share his concerns.

Read the full article from S&P Global Market Intelligence

Private Equity and Real Estate

PE's ESG agenda advances in US, but barriers remain

The U.S. private equity sector is making progress in implementing environmental, social and governance strategies, but reporting on these factors is still in the early stages, experts told S&P Global Market Intelligence.

Read the full article from S&P Global Market Intelligence

Morgan Stanley set to earn landmark REIT M&A fee on VICI Properties deal

The firm's work on the roughly $17.20 billion transaction comes as real estate investment trust M&A volume is rebounding from the COVID-19 pandemic to its highest level in years.

Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

Netflix searches for next growth opportunity amid maturing streaming market

Analysts say competition will make it harder for Netflix to add new subscribers. But they still see some opportunities ahead, such as Netflix's foray into gaming and efforts to end password sharing.

Read the full article from S&P Global Market Intelligence

Metals and Mining

$22.6B Mexican lithium mine bogs down in drug cartel, tech risks

Tesla sought lithium carbonate from northern Mexico, but the task has proven more complicated than it first appeared.

Read the full article from S&P Global Market Intelligence

The Week in M&A

Bank M&A 2021 Deal Tracker: Deal value climbs to post-financial-crisis high

Read full article

First Horizon expects to see significant benefits of merger from Q1'22

Read full article

Fulton interested in M&A, targeting banks with $1B to $9B assets

Read full article

Media, telecom M&A activity falls 11.3% YOY in September

Read full article

Mega mergers, HCA's Utah expansion lead Q3'21 US hospital M&A

Read full article

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @etain_lavelle on Twitter.

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets. Click here to subscribe.