Earlier last week most of the European Private Equity industry descended on a somewhat cold and quiet Cannes to attend IPEM, the leading conference for LPs, GPs and service providers to network and fundraise. The French riviera has a special feeling in the winter, the glitz and glam of tv stars and the excitement and euphoria of summer makes way for a calmer, laid back and intimate setting where the industry could make genuine connections and build relationships.

After the bonanza we’ve seen in the past decade, the brutal rise of inflation and interest rates is a very serious test for Private Markets. In a short period, financing has dried up, public markets have dropped and remain volatile, and the fundraising environment is drastically different from this time last year. The theme for the conference was thus appropriately titled “Reality check” in order to face hard new realities without complacency. S&P Global Market Intelligence was there to speak and demonstrate how we can help the industry navigate these challenges and discuss the many opportunities that present themselves. Because while a reality check is necessary and healthy, the private equity model remains as strong as ever and private markets are still the best placed at putting money to work.

The conference kicked off with a discussion on the Macro Forces impacting Private Markets. Whilst acknowledging the macro pressures we face quite often, the best deals are done in a downturn. So, most GPs need to examine how to re-position themselves to capitalize on opportunities that make the most of a challenging environment. The panel compared and contrasted the case for Private Equity and Private debt in a downturn and noted the huge gap in dry powder between private equity and credit markets so we should expect Private equity to keep on being the main driver of deals throughout 2023.

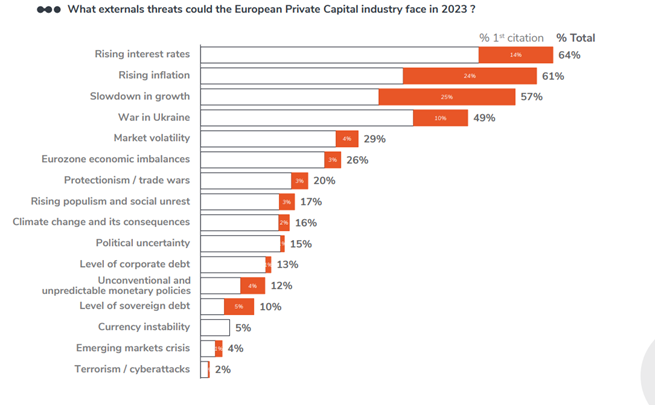

From the Pan-European Private equity survey collected by IPEM we see that many of the concurrent disruptive forces of 2022 will bleed into the new year with rising interest rates, rising inflation and a slowdown in growth being major headwinds that look set to dominate the business agenda over the next 12 months. I will summarize a few key findings that I believe warrant a highlight as they help us understand better the agenda in store for us in this new year.

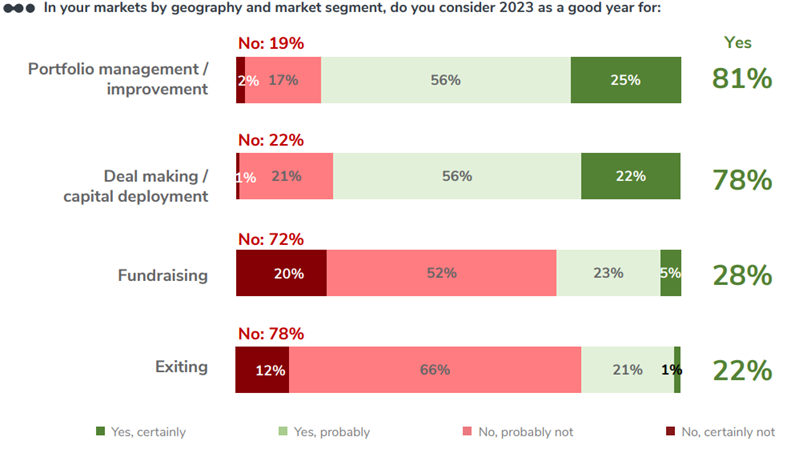

72% of respondents noted that the exit environment will be highly challenging, with concerns over corporate debt levels particularly pronounced in France. Despite this, 78% of respondents have positive expectations for deal-making and capital deployment. The issue of fundraising is also highlighted as critical, with government subsidies and supportive credit markets expected to play a role. The positivity for deal-making and capital deployment is higher among funds with 100m-500m euros and is more muted for 1bn+ euro funds.

A key theme discussed throughout the conference is the importance of Portfolio management and improvement, with most GPs expecting to prioritize value preservation over growth and value creation. Additionally, a majority of GPs expect more restructuring opportunities to emerge this year, as some companies sell assets or reconsider investments to protect shareholder returns and generate greater liquidity.

An interesting conclusion from this survey is that the private capital markets is expected to be LP-led in 2023, with LPs holding more power than GPs. This would be the first time this has happened since IPEM’s annual survey began in 2019. However, a tough exit environment will impact LPs' ability to be more active, tempering expectations of distribution from GPs that can be recycled into the market. Despite such, two-thirds of respondents expect to raise new funds in 2023, which is consistent with 2022 levels. This means that fund managers still believe that they expect to raise more capital than in 2022 but the expectation of actually deploying that capital have dipped from 62% in 2022 to 48% meaning that Dry Powder stockpiles will keep increasing throughout 2023.

The general optimism for dealmaking remains positive despite the challenges of the business ecosystem in 2022. Conference panelists believe that the key source of funds for fundraising in 2023 will be Sovereign Wealth Funds, which is expected to grow by 8% from 2022. Conversely, retail investors, asset/wealth managers, and family offices/HNW are expected to tighten their investment belts significantly.

While French GPs and funds between 500m-1bn euros view retail investors as vital to fundraising strategies, this will be offset by a marked decrease in funding from pension funds and insurance companies. In terms of capital deployment, investments further afield are predicted to be curtailed in 2023, and more investments are expected in domestic markets and across Europe, but with reduced growth compared to 2022 and pre-pandemic levels. Southern European and DACH-based GPs said that they are most likely to focus investments within their respective borders.

There was a broad consensus that in 2023, portfolio improvement is a priority. Robust operational housekeeping in difficult times can lead to both value preservation and value creation, particularly given that many of the GPs portfolios have been impacted by supply chain issues, higher inflation, and energy costs. Firms that moved quickly and decisively during the pandemic are in better shape than those who didn't. In 2023, the internal priority list for firms is topped by ESG (72%), particularly in Infrastructure funds (94%), followed by HR/Talent management (67%). PR/Communication, Marketing and Fund Reporting/Transparency also have a high focus, and these areas will be prioritized this coming year. With capital likely to contract during the next 12 months, effectively articulating strong ESG performance will be critical in gaining access to finance in a constrained market.

I came out of the conference with more optimism and positivity towards the industry for 2023 despite the very real challenges and a rapidly changing macro environment. While I do have some concerns that this drive and enthusiasm displayed by GPs will not be shared by limited partners as we noted less participation by pension funds and insurance companies which could signify that they intend to allocate less to the asset class. Small and mi-cap segments of the industry also seem to be better positions to succeed in such a market and are showing strong resilience. On a very positive conclusion I also took note of the fact that most European GPs have assigned a high priority to climate considerations and that climate finance may be achieving a significant maturity to become an asset class in its own right.

If you're already an S&P Capital IQ Pro subscriber, you can access our Dry Powder & AUM Trends data here and our Fundraising Trends here