Supply chain management has always been an important strategic issue for companies that rely on others for resources to help deliver the products and services being sold. Effectively managing a supply chain can provide an opportunity to develop reliable sources, cut excess costs and deliver products to consumers at a faster pace through strong inventory control. Now, with the focus on sustainability on the rise, supply chain management includes additional considerations. Today companies are also looking to engage with suppliers who are environmentally friendly, respect human rights, and provide safe and inclusive workplaces.

This large online retailer deals with thousands of suppliers around the world. To mitigate potential risks, the sustainability group was asked to help the supply chain management identify firms that were socially responsible — in particular, firms that had diverse workforces that were paid well and treated fairly. The sustainability team needed a way to scale its assessments of current and potential counterparties given the volume of activity.

![]()

Pain Points

Members of the sustainability group had created a list of firms they knew did not meet the company’s criteria for being socially responsible. They wanted to be able to quickly identify other firms that should be added. Given the company’s extensive supply chain network, the group felt a simple first step would be to exclude firms that did business with those already on the list. To support this, the group needed:

- Comprehensive import and export data with details on buyers/sellers, product descriptions, and values.

- The ability to identify specific companies, along with their supplier and customer base.

This would eliminate the need to search websites and other material, which would be a very manual process and likely yield poor results. The team met with S&P Global Market Intelligence (“Market Intelligence”) to learn more about the firm’s capabilities in this area.

![]()

The Solution

Market Intelligence described its supply chain data on S&P Capital IQ Pro that provides global import and export transaction details, with information on buyers and sellers, product descriptions, values, and more. Importantly, the Trading Network tool on the Capital IQ Pro platform would enable users to create a detailed, interactive visualization of trade networks, presenting a snapshot of a company’s entire supplier and customer base. The extensive data and robust web - based tools would help the sustainability team:

| Understand detailed trade flows | Our supply chain data provides access to 2 billion transaction records, 13 million company-to-company relationships, and approximately 40% of global merchandise traded by dollar value.[1] The records include importer and exporter company names, product details, dollar values, harmonized international trade (HS) codes, and more. | |

| Search for specific products, trade routes, and companies | Powerful search and curated analytics on the Capital IQ Pro platform help users easily to zero-in on companies and their shipment activity. | |

| Visualize trade networks | Network View provides a fast way to get a snapshot of a company’s entire trading network. In addition to providing an easy-to-digest visual, it is interactive. By clicking on any company in the trade network, a new Network View is formed with that company as the center anchor. |

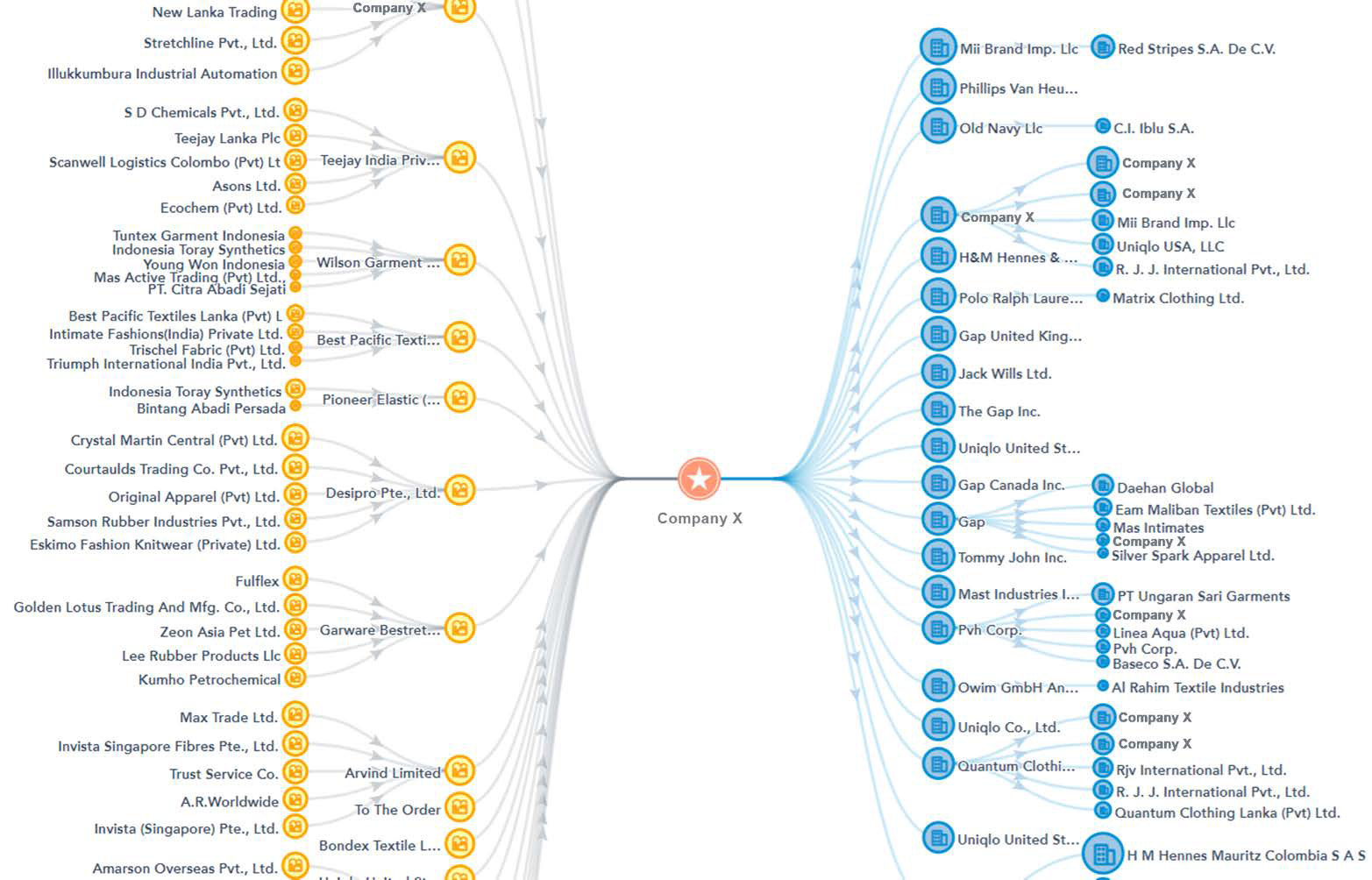

In this Network View sample, we see Company X, a supplier based in Asia, in the center. On the left-hand side in yellow, we see first and second order supplier relationships. On the right-hand side in blue, we see first and second order customer relationships. This graphic simply serves as an illustration of the tool, and is not meant to suggest that Company X, or any of its suppliers or customers, are not socially responsible.

For illustrative purposes only.

![]()

Key Benefits

Members of the sustainability group were very impressed with the offering and the ability to quickly see buying and selling relationships around the world. In particular, they valued the ability to:

- Rely on a trusted information provider known for high-quality data, analytics, and insights.

- Save time and dig deep on data by accessing a web-based platform with tools specifically designed to evaluate supply chains.

- Quickly visualize the trade networks of millions of companies to create a list of qualified/non-qualified firms to share with the supply chain management team.

- Easily identify trade taking place with commodities, companies, or countries that have been identified as having problems with fair and equitable workforce issues.

- Set automatic alerts on current and potential suppliers to better understand their other business partners and selling/purchasing trends.

The group was excited to subscribe to the Capital IQ Pro desktop platform to scale its activities with robust data, analytics, and visualization tools. There is also a data feed option available if needed at some point in the future.

Click here for more information on S&P Capital IQ Pro.

[1] The assumptions in this analysis are calculated using proprietary algorithms in addition to 2016 Global Merchandise Trade by Value data reported to UN Comtrade, the International Trade Statistics database, by the participating governments. Using a factor between 1 and 0.46, we have made these assumptions as of August 28, 2018, to calculate the global merchandise traded by dollar value.