The world of leveraged finance has been marked by economic challenges and tight credit conditions in 2023. But, hope is on the horizon. There are signs of a reopening syndicated loan market and innovative financing strategies being explored by borrowers.

Regional bank turmoil, concerns over the debt ceiling, rapid interest rate hikes, and tepid M&A activity created an environment of uncertainty in the first half of the year. Lenders responded by becoming more selective, favoring highly rated borrowers, and demanding tighter covenants, higher spreads, lower leverage, and increased equity contributions. For borrowers seeking liquidity, private credit emerged as a valuable alternative.

M&A financing: embracing smaller deals and add-on acquisitions

Inflation, rising interest rates, and low asset valuations have made it challenging for private equity firms to execute large acquisitions. As a result, many turned to smaller platform acquisitions or add-on deals. The average debt-to-EBITDA ratio for M&A syndicated leveraged loans in Q2 2023 hit a low of 4.2x, influencing private equity firms to seek smaller, more manageable deals.[1]

Refinancings and amend-to-extend transactions dominated the leveraged loan landscape in the first half of 2023, accounting for 74% of total volume. These transactions significantly reduced near-term maturities in 2024 and 2025.

Private credit joins forces with syndicated lending

In the face of a weak traditional private equity leveraged buyout (LBO) financing pipeline, private credit providers have expanded their reach across the capital structure. In fact, non-LBO transactions financed by private credit have outpaced those in the broadly syndicated loan market. The popularity of unitranche loans has also increased with private credit lenders due to their unique structure, consolidating both senior and junior debt components into a single debt facility.

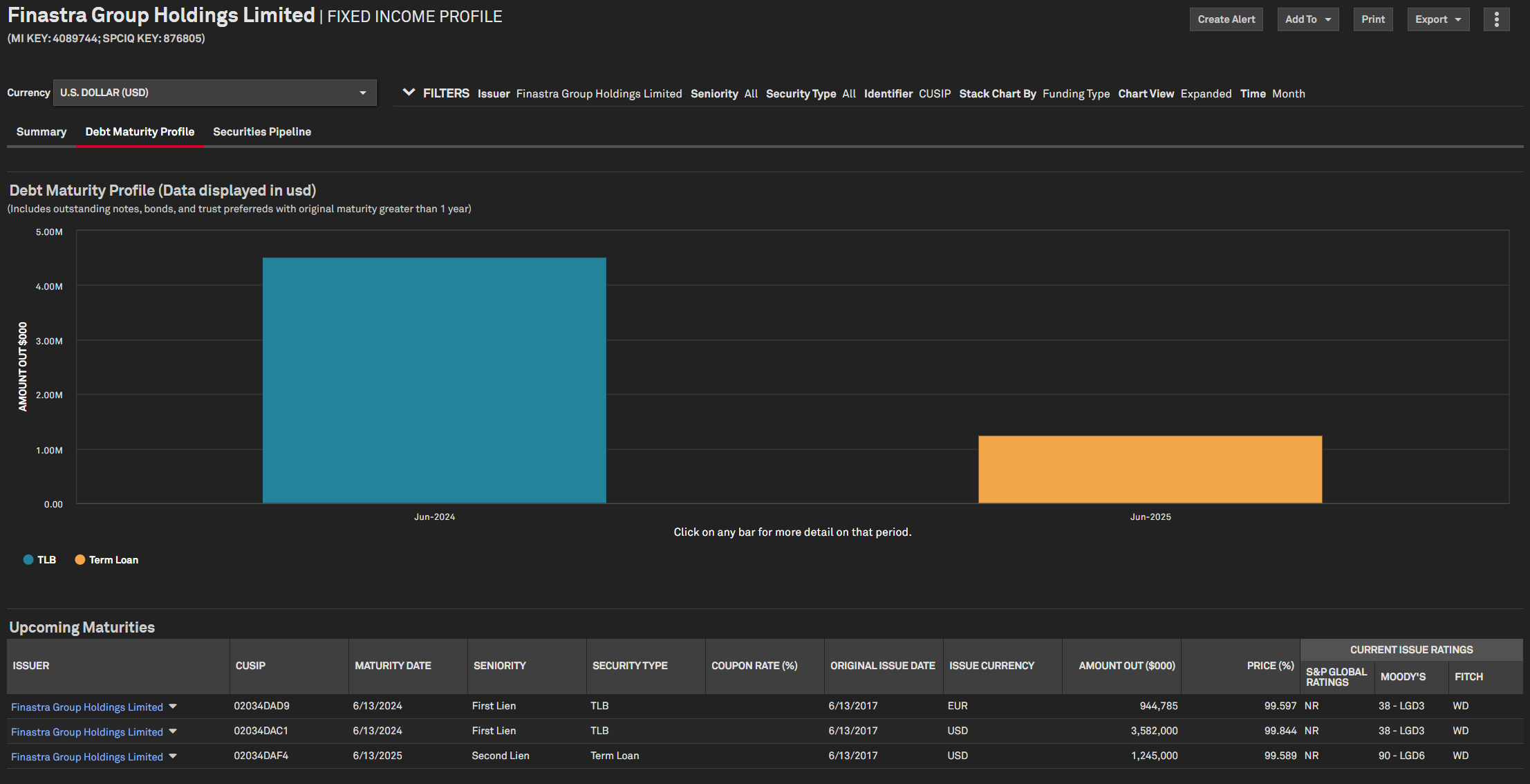

The growing influence of private credit has been underscored by a series of notable deals, including major acquisitions and investments. For example, the recently announced multibillion-dollar debt refinancing for Finastra Group Holdings Limited is a sign of activity picking up rapidly in the second half of the year.

A group of direct lenders led by Oak Hill Advisors provided $5.3 billion to the fintech company in what ranks as the largest private credit package ever arranged. This refinancing consists of a $4.8 billion unitranche loan to help refinance the syndicated term loans that are maturing in June 2024.[2] This repayment will be one of the largest term loans repayments in history and will signify Finastra’s exit from the syndicated loan market.

Source: Corporate Issuance, S&P Capital IQ Pro, September 2023. For illustrative purposes only.

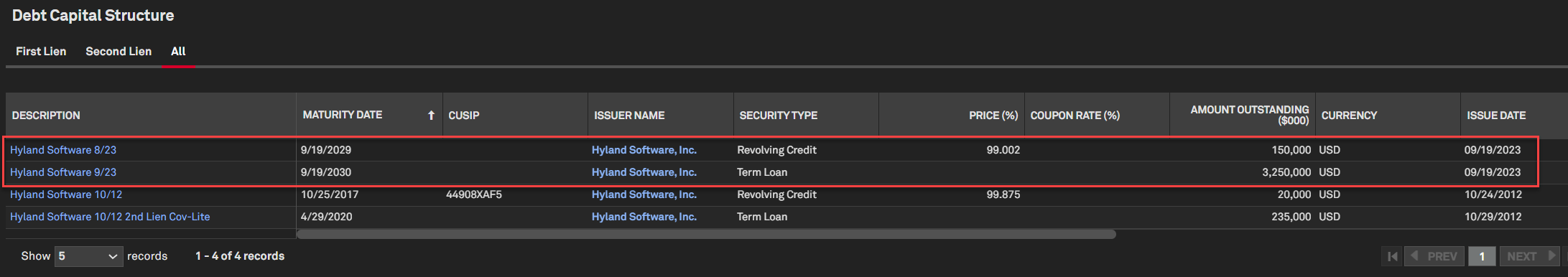

Hyland Software has also successfully secured $3.4 billion in unitranche financing through the private credit market, effectively refinancing previous syndicated loans led by investment banks.

This newly arranged credit package includes a $3.25 billion term loan and a $150 million multi-currency revolver, as highlighted in the updates to their debt capital structure on the S&P Capital IQ Pro platform.

As the syndicated lending market shows signs of reopening, borrowers are poised to capitalize on opportunities to refinance and extend maturities.

These so called dual-track processes, combining syndicated and private credit options, are becoming more common as borrowers aim to secure favorable terms. Additionally, borrowers and private equity firms are exploring various financing options across the capital stack to raise liquidity.

Embracing opportunities and navigating uncertainty

With signs of a syndicated loan market reopening, the second half of 2023 promises opportunities for refinancing and strategic financial management. The industry is showing resilience and adaptability as borrowers and lenders explore new avenues for financing. As market dynamics continue to evolve, staying agile and exploring innovative financing options will be critical to success in the ever-changing world of leveraged finance.

To gain a competitive edge in this dynamic market, consider leveraging the insights and expertise of S&P Global Market Intelligence. Our comprehensive financial data and analysis can provide valuable insights and help inform your decision-making.

Explore S&P Capital IQ Pro.