Climate change continues to take center stage on the European regulatory agenda, with the EU committing to achieve climate neutrality by 2050. New regulations and initiatives to stimulate the sustainability transition continue to emerge, including the Corporate Sustainability Reporting Directive (CSRD) that entered into force on January 5, 2023.

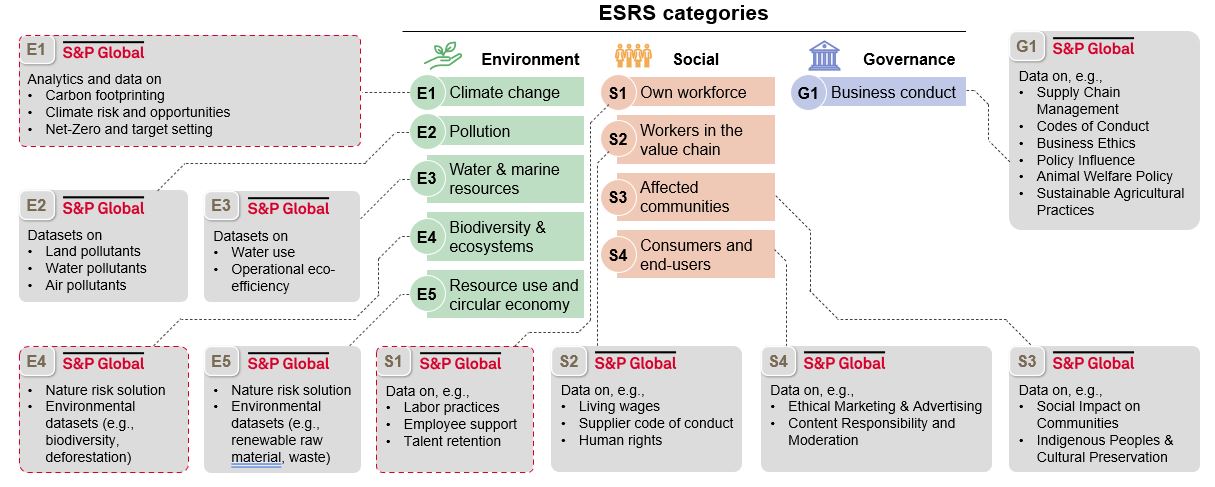

The CSRD proposes to modernize and strengthen the EU rules concerning all three pillars: the environmental, the social and the governance-related information that companies must report. It amends the Non-Financial Reporting Directive (NFRD), the EU's legacy ESG reporting program, and covers categories in addition to carbon, including biodiversity, circular economy, pollution, water, waste, workforce and business conduct – in short, the whole value and supply chain.

Things to Know About CSRD: Common FAQs

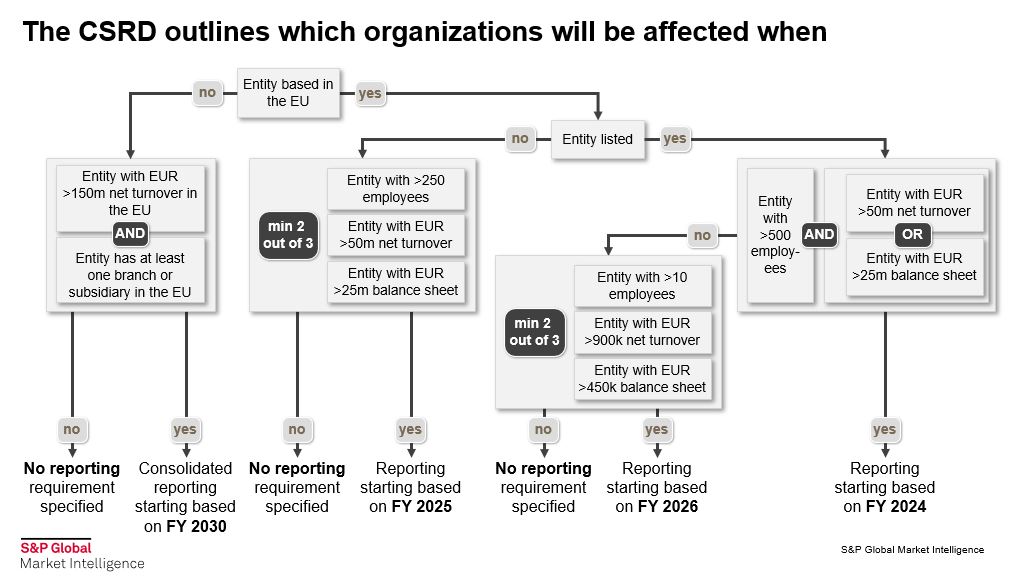

Does CSRD apply to my company?

CSRD applies to a broad group of companies that meet, in general, two of the following three conditions:

- €50 million in net turnover .

- €25 million in assets .

- 250 or more employees.

This includes:

- Large, listed corporations, banks, and insurance companies already subject to the NFRD.

- Other listed EU companies previously not subject to the NFRD.

- Listed European SMEs (that can report using simplified standards).

- Large private European companies.

In addition, non-European companies with significant business in the EU (i.e., annual turnover of above €150 million in the EU) will need to comply.

What is the timeline to comply with CSRD?

The rules will start applying between 2024 and 2030. If a company has not yet measured its carbon footprint, it will be important to start getting prepared as soon as possible.

- Reports are due in 2025 for large, listed companies already subject to the NFRD.

- Reports are due in 2026 for large companies not currently subject to the NFRD that meet the requirements stated above.

- Reports are due in 2027 for listed SMEs and all others that meet the requirements stated above, although SMEs have the option to wait until 2030.

The following decision tree reflects the detailed conditions.

Source: https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en. For illustrative purposes only.

How can S&P Global help?

At S&P Global, we understand that sustainability reporting will be new for many companies and more involved for others. Unlike many service providers, we have all the ingredients needed to manage CSRD reporting for our customers to serve as a one-stop shop.

S&P Global’s sustainability specialists do the heavy lifting for our customers ― from project management to analysis to reporting ― while closely collaborating with their teams throughout the entire process. Our large team of sustainability specialists can draw upon S&P Global's extensive proprietary data and long-standing environmental modeling and reporting experience to handle every step of the CSRD reporting journey.

What unique solutions can S&P Global's sustainability specialists draw upon to do the CSRD analysis for companies?

S&P Global is well known for offering an unrivalled number of datasets and modeling capabilities at the country, sector, industry, and company level. Here is a sampling of S&P Global's sustainability capabilities used in CSRD analysis:

- Nature & Biodiversity Risk: Assesses nature-related risks, impacts, and dependencies across a company's direct operations, which can be applied at the asset, company, and portfolio level.

- ESG Financial and Market Data: Provides key standardized financial and market data metrics for 15,000+ companies with historical annual data available as far back as 2002.

- Carbon Earnings at Risk: Supports' unpriced carbon cost' analysis based on company-reported data, climate models, and other scientific data sources across 15,000+ companies.

- Physical Risk: Assesses company exposure to physical risks at the asset level based on 3+ million assets mapped to 20,000+ listed companies in the S&P Global database.

- Trucost Paris Alignment: Covers 18,000+ companies globally with a set of forward-looking analytical tools to quantify and track energy transition to a low-carbon economy.

- Climate Credit Analytics: Translates complex climate scenarios into drivers of financial performance and supports counterparty and portfolio-level analysis for thousands of companies across multiple sectors.

- EU Taxonomy: Provides a comprehensive assessment of the Eligibility, Substantial Contribution (SC), Do No Significant Harm (DNSH) and Minimum Social Safeguards (MSS) requirements of the EU Taxonomy across 20,000+ companies and 464 business activities.

- Sustainable Development Goals (SDG) Analytics: Quantitatively measure the SDG alignment of products and services for 15,000+ companies.

Source: S&P Global 2023. For illustrative purposes only.

What does a CSRD engagement with S&P Global look like?

S&P Global's specialists follow a client-focused approach that begins with evaluating a company's sustainability strategy and governance structure. They then support in developing a detailed work plan to:

- Quantify carbon emissions across a company's value chains, including business operations, supply chains, and downstream products in use (i.e., Sope 1, 2, and 3).

- Team members help collect the business data that a company already has on carbon emissions and meshes that with S&P Global's carbon emissions data to fill in any gaps. - Assess nature-related impacts and dependencies across a company's direct operations and investment portfolios to evaluate nature and biodiversity risks.

- Apply scenario analysis to evaluate the financial impact of climate-related risks across different time horizons.

- Consider opportunities that could arise from the transition to a low-carbon economy, including how well a company's existing product portfolio and future development plans are positioned for the transition.

- Establish robust science-based targets to follow a reduction pathway and align a company's strategy with the goal of the Paris Agreement.

- Integrate the analysis in the overall risk management process.

The specialists handle all aspects of the undertaking, drawing on industry best practices to deliver actionable insights that enable companies to pinpoint their material sustainability risks and opportunities and craft a clear path to move to a more sustainable economy.

Get ready for CSRD. Click here to request more information about how our sustainability specialists can provide an end-to-end solution to meet your CSRD reporting needs.

How do European banks prepare for their ESG reporting in line with Pillar 3 and Green Asset Ratio?

Access Now