This large financial technology corporation offers an open platform that empowers businesses and people to manage and move money globally in over a hundred currencies. Its corporate counterparty base spans multiple industries, ranging from well-established global multinational corporates and household brands to innovative start-ups, of which each organization is looking to work with a secure payment gateway for commercial transactions.

The risk management team at the corporation is tasked with having a good understanding of the credit risk of merchants that utilize the platform and, more rigorously, in instances where the corporation extends financing to merchants. The team is also tasked with being aware of the many industries and markets that are served and capturing emerging market trends. These insights help the corporation identify credit risk and surface areas of concerns to senior management in a timely manner.

Pain Points

To meet the many daily demands, the credit risk management team wanted to leverage robust analytical tools to automate its current processes to easily evaluate credit risk scores and related underlying factors. This would enable team members to:

- Make timely and well-informed onboarding and underwriting decisions across its counterparties.

- Automate the existing manual credit risk assessment through powerful statistical models.

- Increase standardization and streamline analysis through flexible enterprise-wide offerings.

- Put in place an early-warning system to monitor any credit risk deterioration in merchants.

- Gain insights on small- and medium-sized enterprises (SMEs), the firm’s largest counterparty segment, through a 360-degree view of credit risk, including aspects of payment behaviour and exposure limits.

- Access a framework to work with little to no financial information, which would be useful for onboarding new merchants and those with very limited financials.

The credit risk management team met with S&P Global Market Intelligence (“Market Intelligence”) to discuss the firm’s offering.

The Solution

Market Intelligence described its Credit Analytics capability that provides powerful analytical models, unrivalled data and sophisticated workflow tools that help users quickly and easily measure the credit risk of rated, unrated, public and private companies across the globe. This would give the team access to:

A one-of-a-kind solution for smart credit decisions. Credit Analytics includes statistical models with a range of credit risk indicators, from fundamental-based scores to market-based signals that are designed to broadly align with credit ratings from S&P Global Ratings.[1] Users also gain transparency into the drivers of default risk and have early-warning signals to monitor credit deterioration.

Private company and SME solutions, with a 360-degree perspective of credit risk. RiskGauge Reports provide streamlined counterparty credit risk assessments via comprehensive business credit reports powered by dynamic analytical models (such as payment behaviour scores) and robust data. Coverage includes over 50 million public and private companies across the globe,[2] including SMEs. In addition, it also includes an innovative evaluation framework that requires little to no financial data and can work with limited qualitative indicators.

The ability to track changing trends at industry and regional levels. Pre-calculated probability of default and credit scores include more than 5 million public and private companies aggregated across 160 industries, 183 countries and 241 S&P Dow Jones Indices. Country, industry and index-level benchmarks are reported at the median level, as well as other statistical levels, to reveal trends for a given region or industry.

Flexible delivery options. Credit Analytics models and data are fully integrated on the Market Intelligence platform and with Excel® Plug-ins, reducing the need for manual inputs of company information. The offering is also available via a variety of enterprise solutions, including bulk data feeds and API solutions to embed in internal and third-party platforms, that can further assist in workflow automation.

An Overview

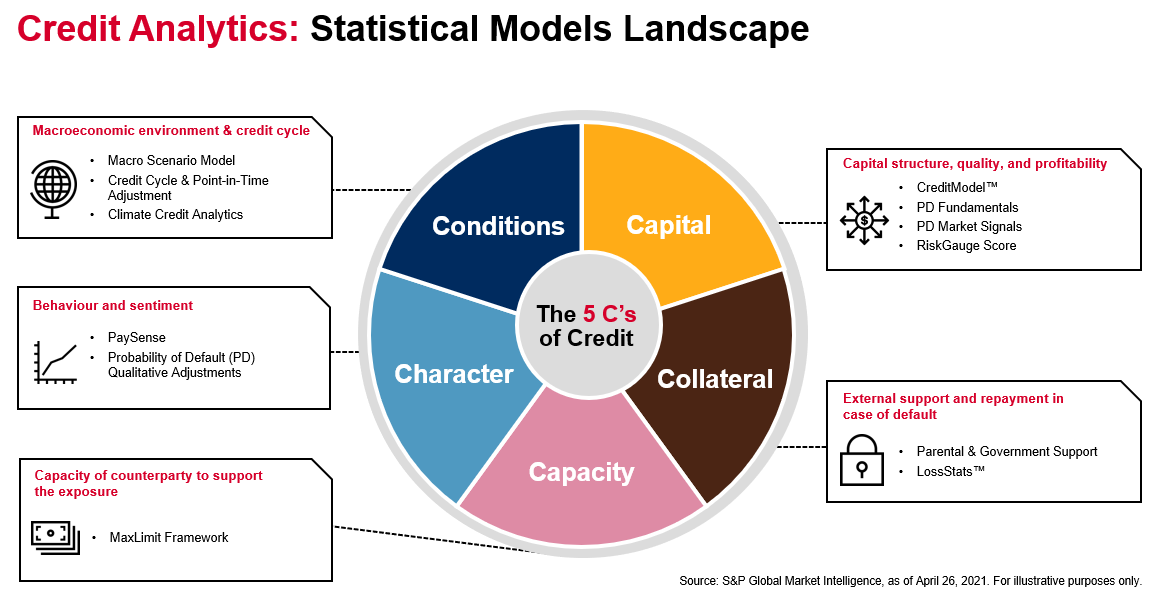

Credit Analytics’ Statistical Model Landscape

Cover all dimensions of credit risk through various analytical models and frameworks

Key Benefits

Members of the credit risk management team saw many benefits to utilizing Credit Analytics, including the ability to rely on:

- A well-recognized information provider trusted by risk management professionals around the world.

- A sound process for generating a credit score to assess an entity’s creditworthiness and monitor changes over time.

- Extensive coverage for SMEs and the ability to generate credit scores with limited financial information.

Integrated access via flexible delivery options and enterprise solutions to support streamlined and automated workflows.

[1] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global Ratings.

[2] All coverage numbers as of June 30, 2020.

Learn more about Credit Analytics

Click HereCorporate Credit Risk Trends in Developing Markets: A Loss Given Default (LGD) Perspective

Read More