Global markets have been mired by inflationary pressures, geopolitical disruption, and the threat of a potential recession for much of 2022. What lies ahead for 2023? In our recent Big Picture webinar, Nathan Stovall, Principal Analyst for S&P Global Market Intelligence’s Financial Institutions research team, shared an outlook for U.S. banks and insurers, including the impact that central bank policies will have on profitability, bank credit quality, and other insights from our Big Picture Outlook report for U.S. Financial Institutions.

Editor’s Note: the commentary and outlooks in this post were shared on November 17, 2022. They do not reflect any potential change in forecast from the intervening month.

Richard Neale – Managing Director, Financial Institutions Group, S&P Global Market Intelligence

Inflation has been the big story of 2022. Nathan, I'd love to get your perspective on central banks that are trying to bring down inflation. How are the hits going, and how is that impacting the financial sector?

Nathan Stovall – Principal Analyst, S&P Global Market Intelligence

Thanks, Richard. I think we want to take a step back first and talk about what got us here. We saw governments and central banks respond to the pandemic by flooding the markets with cash through unprecedented stimulus and aggressive loosening of monetary policy. Now, as economies have reopened and supply chain constraints have persisted in part because of the issue over the Russian invasion of Ukraine, inflation has reared its ugly head.

That prompted central banks to reverse course quite quickly with the Fed leading the way. The prospect of high inflation and the Fed's efforts to tame it through swift rate hikes – which have exceeded everything we saw during the last rate hike cycle in nearly one-sixth of the time – has prompted fears in the market that we've got a recession lying on the horizon, and possibly a deep one.

Those fears are somewhat warranted given the magnitude of change we've seen. Borrowing costs are much higher – about double what they were, and that's a big deal if you've got variable rate loans. Also the Fed's track record here is not that great [as] soft landings really haven't been achieved in the past. But there's some good news for sure. Many financial institutions have been waiting on higher rates for some time.

Historically, low rates pressured profitability for U.S. banks and life insurers. [They make] money primarily on spread, taking in primarily through deposits and lending out at a higher rate. When rates were near zero, funding costs declined but ultimately hit a floor. Yields on loans and securities continue to fall, [driving] severe margin compression.

Life insurers felt profitability pressures as well as lower rates left them with few attractive places to put cash to work in the bond market. Rate hikes are offering some relief, and we're seeing that play out now. Loans are repricing higher, investment securities are more attractive and funding costs are lagging rate hikes, which we think will allow U.S. bank margins to expand by nearly 30 basis points this year.

Higher rates are also good for life insurers since they make annuities more attractive, and they've actually offered very attractive rates relative to bank deposits thus far. Still, there [are] a number of headwinds out there, and we're certainly hearing plenty about those that have come with elevated inflation [and] the rate hikes that have followed.

First and foremost, we've seen much tighter financial conditions in the market and they force greater discipline from start-ups. That's really apparent with fintechs and tech-focused names who are focused on growth at all cost, but they've been forced to really shift towards profitability and expense control. We've seen them respond by conducting layoffs, which started in the summer of 2022 after many boosted headcounts in 2021. We see more of those recently and expect that trend to continue as companies try to right-size their operations and meet new investor expectations.

We also think that the property and casualty insurer space in the U.S. will post a combined ratio, which is losses on claims and other expenses against premiums earned in excess of 100% in 2022. That would be the first time we've been above 100% in five years, and that's meaningful because it means the industry is essentially not making money from an underwriting perspective. That's really been driven by the fact that supply chain issues have hit U.S. P&C premium growth and negatively impacted underwriting profitability, particularly due to the negative impact it's had on the auto business, the industry's largest business line.

The life insurance space is not [exactly] safe from slower growth in the future as well. They had a record year in 2021. Everybody was thinking about mortality and much of that continued through 2022. But we project that could decline by 50% in 2023 due to the prospect of higher employment, which will create top-line challenges for carriers that focus on workplace benefits. It should also be noted that more than 20% of life insurance business tends to come from major medical business, and that line would take a hit if unemployment rises.

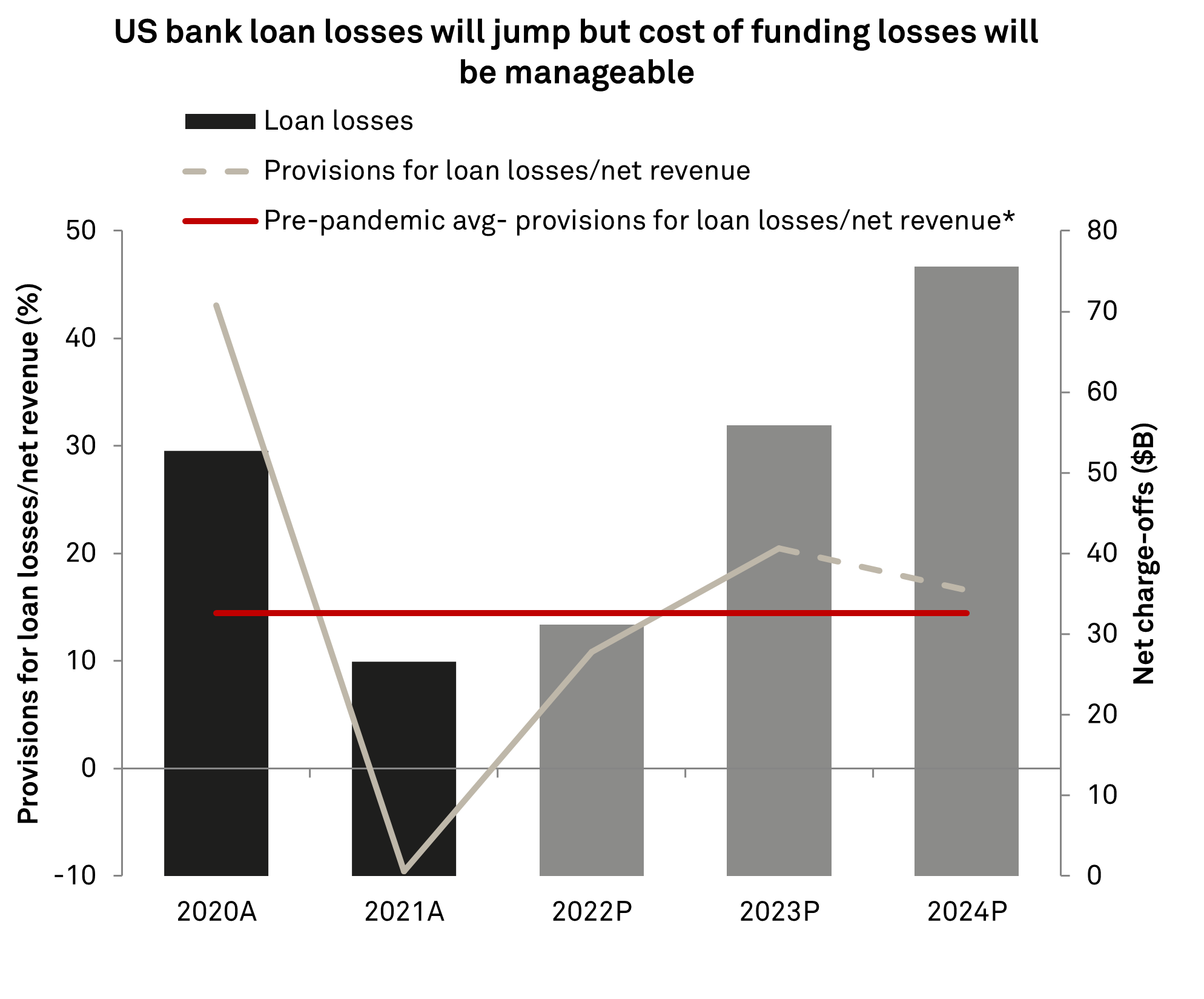

Lastly, we think bank credit is going to slip from current levels. The good news is that we don't really see any real signs of credit deterioration yet. The consumer is strong, has healthy balance sheets and unemployment remains low for now. We think [bank] credit will slip, and loan losses can jump nearly 80% next year.

As you can see in the chart, it's really a normalization of credit. We look at loan losses, the cost to fund loan losses through provisions and that cost relative to net revenue. Then, we show how our projections compare to the pre-pandemic average from 2013 to 2019. The reason why we look at this: loan losses come out of bank earnings. We want to show not only our expectation for loan loss growth, but the cost of funding those.

Graph 1: Bank Loan Losses & Provisions

Source: S&P Global Market Intelligence

Even with an increase, we think that cost will be manageable. Yes, it will rise above the pre-pandemic average, but not dramatically above the historical average. That stands very contrary to some of those bearish sentiments that you're seeing out there in the market today. [It’s] really a normalization of credit in line with what you might see with a regular downturn and maybe what we saw in 2001, but a far cry from the deep recession like the one that occurred in 2008.

Richard Neale

Thanks, Nathan. What's driving that confident view that you have around bank credit quality and that it's not going to deteriorate notably over time?

Nathan Stovall

It's a fair question because there are many signals flashing out in the market today, but bank management teams are not seeing any signs of distress with the borrowers and they're looking very hard. It's not showing up in delinquencies, early-stage indicators like criticized loans. We also saw stimulus drive savings to record highs during the pandemic. While consumers have been able to dip into those savings, they still have a large cushion [of] more than $2 trillion in excess savings accumulated during the pandemic.

That has allowed the consumer to be far, far less levered today. U.S. household debt-to-income stands at 9.5% – that's about two percentage points below the 40-year average. If you look at 2008, it was at 13.1%, so well above the historical average. It's pretty amazing what happens when you throw $10 trillion on the market. If things turn for the worse, in our mind, consumers aren't that stretched and has a cushion.

The other thing I'd say is [that] banks have been bemoaning the lack of loan growth in 2021 and 2022, so they hadn’t extended credit as much as we've seen heading into prior downturns. We are seeing the economy slow. Housing, in particular, has slowed considerably with the spike in mortgage rates, but supplies were not that big there so there's not this massive overhang. There's some pain to come, no doubt, in higher rates, and operating costs [weighing] on borrowers, particularly those with variable rate loans. All tougher conditions for sure and losses will go up, but we expect them to be manageable.