Global markets have been mired by inflationary pressures, geopolitical disruption, and the threat of a potential recession for much of 2022. What lies ahead for 2023? In our recent Big Picture webinar, Dr. Lindsay Newman, Head of Geopolitical Thought Leadership for S&P Global Market Intelligence, discussed the myriad impacts of Russia’s invasion of Ukraine, parameters of a potential ceasefire, what could be in store for both regional economies and the global economy, and other key takeaways from our Big Picture Outlook report on Economics & Country Risk.

Editor's Note: the commentary and outlooks in this post were shared on November 17, 2022. They do not reflect any potential change in forecast from the intervening month.

Richard Neale – Managing Director, Financial Institutions Group, S&P Global Market Intelligence

Lindsay, as we entered 2022, we were all looking for signs of recovery from the pandemic and COVID-19. Yet, Russia's invasion of Ukraine on the 24th of February really took us on a separate trajectory for the year. Can you put that into context for us? Where does it stand today, and what is that view for 2023?

Lindsay Newman, Ph.D., Head of Geopolitical Thought Leadership, S&P Global Market Intelligence

Thanks, Richard, and thank you for including me for today's session. As I've been telling clients many times this year, we always knew that Russian President Vladimir Putin's regional ambitions, his ambitions for his neighborhood, for the West and for NATO, was a long-standing and open test. We just didn't know when we were going to be taking that test.

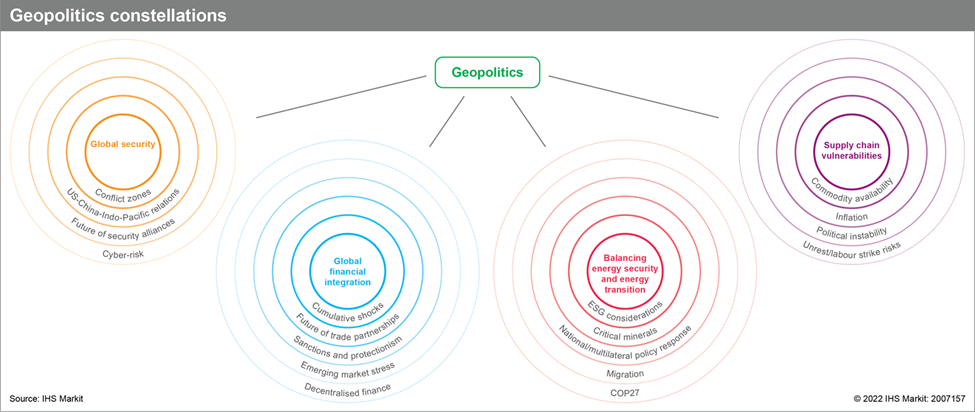

Since Russian troops crossed over to the border in Ukraine on February 24, Europe's near-term security outlook and its economic prospects have been thrown into the air alongside a host of geopolitical risks. Despite recent increasing calls for diplomacy, it looks like we'll be wrapping up 2022 and entering 2023 with the conflict in Ukraine active and ongoing.

What may have been intended by President Putin to be a targeted special operation has turned into something much more. It's launched energy security to the top of our agenda. It's reshaped regional and global economic outlook. It has, perhaps, put the U.S. back at the center stage in terms of being a global security power, and it's reconnected the U.S. and European alliance.

If we look at the conflict itself [and] our outlook for the conflict as [of the] 17th of November, Russia [is] likely seeking to escalate this bombardment of Ukraine that we've been watching, especially over this week and the last several weeks. This week, we saw bombardment in Kyiv as well as Dnipro, targeting critical national infrastructure, including energy infrastructure. This is really seeking to drive forward a negotiation process towards a ceasefire.

Ukraine, on the other hand, is likely pushing forward with its counteroffensive in Southern and Eastern Ukraine, building on the recent regaining of territory in and around the city of Kherson, which is really thousands of kilometers of territory regained.

We’re hearing these increasing calls around diplomacy. Just last week, President Zelenskyy said that Ukraine would be willing to negotiate with Russia under certain conditions, and that's the key here. Those conditions include restoration of territorial integrity, so reclaiming the territory; respect for the UN Charter; some reparations; prosecution for war criminals; and a guarantee that this would not happen again.

President Zelenskyy reiterated this again this week at the G20 Summit. But it's important to mention that if a ceasefire is reached, it would be a temporary freezing of the conflict at the current line of contact and it would be an ending of some, but not all kinetic operation.

The point is that a ceasefire could enable Russia to even regroup and restart an offensive as early as spring 2023. So, the bottom line is that a ceasefire would not necessarily mean the end of the conflict and certainly would not mean that the underlying drivers of the conflict have been resolved.

Richard Neale

Thanks, Lindsay. And one thing that you've mentioned actually a number of times is this whole theme of energy security. We've seen higher energy prices, particularly across Europe, and that's really pushed the cost-of-living front and center to many folks' agenda across the region. Take us through this. What is the likely impact, not just for countries, but also for the market and our customers in the audience today?

Lindsay Newman

As you say, Richard, Russia has been leveraging energy security as a second front to the conflict for months now. The intention is to destabilize Europe and weaken wider Western support for Ukraine. In fact, when Nord Stream 1 was cut off [in September], Russian officials actually connected gas flows to Europe with easing of Western sanctions.

This fall, high energy prices pushed forward the concept of this rising cost-of-living crisis to the center stage across the region. At the EU level, there's institutional level consideration of a variety of proposals, everything from benchmarking to a price corridor to price gaps. We think that the EU negotiation process is going to be protracted into 2023.

Alongside the institutional efforts at the EU level, we're also seeing national governments seeking to stem down these increasing energy prices. That also [involves] tax cuts, subsidies, and price caps, which [aim] to mitigate the household burden [and introduce] greater government interventionism, greater protectionism into regional energy markets.

These energy-saving measures have significant commercial impact, and we're hearing this every day from our clients. If we just take this EU mandate to reduce electricity consumption by 5% during peak hours and 15% in other times, that is going to raise adverse impacts on electricity-intensive sectors, electricity-intensive industries like energy production, fertilizer, basic metals, [and] public utilities.

The goal is really to protect households. We expect that critical infrastructure [and] activities like hospitals, law enforcement [and] water supply are likely to be prioritized while other noncritical activities will be most at risk. All this comes as we get ever closer to winter. We've been telling our clients that [it’s] something that none of us can control. The weather will really be a big factor in where we land into the spring.

We think that energy rationing needed in the event of an unseasonably cold winter will be a key tail risk to watch [regarding] economic activity across the region. A key date to watch for us is December 5, when the EU ban on imports of Russian oil is set to come into effect.

Richard Neale

Thanks, Lindsay. As we look to the [broader] global economic impact, things like supply chain disruptions [have been cited]. We've already discussed energy security, but we've seen surges in commodity prices. What are you seeing for 2023?

Lindsay Newman

What you said at the start [of the panel] was that going into 2022, the question on many of our minds is the pace of this COVID-19 recovery. Would it be linear? Would we have a smooth recovery out of the COVID-19 pandemic? And if you look back to indicators just before the Russia's invasion of Ukraine, like our S&P Global's Purchasing Managers' Index conducted just before the invasion, it was showing signs of optimism.

Russia's invasion of Ukraine has dashed hopes of this smooth linear recovery. There has [been] a very real impact [for Russia] because we've seen Western sanctions [and] a follow-on run of corporate self-sanctioning. All of this has dislocated Russia from the global financial economy and sent forward a contraction in Russia for this year [that] we expect into next year.

For Ukraine, the casualties, the infrastructure disruption, and mass population exodus out of Ukraine into Europe have also sent Ukraine's real GDP into a very significant contraction for 2022. In addition to these direct effects that you've highlighted for us, the invasion by Russia into Ukraine has been threaded into the global economy through supply chain disruption and increasing commodity price surges, particularly across metals, agriculture, and the energy space.

Back in March, we were calling this the “everything rally”, and I think it's a very striking term. Prices have since come down from those highs, but inflation has proved perhaps more persistent, more stubborn than many expected. We now have global consumer price inflation at 27-year highs, and this has been particularly accelerated across Europe.

One of the big trends has been efforts by central banks to curb inflation and tighten monetary policy. But high inflation and these energy constraints are creating these headwinds for the global economy. As you say, my team – Economics & Country Risk – will release its Top-10 Economic Forecast for 2023 and share [the results] in a webinar on December 8.

We see annual real GDP growth contracting, flowing from 6% in 2021 (when we saw that rebound from 2020) to below 2% in 2023. For Europe, we are expecting a recession to begin late in 2022 or early Q1 of 2023. It appears increasingly likely. There's a significant probability of protracted weakness, given these rising debt burdens off the back of national efforts to stem the tide of energy prices and the cost-of-living crisis.

To tie everything I've said together, a key trend to watch in 2023 is how well the unity that we've seen within Europe, [and] between the U.S. and Europe, hangs together as these risks, energy security risks, [and] the economic headwinds continue to bite.