On the 25th of August 2020, S&P Global Market Intelligence hosted a webinar on the impact of COVID-19 on corporate credit risk and International Financial Reporting Standard 9 (IFRS 9) implications. We were joined by:

- Gregg Lemos-Stein, Managing Director and Head of Analytics at S&P Global Ratings who discussed COVID-19 and the Shape of recovery for rated corporates in Europe.

- Luka Vidovic, Associate Director, Credit Risk Solutions at S&P Global Market Intelligence, who discussed the European macroeconomic scenarios and the impacts on credit risk of unrated entities.

- Inna Popesku, Director, Credit Risk Solutions at S&P Global Market Intelligence. Inna will present the impact of changing macroeconomic environment on IFRS 9 impairment calculations.

Read the full transcript and discover which industries have been the most and least impacted from a probability of default (PD) perspective, sector level impact and credit recovery for rated entities, what to consider when looking at the macro-economic factors and the impact on point-in-time PDs for IFRS 9 calculations plus, many more insights.

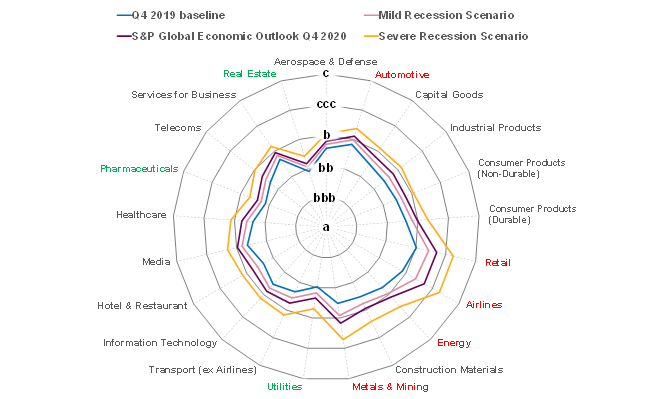

Industry Risk Radar - S&P Global Market Intelligence’s Macro-Scenario model

Notes: The analysis includes the following countries: Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Poland, Portugal, Spain, Sweden, and the United Kingdom. Median credit score for each respective industry. Industries highlighted in red are projected to experience the highest relative and absolute increase in credit risk across all three scenarios. Industries highlighted in green are projected to experience the lowest relative and absolute increase in credit risk across all three scenarios.

Source: S&P Global Market Intelligence. As of July 23, 2020. For illustrative purposes only .

Learn more about Credit Analytics

Request DemoCoronavirus Insights: An Outlook on Corporate Credit risk in Europe and IFRS 9 Implications

Watch On Demand