Understanding the Risks with Net Asset Value (NAV)-Based Lending

NAV-based Lending is on the Rise

Demand for NAV-based lending surged in the 18 months prior to mid-2021, spurred on by private equity funds' need for cash for portfolio companies in the face of the pandemic.[1] This tool complements subscription lines, which are commonly used as the first lending mechanism in the life cycle of a fund. As the name implies, NAV-based lending typically requires fund investments. NAV facilities are usually set with a loan-to-value test, which is then calculated so as not to exceed a certain percentage of a fund's net assets.

Prior to the pandemic, discussions were largely around using the facility for "upstreaming", enabling funds to get distributions back to their investors sooner. But as managers sought liquidity to protect underlying assets following the initial lockdown, interest in NAV financing grew. As the dust settled, managers saw opportunities for expansionary M&A, and NAV-based lending offered a tool to enable them to execute such strategies without requiring additional equity. Independent of the pandemic, there was also an increasing number of specialist providers or secondary funds offering NAV financing, and this influx coincided with an increase in demand.

Today, private investment funds across all asset classes are increasingly taking advantage of NAV financing to improve fund returns or achieve other objectives. According to Preqin,[2] funds have a combined $9tn U.S. in unrealized value, a massive market that is growing exponentially. As such, Preqin says, NAV financing is predicted to be ubiquitous among private equity funds within the next five years. Fueling this trend will be the growing demand for NAV credit that is increasingly being met by more and more specialized NAV lenders. Recent NAV lending M&A activity, specific fund launches and use as a sub-strategy for limited partner private credit allocations have substantiated NAV lending’s continued growth.

As Use Increases, So Do Risks

As Alternative Investment Funds (AIFs) mature, greater transparency is needed. This is especially the case given the NAV-lending trend with more funds accessing loans from banks and other financial institutions to boost their leverage. This increased leverage within the AIF universe poses potential credit risks to various counterparties that provide fund financing. As a result, it is important for these counterparties to effectively evaluate the credit risk of an AIF.

But Lenders Face Challenges with AIF Credit Risk Analysis

There are many challenges with AIF credit risk analysis:

- The AIF universe comprises mostly unrated entities and transactions, so there is not an assessment of credit risk readily available.

- The NAV facilities enable sponsors to cherry-pick provisions from the underlying eligible portfolio of assets, as per leveraged credit agreements. This makes it difficult to have a consistent method/guidance on calculating the asset value at stress and the leverage (i.e., loan-to-value (LTV) ratio).

- An important factor for the LTV ratio is the diversification of the underlying loan portfolio. The more diversified the loan portfolio, the more favorable the LTV terms may be for the borrower. However, incorporating the portfolio concentration/diversification into credit assessments and/or pricing is not straightforward and transparent.

- Regulators may sharpen their focus on AIFs given concerns about how the use of leverage within the AIF sector may contribute to the build-up of systemic risk in the financial system.[3]

Leveraging S&P Global Market Intelligence’s AIF Scorecard

S&P Global Market Intelligence’s Credit Assessment Scorecards provide a valuable framework for assessing credit risk, including access to benchmarks and attribute-driven scoring guidelines.[4] The AIF Scorecard provides an easy-to-use, intuitive structure to evaluate the creditworthiness of funds and assess the credit risk of an AIF’s debt instruments.

The AIF Scorecard is an Excel®-based model that provides a consistent framework for calculating credit risk, with the ability to identify default risk through both quantitative and qualitative factors tailored for AIFs. Users can generate probability of default (PD) values for the portfolios being analyzed and perform sensitivity analyses, scenario analyses and stress tests. They can also refine their view of stressed leverage on specific risk factors, including concentration, market risk, risk of strategies and more. The solution generates credit scores that are designed to broadly align with S&P Global Ratings credit ratings, supported by historical default data back to 1981.

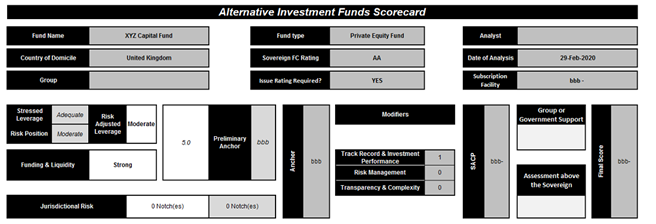

As shown in Figure 1, the AIF Scorecard provides a granular and transparent framework for assessing credit risk. It incorporates measures that can affect the likelihood of default, which are sensitive to changes in an AIF’s market conditions. This includes:

- Stressed leverage

- Risk position

- Funding and liquidity

- Jurisdiction risk

- Fund track record and investment performance – risk management

- Transparency and complexity

Figure 1: The AIF Scorecard

Source: S&P Global Market Intelligence. Simplified version for illustrative purposes only. SACP = Stand-alone Credit Profile

The AIF Scorecard includes a comprehensive handbook and standardized framework that provides guidance on the stressed leverage calculation to understand the LTVs for NAV facilities. Technical documentation is available that describes the analytical/statistical processes used to develop the underlying model, identify the data used in construction and provide testing performance results. Scorecard implementation and application training workshops are also provided, along with ongoing analytical and operational support.

To learn more about S&P Global Market Intelligence’s AIF Scorecard, contact us here.

_________________

[1] “PE houses accelerate fund-secured solutions in the wake of the pandemic”, S&P Global Market Intelligence, April 12, 2021.

[2] “Fund Finance: The next generation”, Preqin, September 28, 2022, www.preqin.com/insights/research/blogs/fund-finance-the-next-generation.

[3] “ESMA consults on guidance to address leverage risk in the AIF sector”, European Securities and Markets Authority (ESMA), March 27, 2020, www.esma.europa.eu/press-news/esma-news/esma-consults-guidance-address-leverage-risk-in-aif-sector.

[4] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.

Learn more about our Credit Assessment Scorecards

Click hereFund Financing Through a Credit Lens Credit Risk Factors for Alternative Investment Funds AIFs

Read More