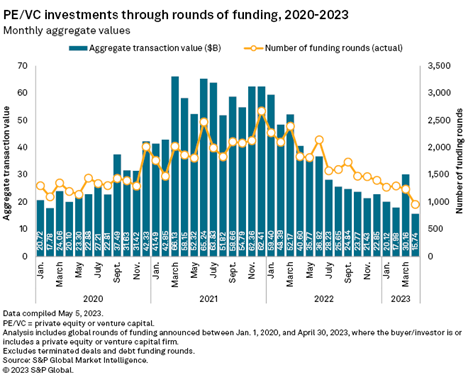

Other than Microsoft’s investment in OpenAI, the first quarter of 2023 has been the worst quarter for venture capital and early stage investing in 5 years, with the startup industry struggling to raise funds and stay afloat. Venture capital (VC) funding in startups has seen a significant decline, with funding cut in half across North America with Europe also being affected. What’s more, according to Preqin data, VCs had raised over $540bn of ‘dry powder’- funds they have yet to invest – at the end of Q1, which is an all-time high for the industry. This suggests that the funding is available, but that VCs have lost faith in startups to responsibly manage their investments. In fact, April totals for both value and volume of funding rounds were the lowest in any month since January 2020.

In this blog, I will outline the likely reasons behind this downturn and what it means for the startup industry and new CEO’s trying to take their ideas to market.

The tech industry, which has been a major driver of the startup industry, has seen a significant downturn in recent years. This, alongside worsening macroeconomic conditions, has diminished enthusiasm for riskier investments, leaving startups with a pressing need for capital. As a result, they often have limited options - pursue unfavorable debt deals, accept a decline in their valuation, or potentially face insolvency."

Even before Silicon Valley Bank (SVB) and First Republic collapsed, we were seeing unfavorable business environments for founders and early-stage investors. As many founders are young or new to their industry, they have likely never experienced a prolonged bearish market. After the SVB collapse, it became evident that while founders were successful in raising cash, they didn’t have strong strategies in place to manage the risk that comes with it. Traditionally, you would expect a business to grow into money over time, but the post-pandemic tech frenzy saw a flow of funding into the startup scene, which resulted in cash reserves that far exceeded the needs and size of a company. In some cases, startups were dealing with $200+ million dollars in cash to manage a business with 20 employees.

It's understandable that founders initially forego traditional risk management when they are on the cusp of launching a breakthrough product and strategizing for continued growth. But, one can only hope that following the SVB collapse, they are learning their lesson, especially as investor confidence in the startup industry is rapidly changing. While there is no single fix for these issues, it’s necessary that startups develop a long-term cash strategy, including investment in a professional finance team. While it can be hard to find a CFO experienced in tough economic conditions like prolonged inflation, it’s crucial for long-term success. And soon, it may be a barrier to entry as investors increase their demands to have experienced finance teams in place to manage the cash they are investing.

As startups continue to run out of cash, struggle to raise funds, and succumb to the consequences of poor cash management, investors that once looked to capitalize on rising tech valuations are becoming increasingly cautious. To survive this tough environment, founders are forced to cut back on operations or pivot their business models. In many cases, they are agreeing to terms of funding that aren’t as favorable as they once were, like higher equity stakes or lower valuations, which discourages founders from scaling up on their ideas.

If you're already an S&P Capital IQ Pro subscriber, you can access our Dry Powder & AUM Trends data and our Fundraising Trends here

Build a 360° view of the private markets with the combined insights, data, software, and tools from S&P Global and IHS Markit.

Find out more