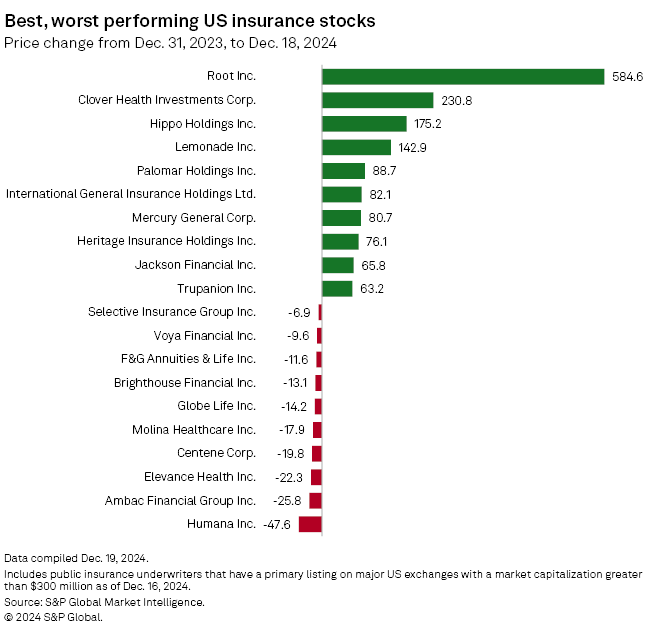

Insurance technology companies were some of the best performing US insurers on Wall Street over the course of 2024, while the managed care sector had a less resilient year.

Root Inc., Clover Health Investments Corp., Hippo Holdings Inc. and Lemonade Inc. were the top four performers for insurers with a market cap greater than $300 million for the year, with each seeing shares grow by triple-digit percentages, according to an S&P Global Market Intelligence analysis.

CreditSights analyst Josh Esterov said in an interview that he felt it important to "contextualize" the top four's recent performance. Although shares grew in 2024, Esterov said that at least for Root, Hippo and Lemonade, it was partially fueled by some "recent recovery" related to recuperation in the retail auto space as well as improvements on the regulatory front for homeowners insurance.

"It's not necessarily the case that this is some kind of resounding approval for the business model, because in a historical context, all of the names are basically still trading down," Esterov said.

Top performers

Root conducted an IPO in October 2020 at $27 per share, and its stock performed poorly leading to the company's decision to complete a 1-18 reverse stock split.

Root's stock struggled to gain ground in the year after its reverse stock split and was declining, ending 2023 at $10.48. In February, the stock's performance started to take off and it closed Dec. 18 at $71.75 per share, roughly a 585% increase over the course of 2024.

Lemonade's IPO was at $29 per share in July 2020. The company's shares ended 2023 trading below their IPO price at roughly $16, though the stock has jumped since to $39.18 as of business close Dec. 18, reflecting a 142.9% gain over the course of 2024.

Root and Lemonade were also among the most shorted US insurance stocks in the first half of 2024.

Hippo started trading shares Aug. 3, 2021, after merging with a special acquisition purpose company, and its stock struggled. The company carried out a reverse stock split of 1-25 in September 2022. At the end of 2023, Hippo shares were trading at about $9 and they finished at $25.10 as of Dec. 18 close.

Clover went public through a SPAC in 2021. Clover's stock finished 2023 trading at 95 cents. Even though the stock has seen a 230.8% increase over the course of 2024, Clover shares are trading at $3.15, which is far below its first day of trading in January 2021, when it closed at $15.90.

2024 losers

Several managed care insurers finished 2024 with the worst stock performance across the insurance industry.

Esterov said the trend was fueled by a number of factors, including operational challenges in Medicare and Medicaid. Elevated utilization rates of Medicare are negatively impacting margins for providers, and it is particularly an issue for Humana Inc., Esterov said.

Humana also faced troubles this year as the company revealed in October that changes to the quality ratings of its Medicare Advantage plans would hurt future bonus payments the company receives from the US government.

Humana's shares posted a decrease of 47.6% and were trading at $239.85 as of the close of business Dec. 18. Humana did not respond to a request for comment by the time of publication.

Health insurers also saw their stocks decline following the killing of UnitedHealthcare Inc. CEO Brian Thompson in an attack that appears to have been targeted.

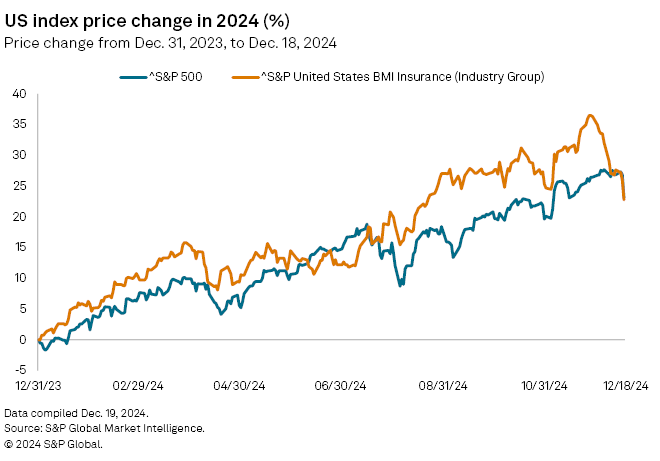

Industry performance

For the majority of 2024, the S&P US BMI Insurance Index was outperforming the broader market. However, both the insurance index and the S&P 500 saw a similar drop around Dec. 18, the day the Federal Reserve cut interest rates and signaled that it would slow the pace of future cuts in 2025.

In 2024, the S&P US BMI Insurance Index saw a 22.8% increase as of the close of business Dec. 18, while the S&P 500 grew 23.1%.