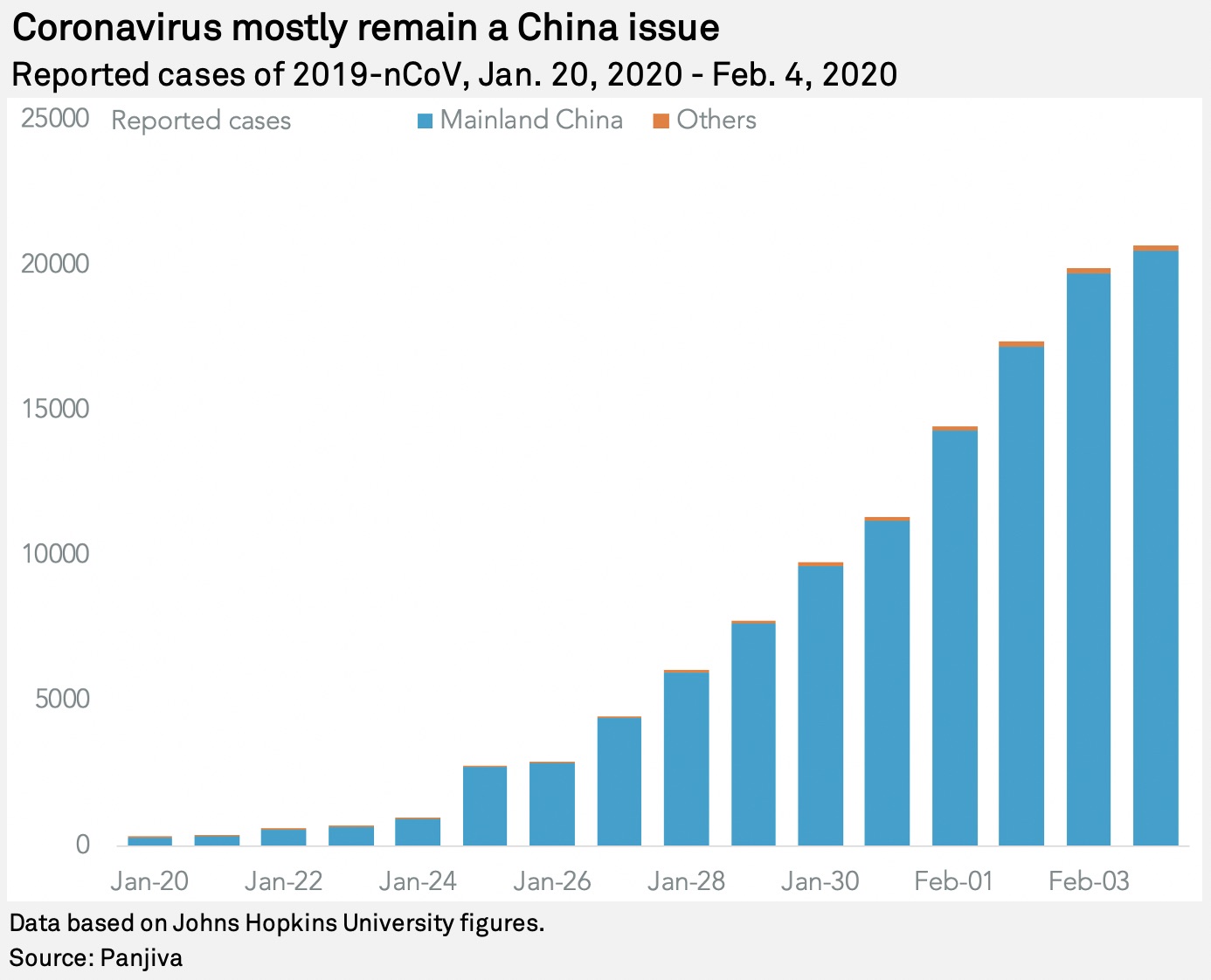

The spread of the new coronavirus has continued and reached nearly 25,000 cases, Panjiva's analysis of Johns Hopkins University data shows. While predominantly still an issue in China — which represents 99.0% of cases identified — there is already noticeable impact on the global shipping industry. As outlined in Panjiva's research of Jan. 31, that is being driven in part by the extension of the Lunar New Year holiday factory shutdowns through Feb. 9 in many cases.

|

Almost all areas of the logistics industry could be affected. From an administrative perspective, shipping companies' operations are facing holdups because of crew not being allowed to disembark if the vessels have visited China, according to S&P Global Platts.

The container-line industry is already considering canceling specific sailings. Both Maersk and CMA-CGM are already implementing plans for reducing Asia-to-Europe capacity, while Ocean Network Express has indicated weaker demand may lead to additional shipping route reductions in the first quarter.

Similarly, shipping from Asia to Europe may be limited by Russia's decision to close the land border with China, potentially restricting rail-based shipping, according to the Financial Times.

Freight-forwarding companies may face the impact more keenly. On top of restrictions to seaborne shipping, there is also a reduction in airfreight capacity to deal with as a result of reduced "belly cargo" shipping in passenger jets.

Flexport notes that could lead to reduced capacity and increased/volatile shipping rates. The firm has also flagged that shipping via the Yangtze River that passes through Wuhan — the epicenter of the coronavirus outbreak — could be disrupted.

DP-DHL has said road-based freight through the region will also be disrupted. CH Robinson has cautioned that once factories do reopen, there could be a surge in shipping and shortage of capacity, The Loadstar reports.

Panjiva's data shows that Flexport Inc. is more exposed than Deutsche Post AG's DHL on U.S.-seaborne import routes from China. Shipments from China accounted for 52.2% of Flexport's volumes in 2019, led by shipments from Guangdong province and minimal direct shipments from Hubei. For DP-DHL, meanwhile, China represented just 31.4% of shipments and has been led by shipments from Jiangsu and Guangdong, while shippers from Hubei directly represented just 0.4% of the total.

|

Auto shipping may feel the pain on a global basis. Indeed, DP-DHL notes that Wuhan is known as China's version of Detroit.

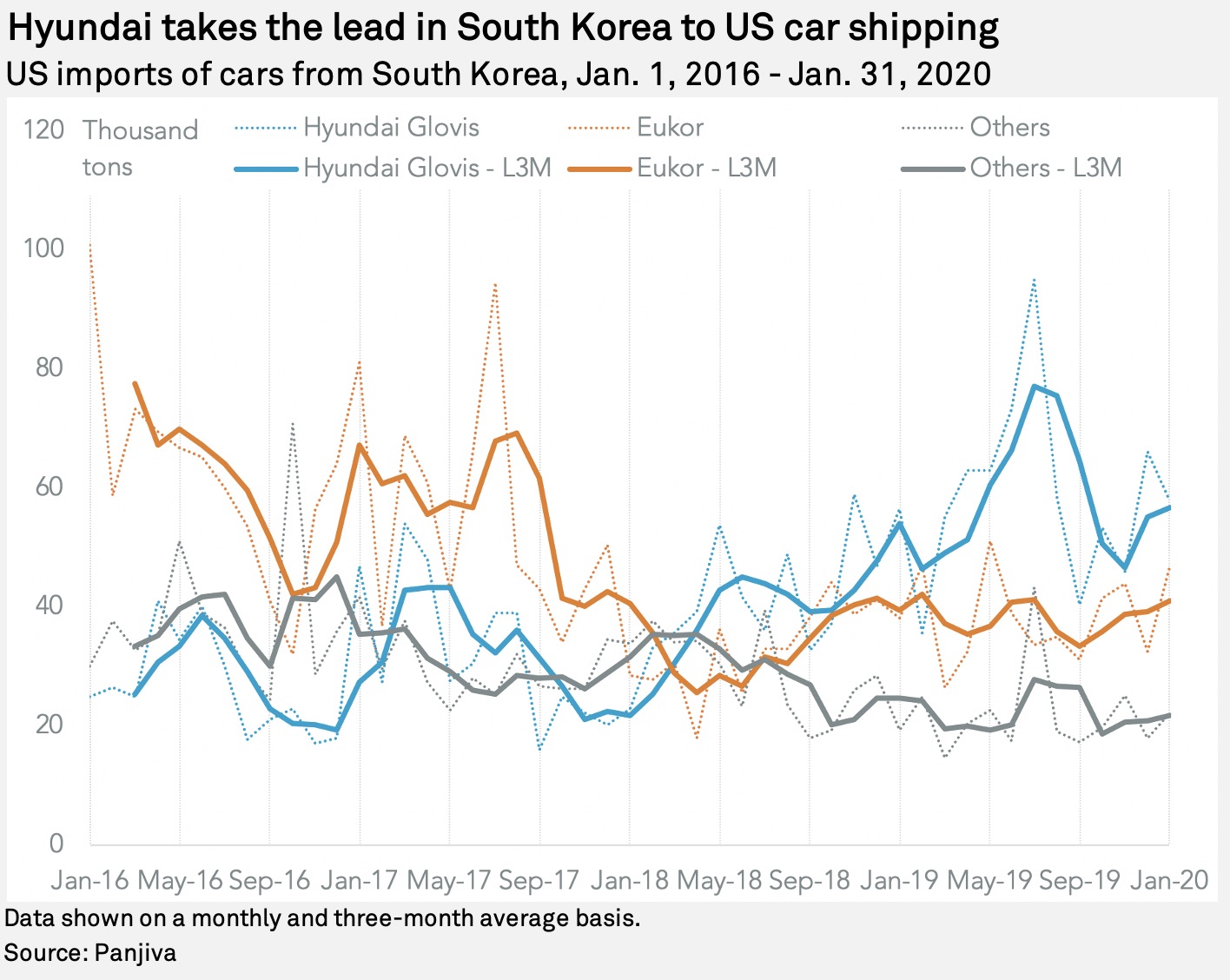

There is already signs of the impact spreading through automotive supply chains directly. For example, Hyundai Motor Co. has stopped production of vehicles in South Korea in response to parts shortages, according to Reuters.

That's likely to mean that car carrying firms will also see a slowdown in business. Leading carriers on South Korea to U.S. lanes in 2019 were Hyundai Glovis Co. Ltd. with a 49.4% share of volumes and Eukor (controlled by Wallenius Wilhelmsen ASA and Hyundai) with a 32.2% share. Shipping on South Korea-to-U.S. routes has accelerated recently with an 11.6% surge in deliveries in January compared to a year earlier following a 1.5% rise in fourth quarter. The January figures are likely to be flattered by the earlier-than-normal Lunar New Year.

|

Panjiva and S&P Global Platts are both owned by S&P Global Market Intelligence.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.