Download The Full Report

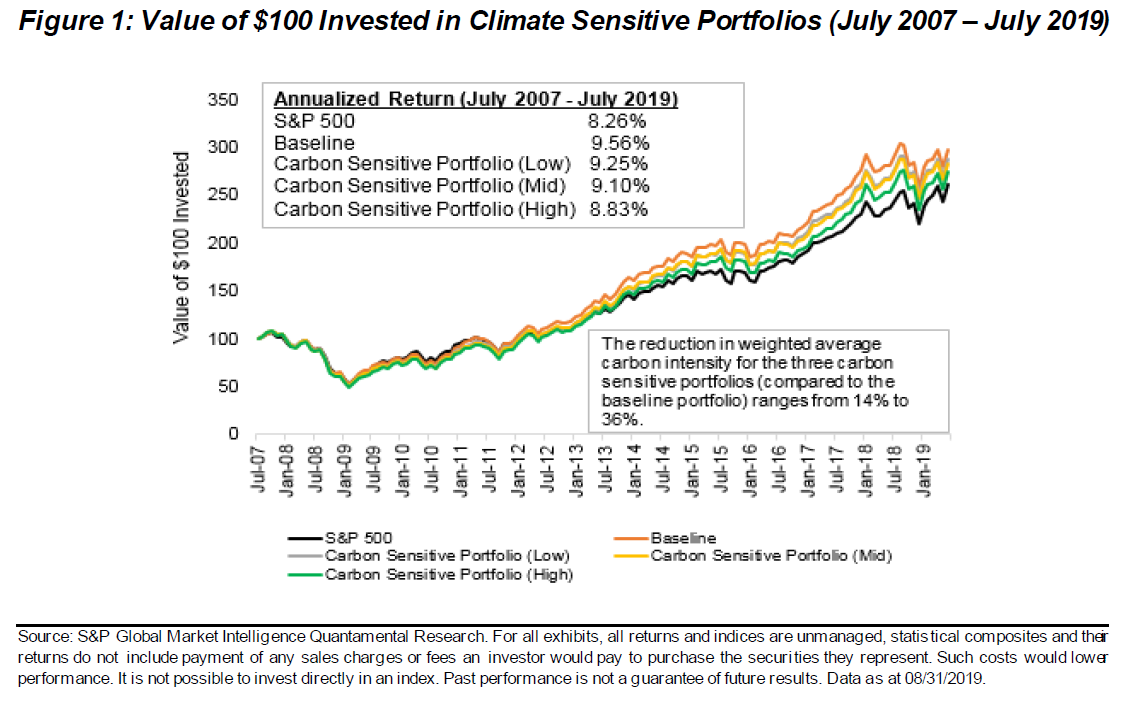

Click HereThe value of global assets with an environmental, social, or governance (ESG) focus topped $1 trillion in the first half of 2020, as the largest institutional investors and companies pledged to tackle climate change and address social issues. Despite this growth in ESG assets, incorporating ESG factors in equity portfolios is perceived to lead to lower returns. Almost half of institutional investors polled in a 2019 investor survey cited the performance of sustainable strategies as an area of concern. Does sustainable investing come at a “cost”, and is the fear of investors around the performance concessions of “green” portfolios warranted? Our research suggests investors’ fears are misplaced – carbon sensitive portfolios have similar returns and significantly better climate characteristics than portfolios constructed without carbon emission considerations (Figure 1).

In this research, we created a “baseline” portfolio and three carbon sensitive portfolios. The baseline portfolio (described in Appendix B) ignores a company’s carbon intensity (CI) when selecting stocks, while the carbon sensitive portfolios target increasingly stringent levels of CI (carbon intensity facilitates the comparison of greenhouse gas emissions across firms of different sizes).

The conclusion from Figure 1 is that incorporating carbon intensity in a stock selection process does not detract from portfolio performance. All three carbon sensitive portfolios produce comparable returns to the baseline portfolio with all the return differences statistically indistinguishable from zero. Carbon sensitive portfolios are typically comprised of highly profitable companies (Table 1), as optimizing energy use through the use of new energy efficient equipment, or adopting energy conservation policies can lower operating expenses.