Sports-camera maker GoPro Inc. reported fourth-quarter 2019 earnings below analysts' estimates, Reuters reports. There were a variety of drivers, according to CEO Nicholas Woodman, including "some retailers had some softness" but "there's nothing conclusive that we've identified that would explain why we came up a little bit short" particularly in regard to the firm's HERO8 product.

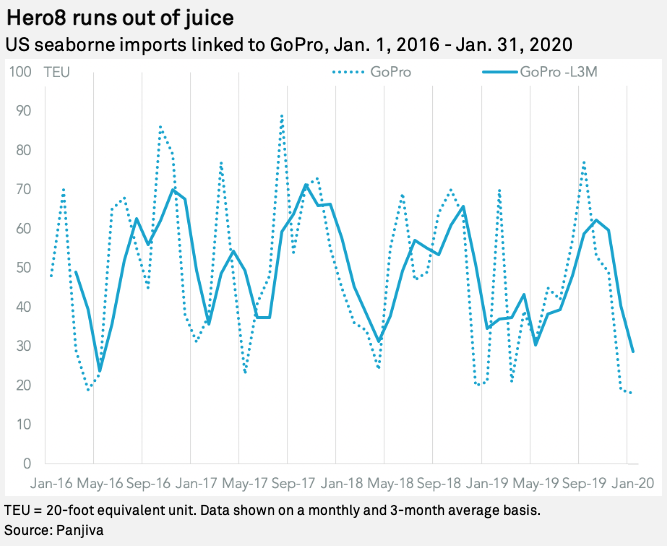

There was an apparent weakness in imports throughout the quarter — Panjiva's data shows U.S. seaborne imports linked to the company fell by 30.8% year over year in the fourth quarter. Imports in January — historically a trough — have continued the decline with a 14.3% slide.

|

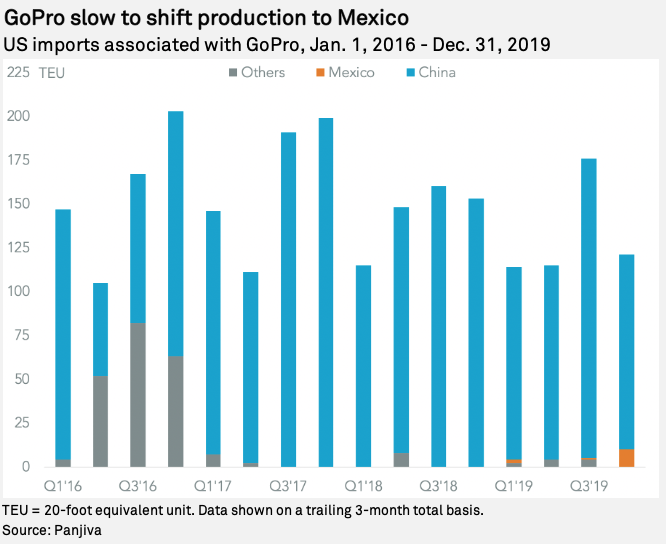

On top of soft demand the firm has had to deal with results that were "negatively impacted by tariffs and freight costs associated with our HERO8 Black production delay," CFO Brian McGee has said. As outlined in Panjiva's research of May 14, the firm has started to shift the production of cameras for the U.S. market to Mexico.

The process has been slow going. While U.S. imports from China fell by 27.5% year over year in the 2019 fourth quarter, imports from Mexico have come to represent just 8.3% of the total. The delay may be one reason why the company has submitted requests for exclusion from section 301 duties for 13 products including enclosures, batteries and accessories for their cameras as discussed in Panjiva research of Feb 5.

|

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.