President Trump's chief trade adviser, Peter Navarro, has raised concerns over America's reliance on healthcare product imports from China in light of the spread of the new coronavirus, the Financial Times reports. While a long way from a formal change in policy, it shines a light on the rising healthcare imports to the U.S. from China.

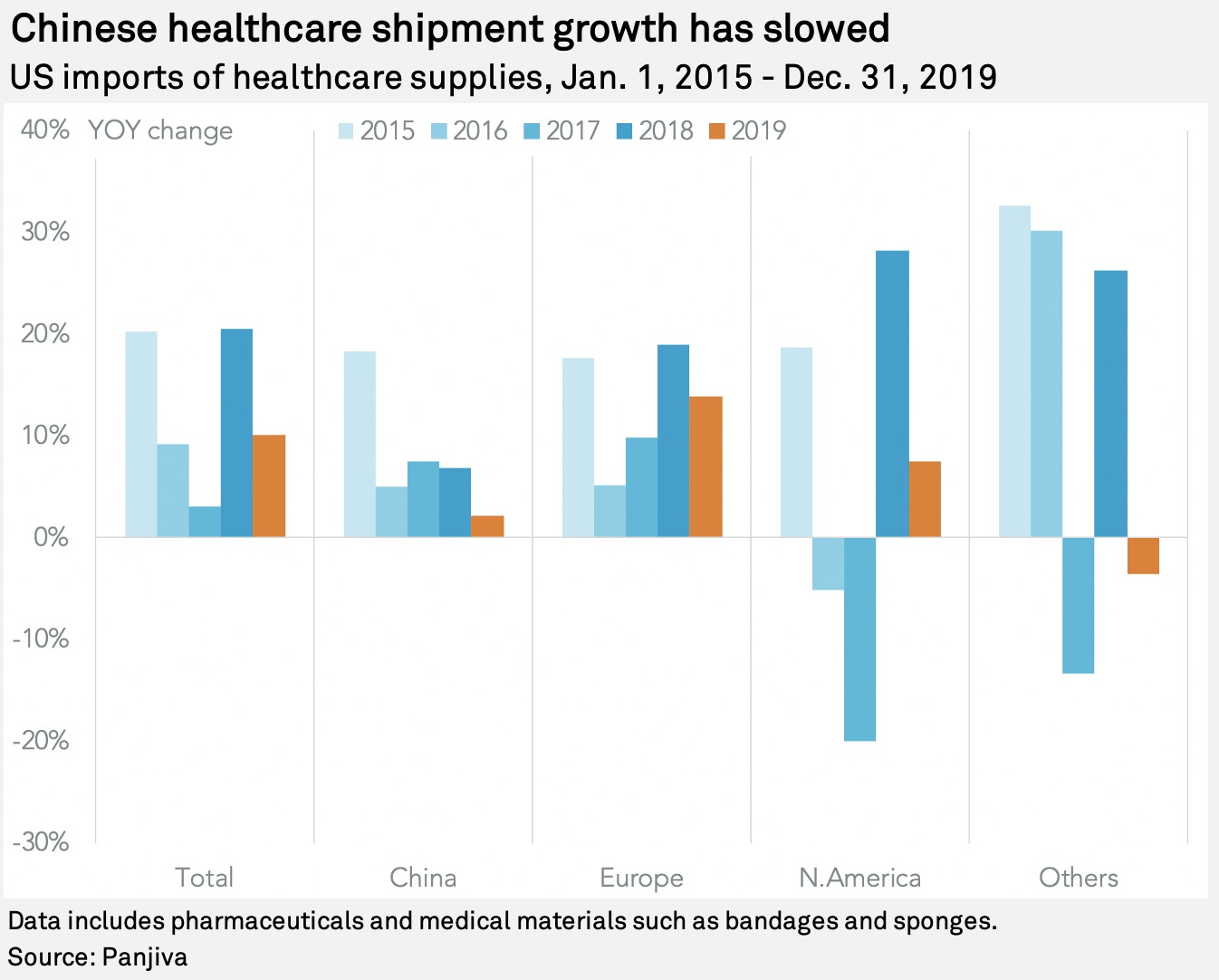

Panjiva data shows that U.S. imports of all healthcare supplies — including pharmaceuticals and disposable supplies under HS 30 — were worth $132.2 billion in 2019, with China representing just 1.2% of the total. A growth of 2.1% lagged the 10.0% growth in the total where imports are led by Europe, which represented 77.4% of the total.

The Trump administration faces a tough balancing act. The pharmaceutical sector is a critical part of the U.S.-China phase 1 trade deal, as discussed in Panjiva's Jan. 20 research. Additionally, the administration has previously outlined plans to allow increased imports to manage total healthcare costs down.

|

Certain products have a higher exposure to China. Imports of surgical supplies — including bandages — included shipments from China equivalent to 39.4% of the total after a 14.1% expansion in 2019. Within that, nearly all laparotomy sponges are sourced from China. Similarly, China represented 43.1% of U.S. imports of heparin and related salts.

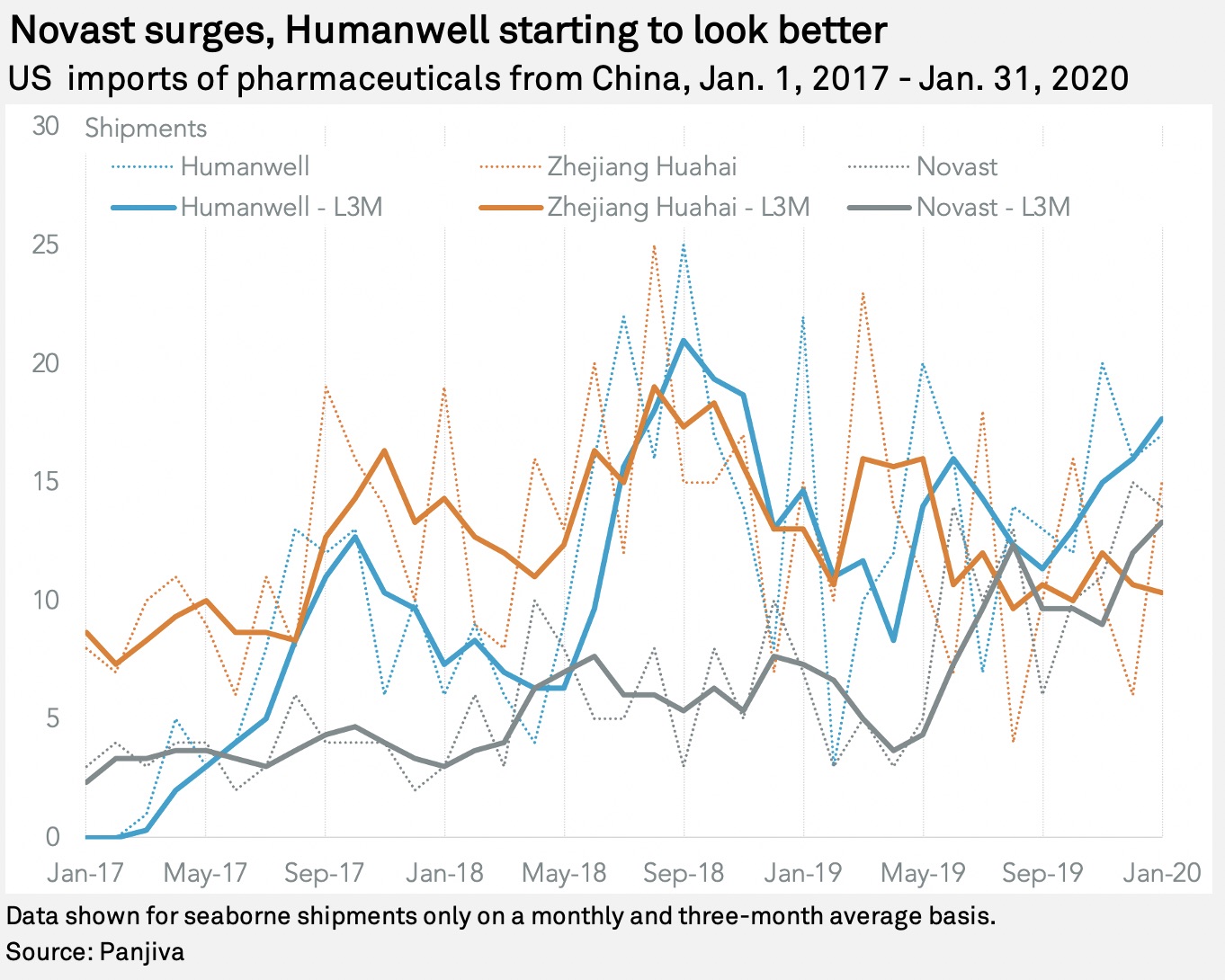

Chinese suppliers of healthcare products have seen a diverse performance recently. Among the major shippers, Humanwell Healthcare (Group) Co. Ltd. saw growth in U.S. seaborne imports linked to the firm grow by 23.1% year over year in the fourth quarter of 2019, though that has reversed to a 22.7% slide in January.

Drugmaker Zhejiang Huahai Pharmaceutical Co. Ltd. has seen a steady decline throughout 2019, including a 17.9% drop in the fourth quarter, with no signs of recovery in January. One winner though has been Novast Pharmaceuticals Ltd., which saw growth throughout 2019, including a 56.5% jump in the fourth quarter and a doubling of shipments in January.

|

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.