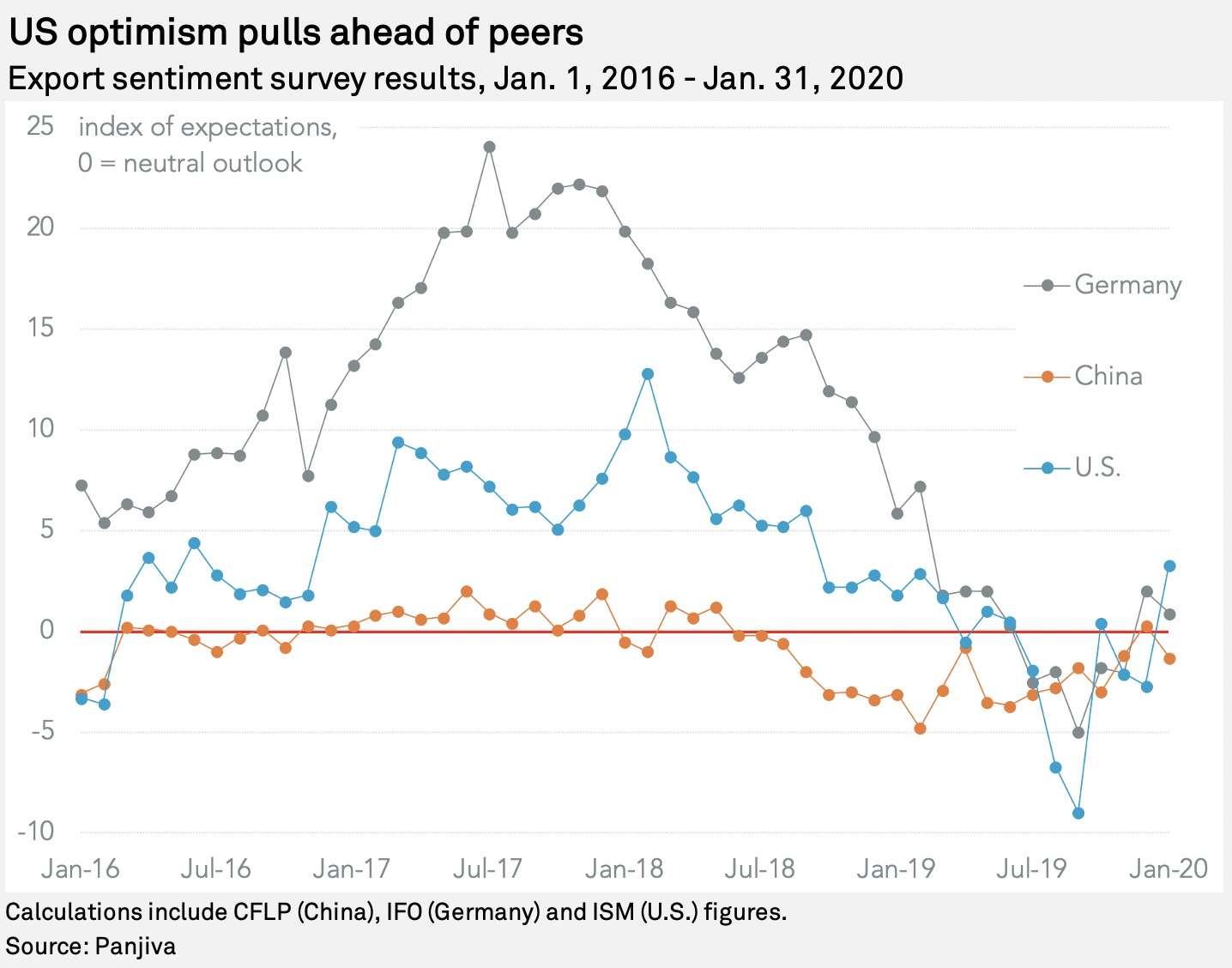

U.S. business attitude toward international trade rebounded in the latest Institute for Supply Management survey. Panjiva's analysis of ISM data shows that new export order sentiment jumped to 53.3 — where a figure above 50 indicates an increase in orders — from 47.3 a month earlier. That was the best result since September 2018.

The phase one U.S.-China trade deal likely drove the improvement. As outlined in Panjiva's recent research, the deal countenances a surge in Chinese purchases of a wide range of manufactured and commodity goods including energy and food.

The increases implied by the $200 billion headline rise in 2020 and 2021 compared to 2017 would require a $76.1 billion year-over-year increase in Chinese imports from the U.S. in 2020 versus the 12 months to Nov. 30. In turn, that would add 4.6% to total U.S. exports of all products.

|

While the outlook for later in 2020 may be bright, there are challenges in the short term. The spread of a new coronavirus has already taken a toll on factory and consumer activity in China, cutting the potential for increased exports of manufactured products in the near term. It also raises the prospect of an interruption in supplies to U.S. businesses — that can be particularly sensitive for companies operating just-in-time supply chains.

The pessimism in China can already be seen in the recent China Federation of Logistics and Purchases survey, which showed a return to negative expectations for exports and imports. The latter is likely a result of the interruptions caused by the factory closures. Sentiment in Germany, meanwhile, is modestly positive — though slightly less than a month earlier — after Brexit was set to proceed in an orderly manner.

|

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.