With the price of West Texas Intermediate (WTI) in the mid-forties, oversupply concerns and the continued threat of a global slowdown have led many to fear a resumed oil price decline. The year-to-date performance of Oil & Gas (O&G) companies, particularly Integrated O&G entities has been strong, further contributing to concerns that oil may be poised to retrench.

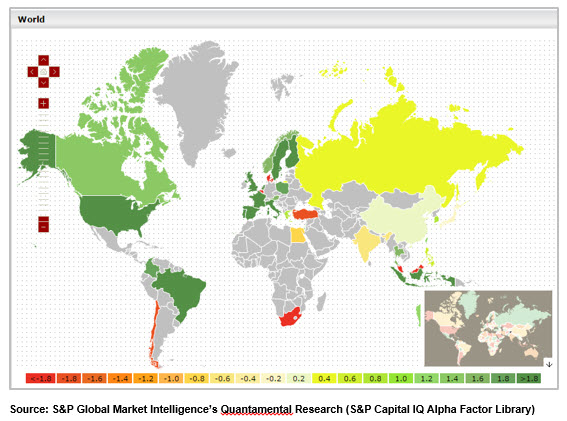

The heat map below shows the performance of the Energy Sector relative to the S&P Global BMI Index for each country. The darker green signifies stronger performance relative to the local market.

Leveraging the S&P Capital IQ Alpha Factor Library, containing over 500 equity strategies, this brief explores the following questions that should aid investors in positioning for a decline in oil prices:

- Which strategies or factors have historically been the best performers in an oil price decline regime?

- In the most recent oil price decline regime, how did those strategies fare versus the longer term history?

- Were there strategies that worked in the recent oil price decline environment that had not been effective historically?