Download The Full Report

Click HereNo simple remedy for gender discrimination exists. But the first step in solving any problem is collecting the data to understand it. Prior installments in this series have revealed both expected and unexpected insights into gender diversity. This research shows firms that share their data on diversity, equity, and inclusion (DEI) have taken further steps to address gender equity concerns. The S&P Global Corporate Sustainability Assessment (CSA) is a premier benchmarking survey and litmus test for inclusion in the S&P Dow Jones Sustainability Index. Firms that participated in the CSA survey in 2021 had better DEI outcomes. Specifically,

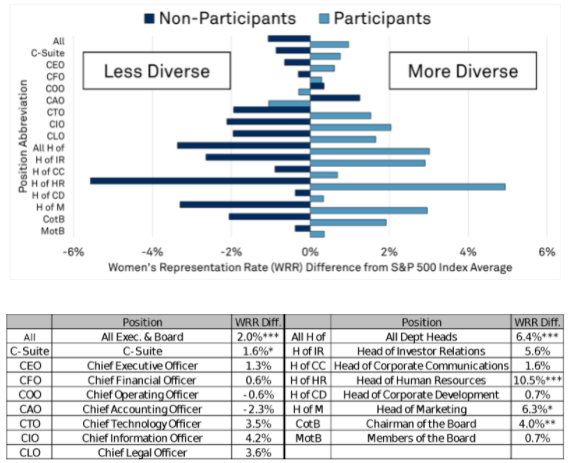

- Participant firms, compared to non-participant firms, in the S&P 500 had greater gender diversity in senior leadership. Large, publicly traded companies are subject to regulatory diversity requirements and to the public scrutiny of their diversity among executives. Consequently, these firms have a de facto diversity minimum. Participant firms go beyond the minimum requirement, particularly with 6% more women appointed in the less visible executive roles outside of the C-suite and board.

- Participant firms, compared to non-participant firms, are less likely to be defendants in a federal court decision. Despite a nearly even split between participant and non-participant firms, non-participant firms were defendants in 60% of all federal court case decisions and 64% of employer discrimination decisions from 2017-2021 where an S&P 500 index constituent was listed as a defendant.

Figure 1. Relative Women’s Representation Rate (WRR) by

Corporate Sustainability Assessment Survey Participation, S&P 500, 2021.

*** = Significant at the 1% level; ** = Significant at the 5% level; * = Significant at the 10% Level

Source: S&P Global Market Intelligence Quantamental Research, S&P Global Corporate Sustainability Assessment. Data as of February 28, 2022.