Download The Full Report

Click hereSustainable investing, which considers environmental, social and governance (ESG) factors in portfolio selection and management, is a significant consideration for an ever-growing class of investors. Forty-two percent of investors surveyed in North America (Schroders Global Investor Study, 2017) cited performance as a primary concern in sustainable investing. The numbers were even higher in Asia (45%) and Europe (48%).

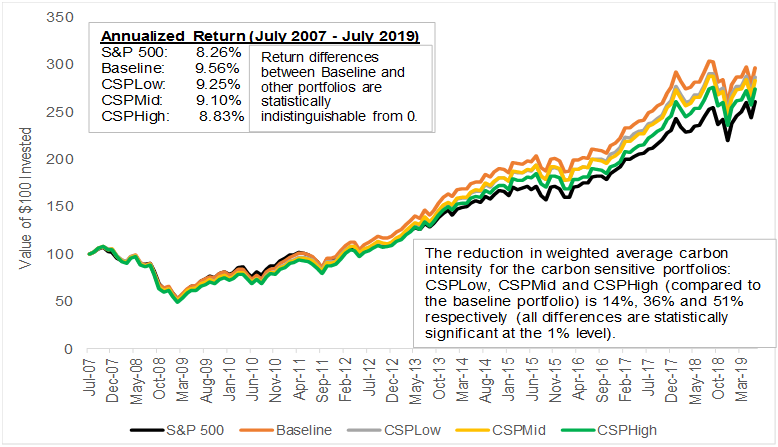

Does sustainable investing come at a “cost”, and is the fear of investors around the performance concessions of “green” portfolios warranted? Our research suggests investors’ fears are misplaced – carbon-sensitive portfolios have similar returns and significantly better climate characteristics than portfolios constructed without carbon emission considerations.

Figure 1: Value of $100 Invested in Carbon Sensitive Portfolios (July 2007 – July 2019)

Source: S&P Global Market Intelligence Quantamental Research. For all exhibits, all returns and indices are unmanaged, statistical composites and their returns do not include payment of any sales charges or fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. Past performance is not a guarantee of future results. Data as at 08/31/2019.

Other findings include:

- Highly profitable firms are likely to be leaders in reducing their carbon emission levels.

- There is no degradation in fundamental characteristics for the carbon-sensitive portfolios compared to the baseline portfolio, even though the difference in constituents can be as high as 20%.

- Carbon-sensitive portfolios have other desirable climate characteristics.