Sports clothing manufacturer Under Armour Inc. reported a fourth-quarter net loss of $15 million, compared to analyst estimates of a $47 million profit, S&P Global Market Intelligence data shows. That partly reflected revenue growth that was 2 percentage points lower than expected.

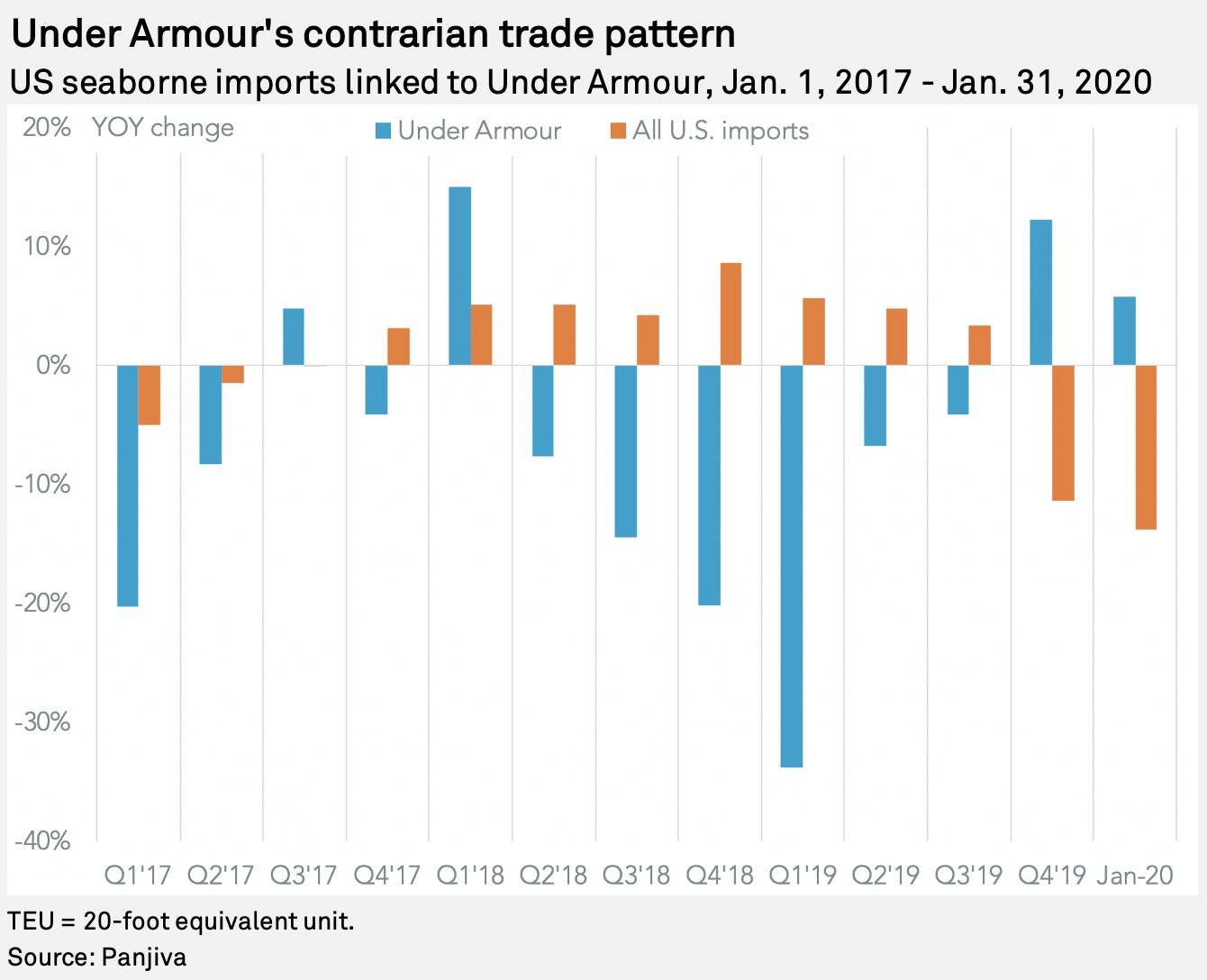

Panjiva's data shows that U.S. seaborne imports linked to the company climbed 12.3% year over year in the fourth quarter. The firm has provided guidance that revenue in 2020 will decline by a low single-digit percent rate, while first-quarter revenue is expected to fall by 13% to 15%. Imports to the U.S. in January rose by 5.7%, compared to total U.S. seaborne imports of apparel and footwear, which continued the decline seen in the fourth quarter with a 13.8% slide.

|

Under Armour has identified that the coronavirus outbreak will trim revenue by 1 percentage point for the year, and 5 percentage points, or $50 million to $60 million, in the first quarter. Under Armour CFO David Bergman has also stated that "we are currently exploring and further impacts of the coronavirus." The details put it ahead of many other corporations, as discussed in Panjiva's Jan. 30 research.

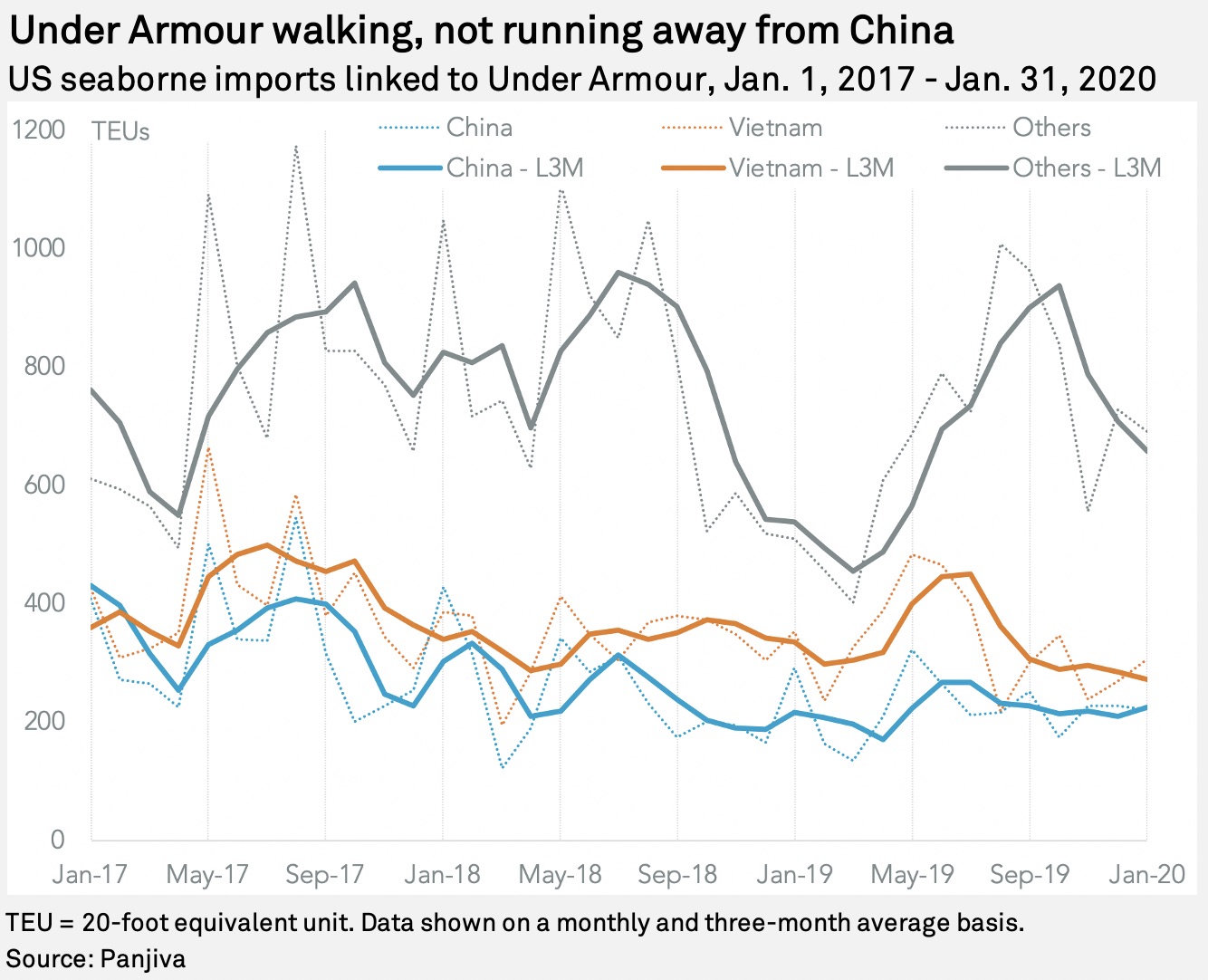

That could include an interruption in supplies of apparel manufactured in the firm in China. Panjiva's data shows that 18.0% of U.S. seaborne imports linked to Under Armour came from China in 2020, led by shipments from Shanghai.

That followed a 12.9% rise in the fourth quarter compared to a year earlier, though in January was a 23.8% slide in shipments. There may be a natural decline following the continuation — albeit at a lower rate — of U.S. list 4A tariffs on certain apparel items after the U.S.-China "phase one" trade deal.

Vietnam led among other major supplier territories to Under Armour, representing 26.8% of the total, though it has been in a steady decline with a rotation in shipments to Taiwan and Honduras.

|

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.